Trillions in Motion: Stablecoins Take Ethereum to Unprecedented Heights

- Ethereum Stablecoins: Record Monthly Transfers.

- USDC and USDT: High transaction volume.

- Leadership in Ethereum.

the blockchain Ethereum has cemented its position as a leader in the stablecoin ecosystem, recording an impressive $4,1 trillion in monthly transfers last month. This milestone reached in February 2025, revealed in data from the IntoTheBlock platform, highlights Ethereum’s crucial role as the backbone of stablecoin transactions, driving the growth of the cryptocurrency market.

Compliant data According to a survey by the IntoTheBlock platform, the market capitalization of stablecoins is currently US$218,02 billion, while Ethereum surpasses this value, reaching US$250.08 billion. Ethereum's share of the market is almost 12% against 10.10% of stablecoins.

Two stablecoins in particular, USDC and USDT, the largest in the market, have been the main drivers of this exponential growth on the network. Together, stablecoins accounted for $740 billion of the total $850 billion stablecoin volume in February.

According to data, Ethereum was responsible for hosting $35 billion worth of USDC and a whopping $67 billion worth of USDT. This development further highlights Ether’s dominance as the primary settlement layer for stablecoins.

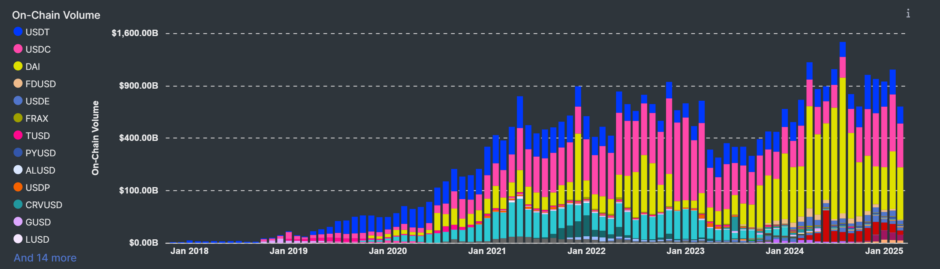

Source: IntoTheBlock

Source: IntoTheBlock

In an upward movement, the stablecoin ecosystem on Ethereum has experienced significant growth in recent years, with a significant increase in transfer volume. In February of last year, the monthly transfer volume of stablecoins was US$ 1,9 trillion, while in February 2025, this number jumped to US$ 4,1 trillion. This movement puts the ecosystem in the spotlight given the growth and important advance in the adoption of blockchain.

This exponential growth in stablecoin transfers on Ethereum demonstrates the growing demand for stable digital assets and trust in blockchain infrastructure. Ethereum continues to be a key pillar in the cryptocurrency market, driving innovation and adoption of stablecoins worldwide.

At the time of publication, the price of Ethereum was quoted at US$2.012,55, up 7% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report