Strategy Holds 500,000 BTC Despite Market Surge

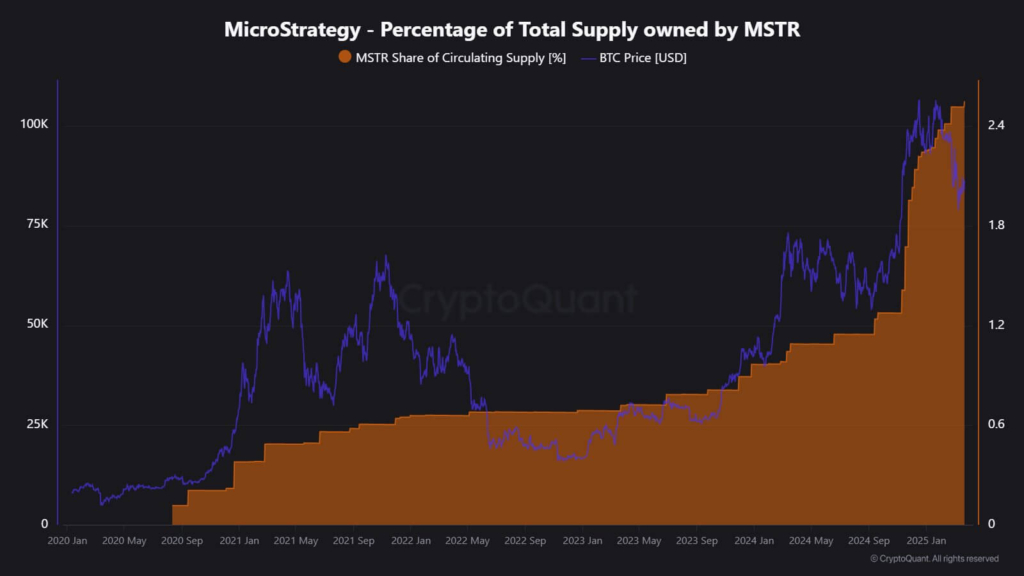

- Strategy now holds 506,137 BTC, making up 2.55% of Bitcoin’s circulating supply.

- It raised $593M through stock sales to fund its aggressive Bitcoin accumulation.

- Despite market fluctuations, Strategy continues expanding its BTC holdings.

Strategy has again increased its Bitcoin holdings, breaking the 500,000 BTC barrier and cementing itself as the biggest corporate Bitcoin holder.

Strategy reported the purchase of 6,911 BTC on March 24 in an SEC filing for $584.1 million at a mean price of $84,529 per coin.

This places its total position at 506,137 BTC with a combined investment of $33.7 billion at an average cost of $66,608 per coin. The company’s unrealized gain is over $10 billion.

Corporate Bitcoin Holdings

Strategy controls around 2.55% of the 19.8 million BTC in circulation, significantly surpassing other institutional investors.

Its position is close to that of all 12 U.S. spot Bitcoin ETFs combined, which hold some 1.1 million BTC together, and is equivalent to almost half of Satoshi Nakamoto’s estimated horde.

In order to finance its Bitcoin strategy, Strategy raised $593 million selling about two million of its class A common shares through an equity offering that will support sales up to $21 billion.

The company still retains authority to sell further $3.57 billion shares.

Separately, it raised $1.1 million through the issuance of its perpetual strike preferred stock, Strike (STRK), which debuted in January. The Nasdaq-listed product features an 8% cumulative dividend, paid in cash or common shares.

Market Reaction

Though falling initially to $311.36 at the market open, Strategy’s stock recovered, ending 7.2% higher. STRK also increased by 1.1% to $86.50, though still below its February high of $99.

Co-founder Michael Saylor hinted at further Bitcoin buys on X, sharing a chart of the company’s buys with the caption, “Needs more orange.”

Strategy is sticking to its Bitcoin-biased plan. With billions of unrealized value and ongoing stock sales driving up acquisitions, its aggressive buy-up strategy remains driving the corporate Bitcoin agenda.

Highlighted Crypto News Today

Cardano Eyes $1 Target as Bullish Indicators Mount

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Poised for Explosive Breakout After Six Weeks of Consolidation

ETH has traded in a tight 2% range for six weeks, setting up for a strong breakout that could ignite a sharp rally.Six Weeks of Stagnation Turns into Bullish SetupWhy This Consolidation Is DifferentWhat to Watch Before the Pop

SOL Correction Nears End as Bulls Target $220-$250

Solana correction phase is ending; analysts eye a bullish breakout toward $220–$250 in the coming wave.SOL Price Correction Nears CompletionTarget Zone: $220–$250 for the Next WaveWhat to Watch Moving Forward

South Korea’s FSC Unveils Roadmap for Spot Crypto ETFs and Won‑Based Stablecoins

FSC eyes approval of spot crypto ETFs and easing of won-based stablecoin rules in H2 2025.South Korea Eyes Spot Crypto ETFs by Late 2025Korean Won-Based Stablecoins to See Regulatory ReliefA Broader Shift in Crypto Policy

Can Trader 0xb8b9 Save His $2M Bitcoin Bet?

Trader 0xb8b9, with a perfect 100% win rate, now faces $2M in unrealized losses. Will he protect his streak or risk it all?The Trader with a Flawless Record$2 Million in the Red: Will the Streak Break?Market Watch: Will Crypto Rebound in Time?Alt Texts for Article Images