Bitcoin’s Future: Analysts Debate $90K Recovery or Further Decline

Decoding Market Predictions: The Potential Upswing or Downfall of BTC as Q1 Concludes

Key Points

- Bitcoin [BTC] reached $88K after President Trump’s ‘less severe’ tariff plans were announced.

- Mixed projections exist on BTC’s potential recovery, with some analysts suggesting it could reclaim $90K and an all-time high.

Bitcoin’s value rose to $88K following an update on President Trump’s tariff plans, which were deemed less severe than anticipated.

This surge came as a relief to many, following warnings of potential downside risks in the event of renewed tariff wars.

Despite this boost, there is still debate among analysts about Bitcoin’s potential to recover above $90K.

Mixed Bitcoin Projections

Some analysts remain optimistic, citing technical charts and structural shifts as indicators that Bitcoin could reclaim its $90K mark and even reach a new all-time high.

Trader and analyst Bob Loukas suggested that the bull market was in control and could potentially see a 15-week rally.

Arthur Hayes, founder of BitMEX exchange, echoed this bullish outlook, attributing the potential rise to the Fed’s shift from quantitative tightening to quantitative easing.

However, others are more cautious, predicting range-bound price action for the time being.

BTC trader, Cryp Nuevo, anticipates another dip to the $80K area, while Glassnode researcher, VizArt, warns that a new all-time high would be unlikely without first reclaiming the $90K-$93K range.

According to Bitfinex analysts, Bitcoin’s recovery could be hampered by reduced speculative interest and activity.

They suggest that a sustained recovery would only be feasible with macro clarity and renewed ETF inflows.

Despite a $744M inflow into spot BTC ETFs last week, it remains uncertain how Bitcoin’s price will react to Trump’s April tariffs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

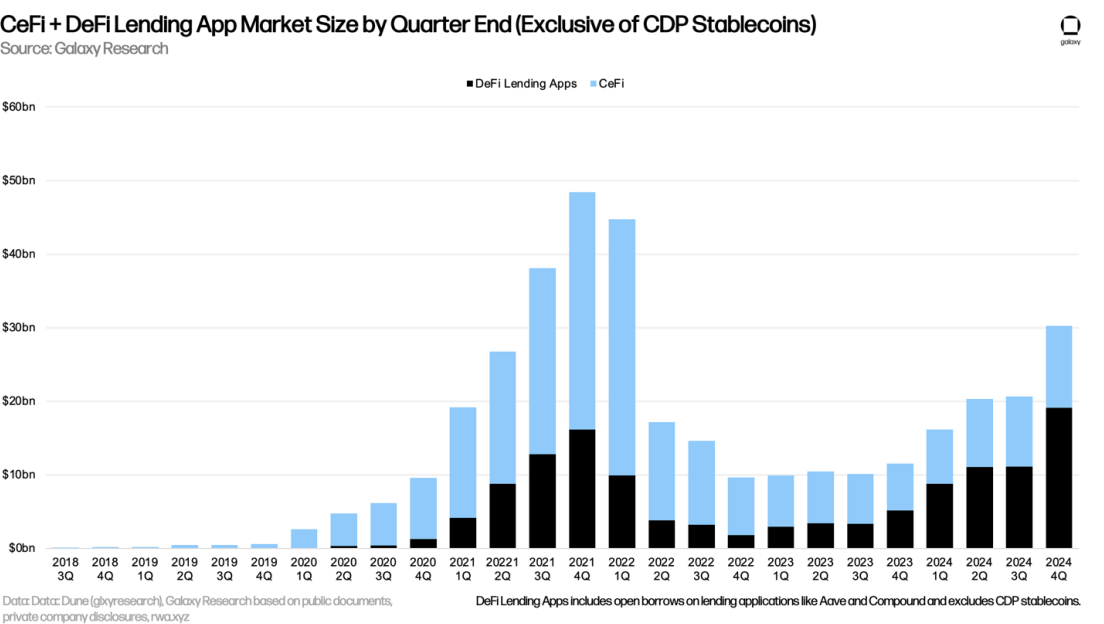

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

USDC’s ‘fueling’ stablecoin market cap rise: Wintermute

Taking a look at the biggest stablecoin players and where they stand

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection