Bitcoin Price Watch: Tight Range Signals a Major Move Incoming

On the 1-hour chart, bitcoin is exhibiting a tight trading band between $83,000 and $84,500, showing signs of accumulation with a series of higher lows after rebounding from $83,142. Entry points for aggressive scalpers are forming between $83,500 and $84,000, with suggested exits around $85,000 to $85,500. However, low trading volume in recent sessions underscores the need for caution, as any move lacks momentum confirmation. A conservative long entry would ideally be placed above the $84,800 mark, contingent on stronger volume confirmation to justify the upward extension.

BTC/USD 1H chart via Bitstamp on March 22, 2025.

From the 4-hour perspective, bitcoin has stabilized after a short-term bounce off the $81,138 level. The asset is currently locked in a consolidation channel between $83,000 and $84,500, with resistance seen near $85,000. The recent bullish push that began on March 19–20 has so far failed to produce a clean breakout, suggesting that any upward move remains tentative. A breakout above $84,800–$85,000 could initiate a climb toward $87,000, whereas failure to hold above $83,000 could reverse momentum and trigger a test of the $81,000 support zone.

BTC/USD 4H chart via Bitstamp on March 22, 2025.

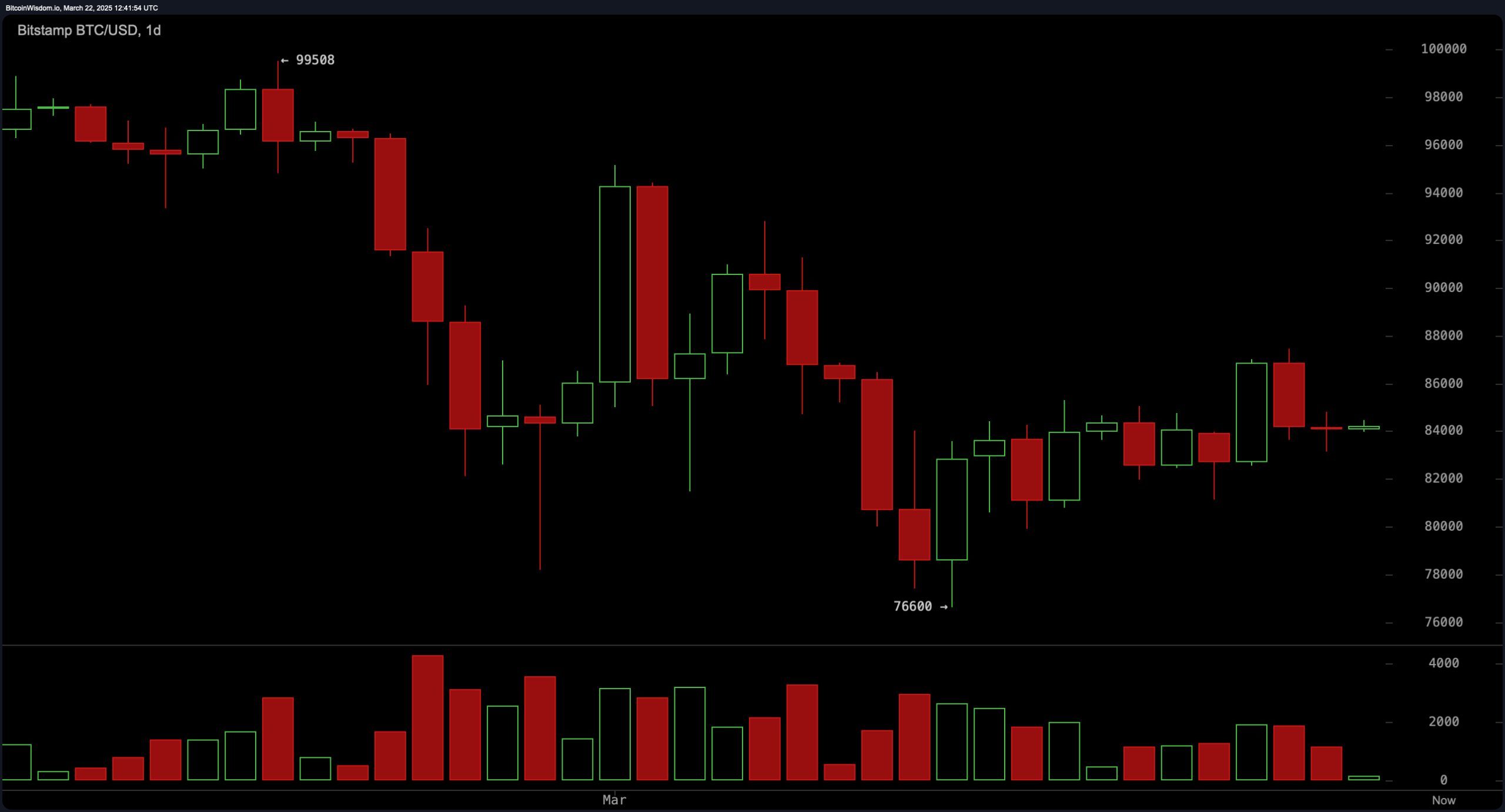

Daily chart analysis indicates a larger pattern of consolidation just below the $85,000 level following a steep decline to $76,600. While the initial selling volume was aggressive, recent candles show subdued participation and indecisiveness. Critical resistance is located at $86,500, and a successful break above this level with rising volume could validate a bullish reversal aiming for the $90,000 zone. The range between $88,000 and $90,000 represents a favorable profit-taking target, while a bullish retest of $82,000 may offer a safer long position for risk-conscious traders.

BTC/USD 1D chart via Bitstamp on March 22, 2025.

Oscillator indicators present a neutral outlook for bitcoin, with the relative strength index (RSI) at 46, the Stochastic oscillator at 63, and the commodity channel index (CCI) at −11. The average directional index (ADX) at 33 and the awesome oscillator at −3,331 also reflect indecisive market conditions. The momentum indicator at 575 suggests some selling pressure, while the moving average convergence divergence (MACD) at −1,869 points to a potential positive signal. This mixed oscillator profile implies that market direction is still consolidating, lacking a strong directional bias until a decisive breakout occurs.

Moving averages (MAs) broadly align with a bearish outlook in the mid-to-long-term, with nearly all key averages above current price levels. The exponential moving average (EMA) for 10 periods is at $84,197 (bearish), while the simple moving average (SMA) for 10 periods is at $83,800 (bullish), indicating near-term ambiguity. All higher-period exponential and simple moving averages — including the 20, 30, 50, 100, and 200 — are generating negative signals, suggesting that bitcoin remains under significant technical resistance. With the 200-period EMA and SMA at $85,487 and $84,758 respectively, bulls must reclaim these levels to shift the market structure.

Bull Verdict:

If bitcoin can break above the $84,800–$85,000 resistance range with meaningful volume, and especially if it clears the $86,500 threshold on the daily chart, a bullish reversal toward $88,000–$90,000 becomes increasingly likely. A strong close above key moving averages would further reinforce upside momentum and potentially re-establish a mid-term bullish trend.

Bear Verdict:

Failure to breach the $85,000 mark and continued rejection below major moving averages could see bitcoin slide back toward $83,000, or even retest the recent swing low of around $81,000. Weak volume and persistent sell signals across longer-term moving averages maintain pressure on the price, exposing downside risk if bullish momentum fails to materialize.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mind AI Collaborates With Spheron Network to Power AI Agents with Decentralized Compute Power

Think Crypto is Used for Illegal Activities? Read This Report First

Thailand Launches Public Feedback on Exchange‑Issued Tokens

Thailand’s SEC seeks public input on allowing crypto exchanges to list their own tokens—feedback open until July 21, 2025.Why Thailand Wants Your OpinionKey Proposals & SafeguardsWhat It Signals for Crypto in Thailand

XRP price rally’s biggest earners are selling $68.5M tokens every day