Bitcoin and Ethereum Options Expiry Could Influence Market Trends Amidst $14 Billion Expiration

-

Today’s expiration of over $14 billion in Bitcoin and Ethereum options is set to significantly influence the cryptocurrency market.

-

Analysts are closely monitoring this event as it may affect immediate price movements, given the high volume of contracts involved.

-

“The total notional value of Bitcoin options due today is approximately $12.075 billion, indicating a substantial market interest,” noted a source at COINOTAG.

With $14 billion in Bitcoin and Ethereum options expiring, traders are bracing for potential price shifts amid heightened market activity today.

$14.21 Billion Bitcoin and Ethereum Options Expiring

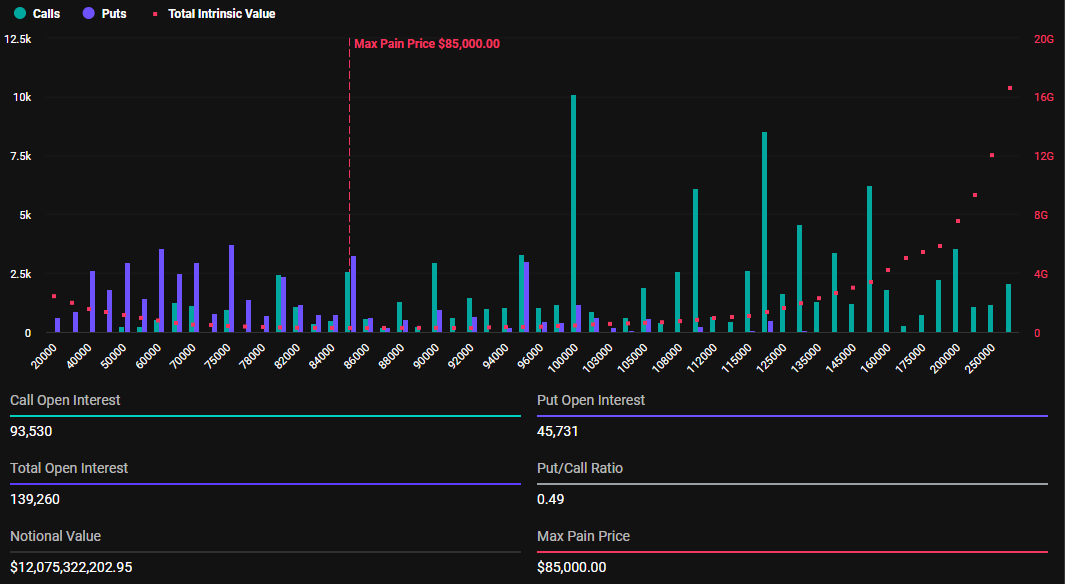

Today’s expiration marks a critical moment in the cryptocurrency landscape, as the notional value of Bitcoin options set to expire reaches $12.075 billion. Data extracted from Deribit highlights a total of 139,260 expiring Bitcoin options, revealing a put-to-call ratio of 0.49. This figure indicates that bullish sentiment prevails, with more traders opting for call options rather than puts.

Additionally, the maximum pain point—a price level that could inflict losses on the highest number of options holders—is strategically positioned at $85,000. Such thresholds are crucial as they often dictate trader behavior leading up to expiration.

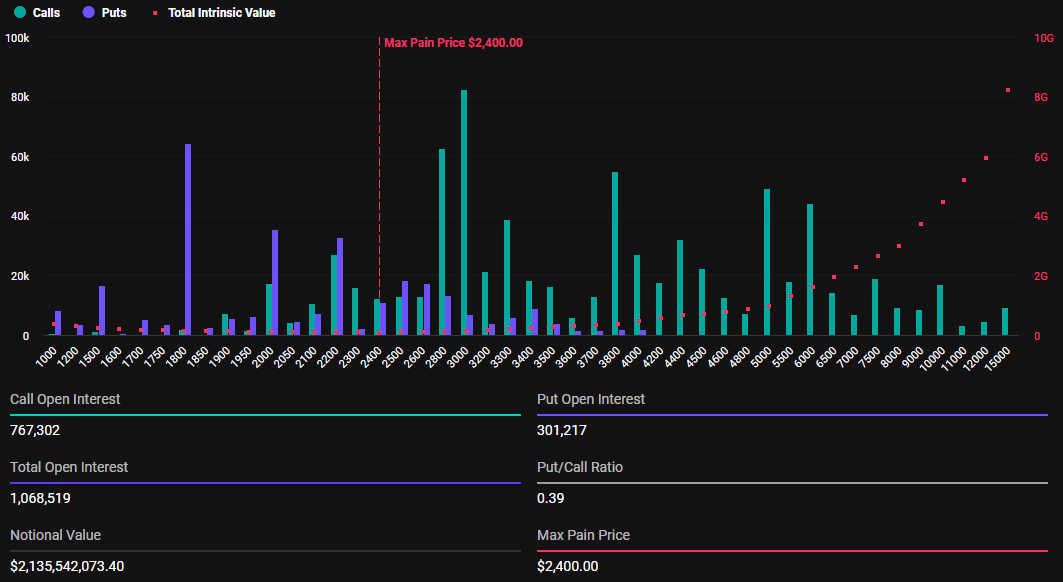

In parallel, Bitcoin is not the only market experiencing significant activity; a total of 1,068,519 Ethereum options contracts are also due for expiration today. These contracts carry a notional value of $2.135 billion, contributing to a combined total that underscores the scale of the market’s engagement. With a put-to-call ratio at 0.39, Ethereum’s market also reflects stronger purchasing pressure as traders anticipate favorable movements.

