The NFT Market Collapsed By 63% In The First Quarter Of 2025

The NFT market begins 2025 on a bitter note, with a brutal drop of 63% in sales. Industry icons, such as CryptoPunks and Bored Ape Yacht Club, are collapsing drastically! Yet, amidst this chaos, some unexpected collections are emerging, redefining the rules of an ecosystem in full transition.

NFT: a market in free fall despite some resistors

In the first quarter of 2025, Bitcoin and Ethereum exhibited catastrophic performances ! And they are not alone, as the non-fungible tokens (NFT) market also experienced a significant decrease, with sales dropping by 63% compared to the same period in 2024, reaching $1.5 billion against $4.1 billion the previous year. March was particularly hard hit, recording a 76% drop in sales, from $1.6 billion in March 2024 to $373 million in March 2025.

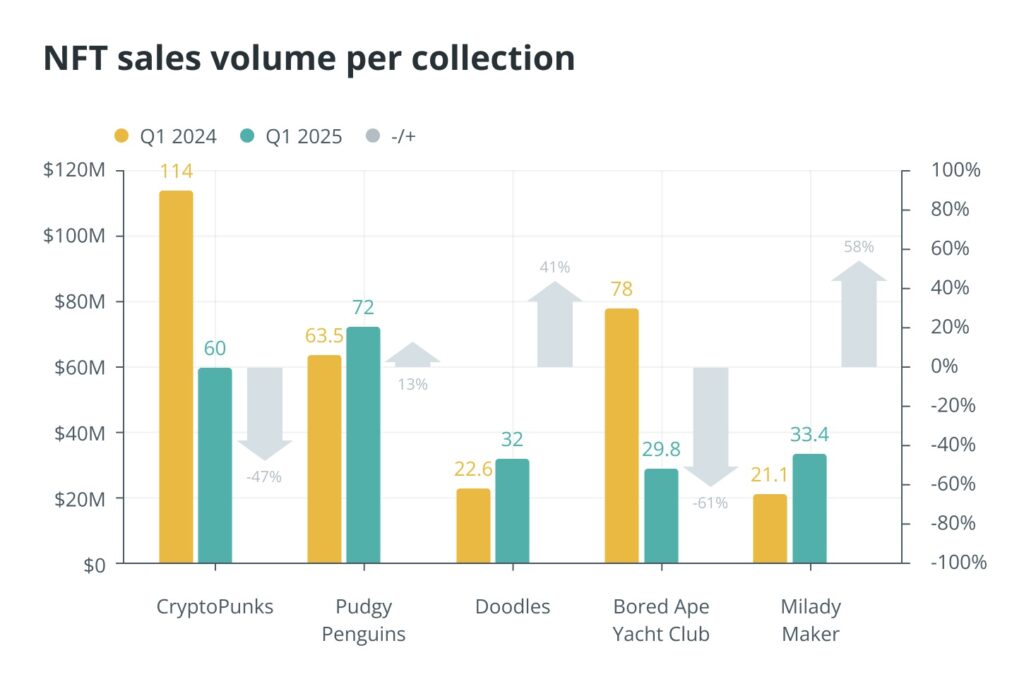

Despite this general downward trend, some NFT collections have managed to stand out and record notable gains. Pudgy Penguins, for example, recorded sales of $72 million during the first quarter of 2025, an increase of 13% compared to the $63.5 million from the same period in 2024.

Similarly, Doodles saw its sales increase from $22.6 million to $32 million, a rise potentially attributed to its growing presence in the mainstream and a recent collaboration with McDonald’s. Milady Maker, an NFT collection based on Ethereum, experienced the largest percentage increase, with a 58% rise in its sales volume.

The giants wobble…

On the other hand, other major collections have suffered significant declines. CryptoPunks recorded $60 million in sales in the first quarter of 2025, a decrease of 47% from the $114 million in the same period in 2024. The Bored Ape Yacht Club (BAYC) experienced an even sharper drop, with sales volume falling by 61%, from $78 million to $29.8 million.

Volume des transactions NFT.

Volume des transactions NFT.

Moreover, Bitcoin-based NFTs have seen their average price increase despite a significant decline in total sales volume. In the first quarter of 2025, the average value of NFTs on Bitcoin reached $633.24, up from $559.05 in 2024 and $63.45 in 2023. However, Bitcoin-based NFT sales plummeted dramatically to $291 million, a 79% decrease from the $1.4 billion recorded in the first quarter of 2024.

As the overall NFT market wobbles, a few collections manage to assert themselves and capture public attention. This resilience in the face of the storm signals a new era for NFTs: more selective, more mature, where only strong brands and innovative projects will emerge, much like Bitcoin miners after the trap awaiting them in a few days.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed keeps interest rates steady and reinforces forecast of cuts in 2025

Solana-based treasury firm aims to outperform Strategy’s Bitcoin model

U.S. Spot Bitcoin ETFs See Sustained Inflows

Prenetics to Sell Genomics Branch, Acquire Bitcoin