Blackrock’s IBIT Carries Bitcoin ETFs to 6th Day of Inflows

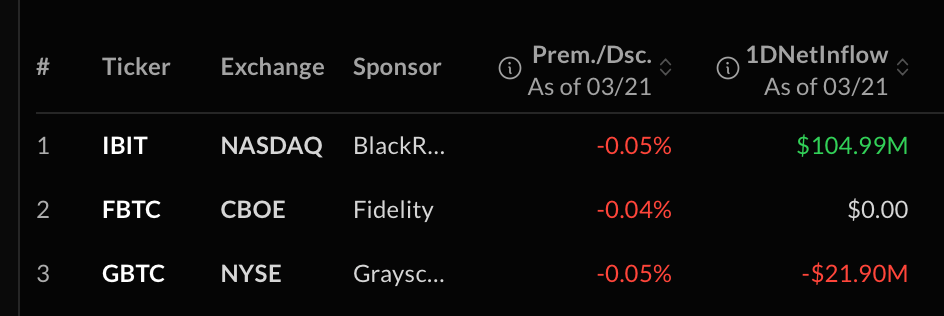

U.S. spot bitcoin ETFs closed the week on a positive note, drawing in approximately $83.09 million on March 21, according to figures from sosovalue.com. Among the 12 funds tracked, Blackrock’s IBIT stood out as the sole contributor, amassing $104.99 million. This was partially counterbalanced by a $21.9 million outflow from Grayscale’s GBTC during the day’s trading.

Source: sosovalue.com

The remaining ten funds reported little to no movement. With Friday’s uptick, total net inflows since Jan. 11, 2024, reached $36.05 billion. The gain from IBIT also extended the group’s inflow streak to six consecutive days, while trading volume across the ETFs hit $1.13 billion on March 21. By March 22, the 12 funds collectively held $94.35 billion worth of BTC, amounting to 5.65% of bitcoin’s overall market capitalization.

In contrast, U.S. spot ether ETFs experienced outflows totaling $18.63 million during Friday’s session. The downturn was primarily driven by Blackrock’s ETHA and Grayscale’s ETH Mini Trust, which recorded losses of $11.94 million and $6.69 million, respectively.

Source: sosovalue.com

Roughly $124.34 million in trading volume moved through the ether ETFs, marking the 13th straight day of outflows across the nine funds. Friday’s decline brought cumulative net inflows since July 23, 2024, down to $2.42 billion. Altogether, the nine ethereum ETFs hold $6.77 billion in ether, representing approximately 2.84% of the asset’s total market value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report