Hashrate Approaches Record High as Bitcoin Price Drives Mining Gains

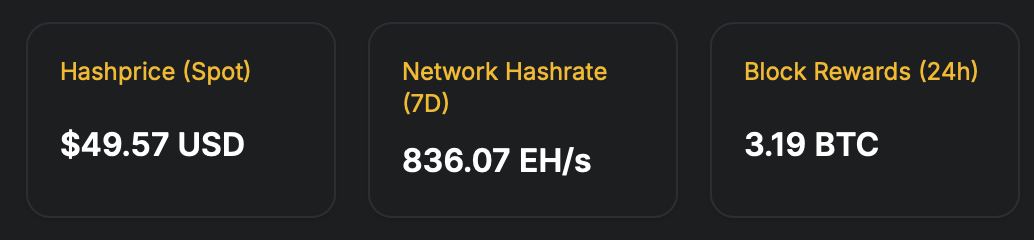

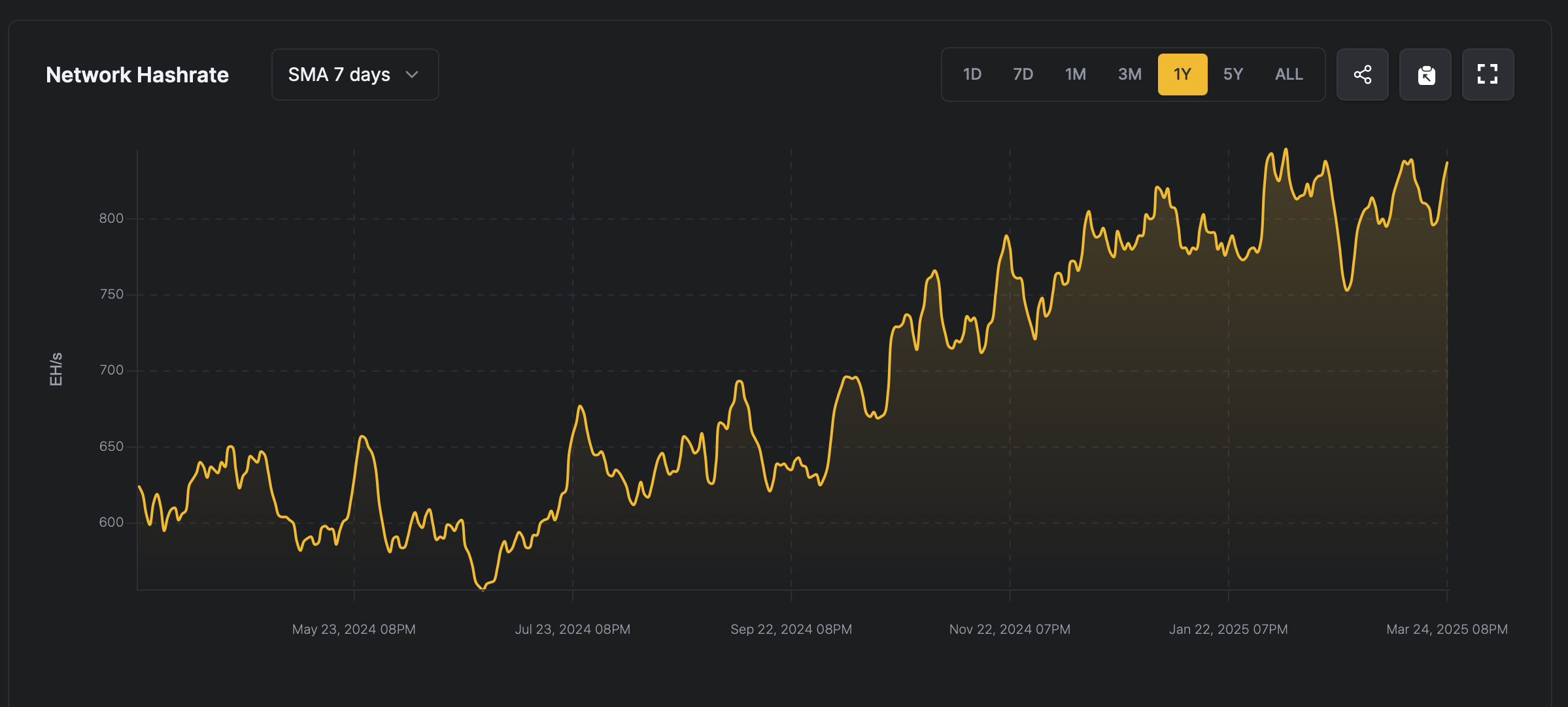

Bitcoin’s hashrate has been climbing steadily, with the network adding 40 exahash per second (EH/s) over the past five days, reaching 836 EH/s—edging close to the protocol’s historical peak. In addition, as bitcoin’s price has moved upward, the hashprice—representing the estimated daily earnings from one petahash per second (PH/s) of computing power—has also seen an increase.

Bitcoin Miners Navigate Tight Margins as Hashrate Nears Peak

On Tuesday, March 25, 2025, bitcoin miners saw improved earnings compared to the previous week. On March 18, the estimated value of one petahash per day stood at $46.21; today, it has risen to $49.57, according to statistics collected by hashrateindex.com.