It is essential to note that the current expiring volume for both assets sharply contrasts with last week’s numbers, which totaled just 21,596 Bitcoin and 133,447 Ethereum contracts. The total notional values then stood at $1.826 billion for Bitcoin and $264.46 million for Ethereum, highlighting a remarkable surge in engagement today.

This increase in options volume is attributed to the overall quarterly alignment of contract expirations, marking the last Friday of March. Notably, Deribit chooses Fridays for options expiry to synchronize with traditional financial market practices, creating a familiar environment for traders transitioning from traditional finance (TradFi).

In essence, expiration dates for options are generally set for Fridays across various markets to streamline the settlement processes and maximize trader participation. Deribit’s adherence to this convention aims to enhance liquidity and maintain an active trading atmosphere during these pivotal moments.

“Tomorrow is not just any Friday; it’s one of the biggest expiries of the year. Over $14 billion in BTC and ETH options are set to expire at 08:00 UTC. How do you think Q1 will wrap?” remarked Deribit in a Thursday social media post, hinting at a significant market transformation.

Implied Volatility Heading Into Quarterly Options Expiry

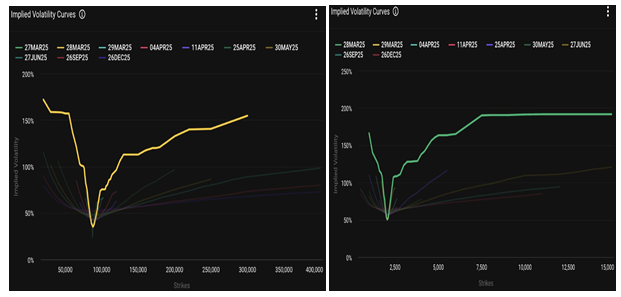

As today’s expiry signifies the close of the first quarter (Q1) for options contracts, analysts from Deribit are closely tracking the implied volatility (IV) curves of Bitcoin and Ethereum. These curves represent market expectations regarding price fluctuations during the contract expiry.

Particularly, Bitcoin’s IV curve demonstrates a considerable bias towards bullish tendencies, as evidenced by the fact that call options are priced substantially higher than puts. Conversely, Ethereum’s IV curve appears flatter, indicating a subdued directional bias, yet overall elevated volatility levels indicate heightened market activity.

“Chart 1 – $BTC: BTC showing some serious upside skew, calls priced way higher. Chart 2 – $ETH: ETH’s curve is flatter, but volume is still elevated across the board. Both markets signal anticipation of movement into or post-expiry,” examined Deribit.

This behavior hints at the market’s expectation for substantial movement during or following the expiry period. Other analysts from Greeks.live have highlighted current market sentiment, mentioning a broadly cautious bearish outlook for Bitcoin among traders.

Feedback from traders suggests a potential retest of lower price levels, particularly around the psychological levels of $84,000 and $85,000. At the time of reporting, Bitcoin was trading near $85,960, which may suggest a possible short-term decline.

Some analysts note that Bitcoin’s price is currently locked in a tight trading range, which implies limited volatility until a breakout occurs. Under this umbrella, key technical levels are being closely monitored.

“Key resistance levels being watched are $88,400, where significant passive selling was observed, and potential support at $77,000, which one trader referred to as the definite bottom,” the analysts explicated.

In addition, the implied volatility has come under considerable pressure owing to the quarterly delivery of options, noted Greeks.live analysts. This environment creates valuable opportunities for traders looking to exploit fluctuations, whether through automated strategies or manual trade executions.

Conclusion

As the day progresses and the effects of the $14.21 billion options expiration materialize, stakeholders in the crypto market must remain vigilant. The upcoming price movements of Bitcoin and Ethereum could set the tone for the next trading period and highly influence investor sentiment. The market’s inclination towards higher volatility—coupled with strategic technical levels—will play a pivotal role in shaping the immediate outlook for these leading cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Goldman Sachs: Tariffs will reduce U.S. jobs

Pi Network Unveils Ad Platform to Empower Developers and Fuel Growth

Ethereum Eyes $4.8K and Beyond After Breakout

Ethereum holds strong after a breakout, keeping the $4.8K target in play with eyes on $8.5K as a potential next stop.Can Ethereum Push to $8.5K Next?What to Watch Going Forward

Qubetics Offers 2789% ROI for Early Buyers as Immutable X and SUI Compete for the Best Coins to Buy This Month

Explore the best coins to buy this month with Qubetics, Immutable X, and SUI. Learn about Qubetics' QubeQode IDE and what sets these projects apart.Qubetics: QubeQode IDE—Empowering Blockchain DevelopersImmutable X: Scaling NFTs for the FutureSUI: A Next-Gen Blockchain with a Unique Consensus MechanismQubeQode IDE: Simplifying Blockchain DevelopmentConclusion