Stablecoins Driving US Dollar Dominance As Fed Faces New ‘Balancing Act’: Billionaire Chamath Palihapitiya

Billionaire venture capitalist Chamath Palihapitiya says stablecoins are now solidifying the US dollar’s position as the world’s most dominant currency.

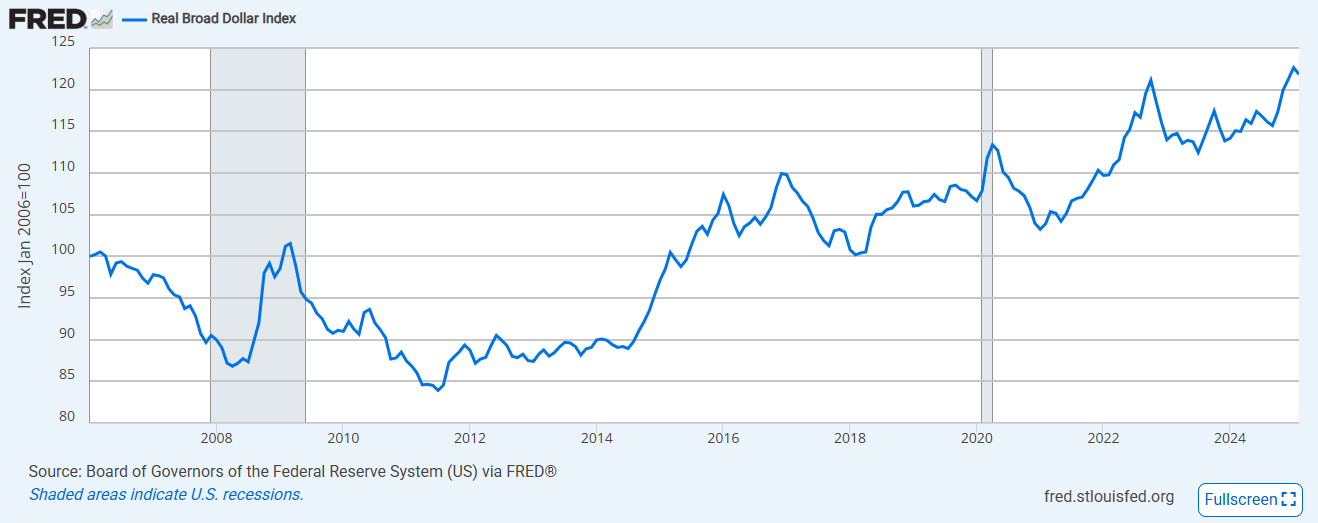

In a new post on the online writing platform Substack, Palihapitiya cites Federal Reserve data to show that the US dollar has soared to its highest level in four decades.

According to the billionaire, a confluence of macroeconomic factors plus the rising adoption of dollar-pegged stablecoins have contributed to the US dollar’s strength against other fiat currencies.

“The US dollar is at its highest valuation in 40 years, reflecting the dollar’s strength against other global currencies…

This increase in the dollar’s strength stems from multiple factors: the Federal Reserve raising interest rates from near-zero to over 4% has attracted global investors seeking higher returns on dollar-denominated assets, while geopolitical uncertainties have enhanced the dollar’s safe-haven appeal.

Dollar-pegged stablecoins like USDT and USDC have driven extended American currency dominance, creating a form of ‘digital dollarization’ that increases global demand for dollars even in cryptocurrency markets.”

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

But Palihapitiya highlights that a surging dollar is a double-edged sword. While it increases Americans’ purchasing power when buying foreign products and assets, Palihapitiya notes that a strong dollar can weigh down on the performance of American companies. A strong dollar can also trigger a financial crisis elsewhere.

“The consequences of the dollar’s strength ripple throughout the global economy. The Federal Reserve is currently facing an additional balancing act, as a stronger dollar helps fight domestic inflation by cheapening imports, but risks triggering financial instability abroad that could eventually harm US markets. US exporters lose competitive ground as their products become more expensive globally.”

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Dollar Index Down 9% in 2025 Boosts Bitcoin Outlook

The US Dollar Index is down over 9% in 2025, marking its worst yearly start ever. Bitcoin bulls see this as a major buying signal.DXY Plunge Sparks Market ReactionsWhy This Is Bullish for BitcoinA Shift in Global Market Sentiment

Staked ETH Hits All-Time High with 35M Locked

Over 35 million ETH is now staked, accounting for 28.3% of the total supply—a new all-time high for Ethereum.Ethereum Staking Reaches Record LevelsWhat This Means for EthereumA Bullish Sign for Long-Term Holders

Trump Claims Strike on Iran’s Nuclear Sites a Success

Trump announces successful attack on three Iranian nuclear sites, escalating tensions and raising global security concerns.Trump Confirms Targeted Attack on IranIran Responds to the EscalationGlobal Reaction and Market Impact

Major Crypto Liquidation Spree: 172K Traders Suffer $682M Loss

172K crypto traders liquidated in 24h, over $682M lost—$596M from longs. What drove the carnage and what comes next?Longs vs. Shorts: Who Took the Bigger Blow?What Sparked the Sell-Off?📊 What Now? Key Takeaways for Traders