Tether $144 Billion Giant Grows 14% in Users—Circle Feels the Heat

Tether hits 400M users, up 14% from 350M since October 2024. Paolo Ardoino eyes 1B users, touts “stablecoin multiverse” on March 27. $144.1B Tether grows on TRON, Ethereum, and emerging markets. Circle pushes Asia as Tether plans 30% Be Water stake.

Over 400 million people—outnumbering the entire U.S.—use Tether (USDT) daily, propelling its market cap to $144.1 billion.

The stablecoin giant added 14% users surge since October 2024, adding 50 million in five months.

CEO Paolo Ardoino dropped the stat on X on March 27, eyeing a 1 billion-user horizon, while rivals Circle scrambles to bolster its Asian foothold.

Tether’s 14% Surge in Five Months

Tether’s user base ballooned from 350 million in October 2024 to over 400 million by March 27, 2025.

That’s a 14% increase in less than half a year, a pace that outstrips many traditional financial growth curves.

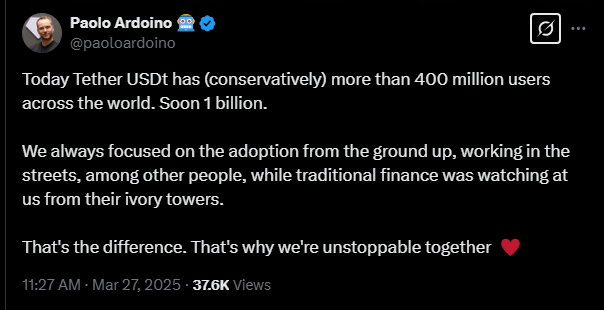

Ardoino shared the figure in a post on X, tying it to Tether’s strategy of grassroots adoption.

The company’s stablecoin, USDT, now boasts a market cap of $144.1 billion, cementing its status as the largest in the sector.

Source: X

Source: X

The growth isn’t slowing. Ardoino predicted Tether could hit 1 billion users, though he didn’t specify a timeline or detail how the company tracks its estimates.

Still, the numbers speak: 50 million new users in five months signal a demand that’s hard to ignore.

Ardoino doesn’t see Tether as a lone player. He called it part of a “stablecoin multiverse” in his March 27 X post, noting that “hundreds of companies and governments” are launching or planning their own stablecoins.

Tether’s reach spans blockchains like TRON, Ethereum, and others, with a strong foothold in emerging markets. This multi-network presence has fueled its 14% user surge since October 2024.

Unlike traditional finance, which Ardoino said “watched from their ivory towers,” Tether built its base “in the streets, among other people.”

The approach has paid off, with USDT’s $144.1 billion market cap dwarfing competitors. Yet, the multiverse he envisions suggests a crowded field ahead.

Circle Faces Pressure in Asia

Circle, Tether’s main rival , isn’t sitting still. The company has ramped up efforts to expand in Asia, a region ripe for stablecoin adoption.

But Tether’s 400 million users and 14% growth since October 2024 cast a long shadow. Circle’s USDC trails in market cap—nowhere near Tether’s $144.1 billion—leaving it to play catch-up.

Tether’s edge lies in its scale and speed. A 50 million user increase in five months signals momentum Circle must counter. As competition heats up, Asia could become the next battleground for stablecoin supremacy.

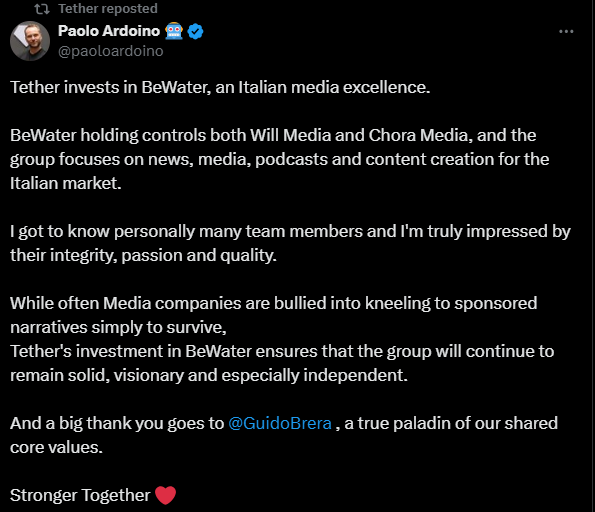

Tether isn’t content to rest on its laurels. The stablecoin giant bought a 30% stake in Be Water, a Rome-based broadcast media firm.

Source: X

Source: X

The move hints at a broader investment strategy, diversifying beyond its $144.1 billion stablecoin core. Details remain sparse, but the acquisition aligns with Tether’s pattern of exploring new ventures.

Meanwhile, its user base keeps climbing—400 million and counting—driven by adoption across TRON, Ethereum, and emerging markets. The Be Water deal could signal Tether’s next chapter.

A Market in Motion

Tether’s 14% user growth—from 350 million in October 2024 to over 400 million by March 27, 2025—underscores its grip on the stablecoin market.

With a $144.1 billion market cap and a 50 million user spike, it’s outpacing rivals like Circle, which is doubling down in Asia.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How Elon Musk’s Starlink is cashing in on Trump’s tariff talks

Share link:In this post: Trump’s steep tariffs have prompted countries such as Lesotho to fast-track Starlink licenses as a gesture of goodwill toward the U.S. U.S. diplomats have quietly urged regulators worldwide to speed Starlink approvals during trade talks. By leveraging tariff threats, Washington is steering markets to American satellite services before Chinese competitors can move in.

UK becomes the first country to make a trade deal with Trump

Share link:In this post: Trump will announce a trade deal with the UK on Thursday from the Oval Office. The deal is the first since Trump imposed global tariffs earlier this year. Details are unclear, but it likely covers cars, tech taxes, and farm goods.

Governor Hobbs greenlights Arizona’s Bitcoin reserve fund after signing HB-2749 into law

Share link:In this post: Arizona Governor Katie Hobbs signed a bill into law allowing the U.S. state to keep unclaimed crypto and establish a ‘Bitcoin Reserve Fund’ not using taxpayers’ funds. House Bill 2749 will not allow investment but will transfer unclaimed assets, airdrops, and staking rewards into a reserve, creating AZ’s first crypto reserve. Earlier, Hobbs vetoed Senate Bill 1025, which would have allowed the state to invest up to 10% of treasury and pension assets in digital assets.

If You’ve Held XRP from $0.006 to $3, Expect Prices Beyond Expectations: Expert Says