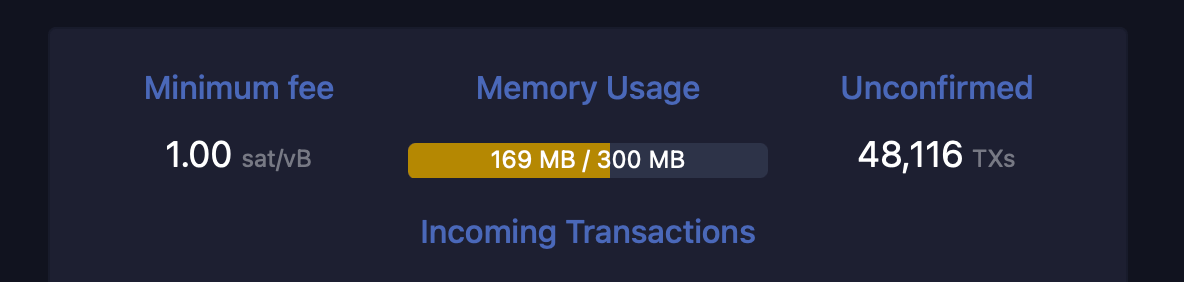

This uptick has provided a modest relief for miners, who had been experiencing tighter margins during the initial three weeks of March. Data from mempool.space indicates a pickup in network activity, with 48,116 unconfirmed transactions sitting in the mempool as of 6:30 p.m. Eastern Time on Tuesday.

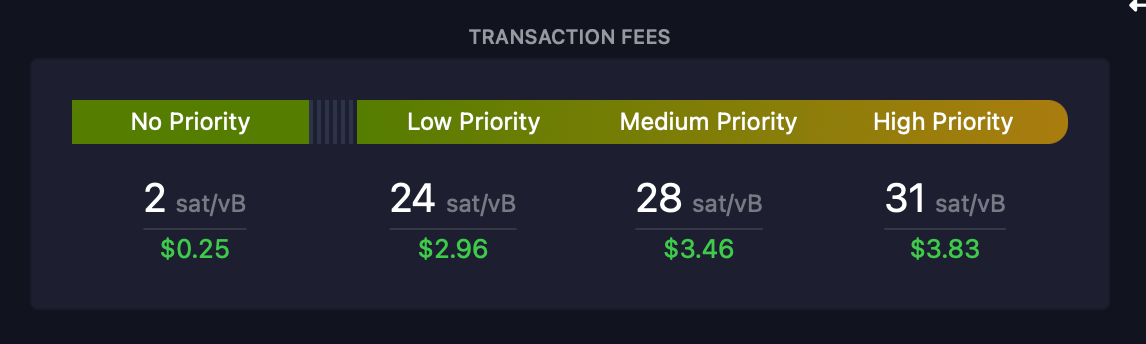

Transaction fees have inched up as well. At the current rate of 31 satoshis per virtual byte (sat/vB), a high-priority transfer now carries a cost of $3.83. The recent climb in BTC’s price is the primary driver behind the revenue boost, as transaction fees have only accounted for 2.14% of total earnings over the past 24 hours.

The latest price movement has also pushed the hashrate higher, with the network gaining 40 EH/s—rising from 796 EH/s on March 20 to 836 EH/s today. This upward trend coincides with a 1.43% difficulty adjustment that took place two days ago at block height 889,056.

Currently, mining difficulty is set at 113.76 trillion, slightly below the all-time high of 114.17 trillion recorded six weeks earlier at block height 883,008. The current shift in network dynamics suggests a recalibration period for miners, balancing operational costs against earnings as difficulty and price fluctuate.

With transaction fees still playing a minor role in revenue, miner profitability appears increasingly tethered to BTC’s market value. As the protocol inches toward historical thresholds, participants may need to adapt strategies to navigate tightening margins and evolving network conditions.

On the other hand, advances in application-specific integrated circuit (ASIC) hardware may also be contributing to the increase in computational output. Empirical analysis reveals that fluctuations in bitcoin’s fiat valuation precipitate corresponding adaptations in network hashrate, manifesting after a temporal delay spanning one to six weeks—a rhythm dictated by miners calibrating operations to align with evolving profit incentives.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Texas Protects Bitcoin Reserves, SB21 Decision by June 22 ✅

Texas shields off‑treasury Bitcoin reserves and awaits SB21 outcome by June 22 on state crypto investments.New Safeguards for Bitcoin ReservesSB21: A Pivotal Decision NearsWhy This Move MattersKey TakeawaysWhat’s Next

Bearish Capitulation Sparks Bitcoin Momentum Reversal

Bitcoin demand momentum is deeply negative—bear capitulation may signal a reversal is at hand.Bear Capitulation: A Turning Point?Bitcoin Demand Momentum Hits LowsSigns of a Reversal BuildingConclusion

CoinMarketCap Removes Malicious Wallet Popup Prompt

CoinMarketCap removed a phishing wallet-verify popup today, secured its systems, and continues security checks.Phishing Alert on CoinMarketCapCommunity & Wallets Raised the AlarmSecurity Under ScrutinyConclusion

Wish You Bought Cardano Early? Qubetics is the Popular Crypto Coin to Buy Now With a 40X Forecast

Qubetics enters its final presale phase with a live dVPN, real utility, and limited supply. Early buyers eye gains like early Cardano investors.Why Qubetics dVPN is a Core Feature Behind This Popular Crypto Coin to Buy TodayCardano: Missed Wealth That’s Still RememberedThe Verdict