ETH Price Faces Resistance At $2300, Liquidation Pressure Mount

ETH price has reclaimed its realized price at $2040 its key hurdle is $2300 strong resistance. Ethereum liquidation heat map. ETH RWA sector surged more than 230% with a market cap hitting $19 billion. ETH Crowd vs smart money market sentiment.

ETH price has achieved stability after it regained its realized price value at $2,040. Further upward price movement faces strong obstacles at the next critical resistance level of $2,300.

As of press time, ETH price of $2,081.55 exceeded the realized price values which reflected positive market sentiment and potential to move to $2300.

A price breakthrough beyond $2,300 would be constrained because this level represents a historical major resistance band.

A successful breach of this resistance area would create the possibility of a price increase towards $3,189.

ETH price action chart Source: Glassnode

ETH price action chart Source: Glassnode

The strongest level of support for price retracements occurs at $1,412 while the target resistance area stands at $1,412.

The Ethereum market receives intense scrutiny from investors as it passes through these noteworthy price regions.

Further price gains are likely after breaking $2,300 but the market could consolidate at realized prices in case of a breakout failure.

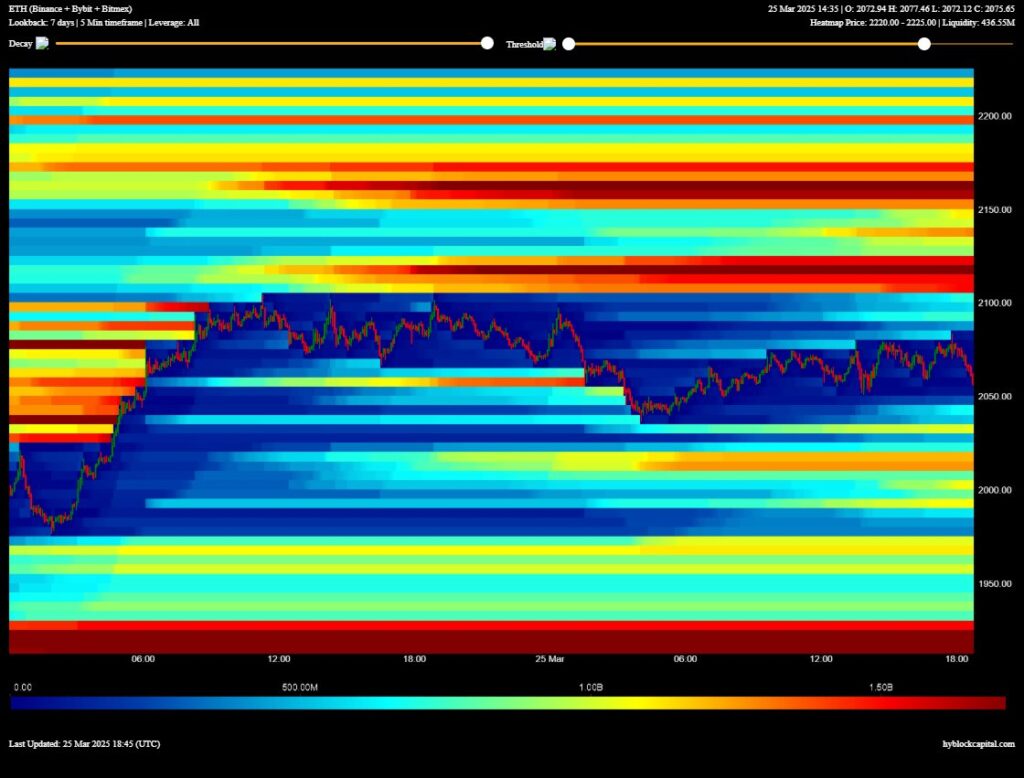

Ethereum Liquidation Heat Map

The liquidation heat map feature of Ethereum develops identified regions which present the risk of trader liquidation.

The geographical map shows active liquidity centers which represent intensive trading activity.

The market value of Ethereum stands at $2,075 while its primary trading areas exist between $2,200 and $2,235.

High sell orders are located in these red zones so this area functions as an essential resistance barrier.

Liquidity reaches its peak at $2,000 which might provide a supportive effect. The market zones require trader close observation due to their ability to trigger trading mechanisms which create price swings.

ETH has a stronger potential to boost bullish trends if it surpasses the $2,200 mark. The price holding above $2,000 stops further selling pressure but failure at that level results in more selling activity.

ETH liquidation heat map Source: Hyblock Capital

ETH liquidation heat map Source: Hyblock Capital

Negative fluctuations in liquidity influence Ethereum price movements because it makes them hypersensitive to these important levels.

The recognition of liquidation points helps traders determine how to handle market volatility while making decisions in this ever-changing market environment.

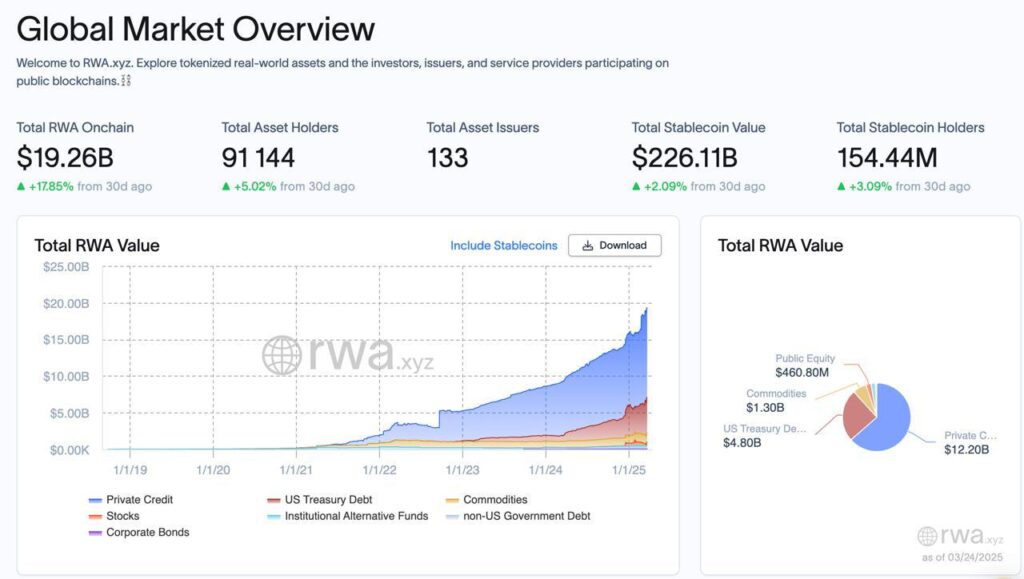

ETH RWA Sector Surged More Than 230% With a Market Cap Hitting $19 Billion

The Ethereum Real-World Asset (RWA) sector has experienced massive growth, surging over 230% and reaching a market capitalization of $19 billion.

This rapid expansion signals increasing adoption and confidence in Ethereum’s role in tokenizing real-world assets.

ETH dominates this sector, benefiting from its robust blockchain infrastructure. Currently, the total RWA on-chain value stands at $19.26 billion, reflecting a 17.85% rise in just 30 days.

ETH chart showing Global Market Overview Source: Mikybull Crypto

ETH chart showing Global Market Overview Source: Mikybull Crypto

Meanwhile, stablecoins tied to RWAs have grown to $226.11 billion, reinforcing Ethereum’s relevance in decentralized finance. With 91,144 asset holders and 133 issuers, the sector is thriving.

Institutional participation has also increased, with the U.S. Treasury debt in RWAs reaching $4.8 billion. Private credit leads the space, holding $12.2 billion.

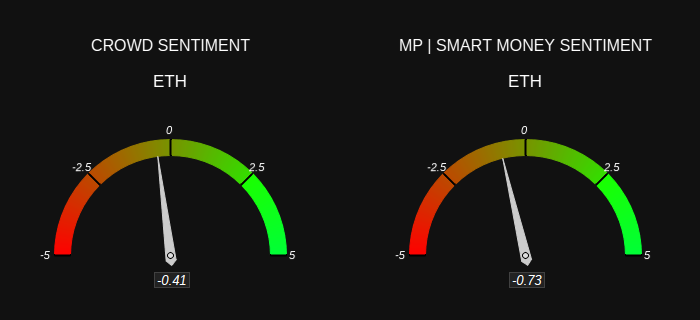

ETH Crowd vs Smart Money Market Sentiment

Ethereum’s market sentiment remained bearish, with both crowd and smart money indicators showing negative values.

This signaled cautious investor behavior and potential short-term price pressure.

The crowd sentiment score sat at -0.41, indicating mild bearishness among retail investors.

Meanwhile, the smart money sentiment, reflecting institutional and experienced traders, is even lower at -0.73.

Crowd v Smart Money sentiment | Source: X

Crowd v Smart Money sentiment | Source: X

This suggests that larger investors remain skeptical about ETH’s short-term price action.

Generally, when both retail and smart money lean bearish, market momentum weakens.

However, sentiment shifts quickly in crypto, and such downturns often present accumulation opportunities. If sentiment recovers and flips positive, ETH could see renewed demand.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will Bitcoin Bulls Break Through the ‘Profit Wall’ Before Weekend?

Bitcoin Nears Crucial Threshold: Long-term Holders Close to Peak Profitability Levels

Bitcoin Nears Massive $100K Upsurge: Key Indicators Point to Swift BTC Rally Recovery

Bitcoin Tests Critical Resistance Level: On-Chain and Derivatives Support Suggest Possible Surge to $100k

Canary Capital's Litecoin ETF is about to face SEC decision, analysts expect delay