Bitcoin Dips Slightly Ahead of Federal Reserve Meeting

Bitcoin ( BTC) traded within a tight range of $81,630 to $84,725, dipping slightly by 1.37% over the past 24 hours to $81,629 as markets anticipate the upcoming Federal Reserve meeting. The leading cryptocurrency eked out a 0.66% gain over the past seven days.

( BTC price / Trading View)

- 24-hour trading volume: $24.18 billion, marking a 3.58% decline as overall market activity slowed.

- Market capitalization: $1.63 trillion, down 1.30% since yesterday.

- BTC dominance: 61.67%, down marginally by 0.01% in the past day, signaling a stable market share relative to altcoins.

- Total BTC futures open interest: $48.57 billion, down 1.07%, indicating reduced leverage in the derivatives market.

- Liquidations: $49.39 million in total liquidations, with long liquidations at $26.60 million and short liquidations at $22.79 million, showing a balanced impact on bullish and bearish positions.

The Federal Open Market Committee (FOMC) meeting, set for March 18-19, is a key event that could introduce significant price swings for bitcoin. Investors are closely monitoring the Federal Reserve’s stance on interest rates, with the official rate announcement scheduled for March 19 at 2 PM eastern standard time.

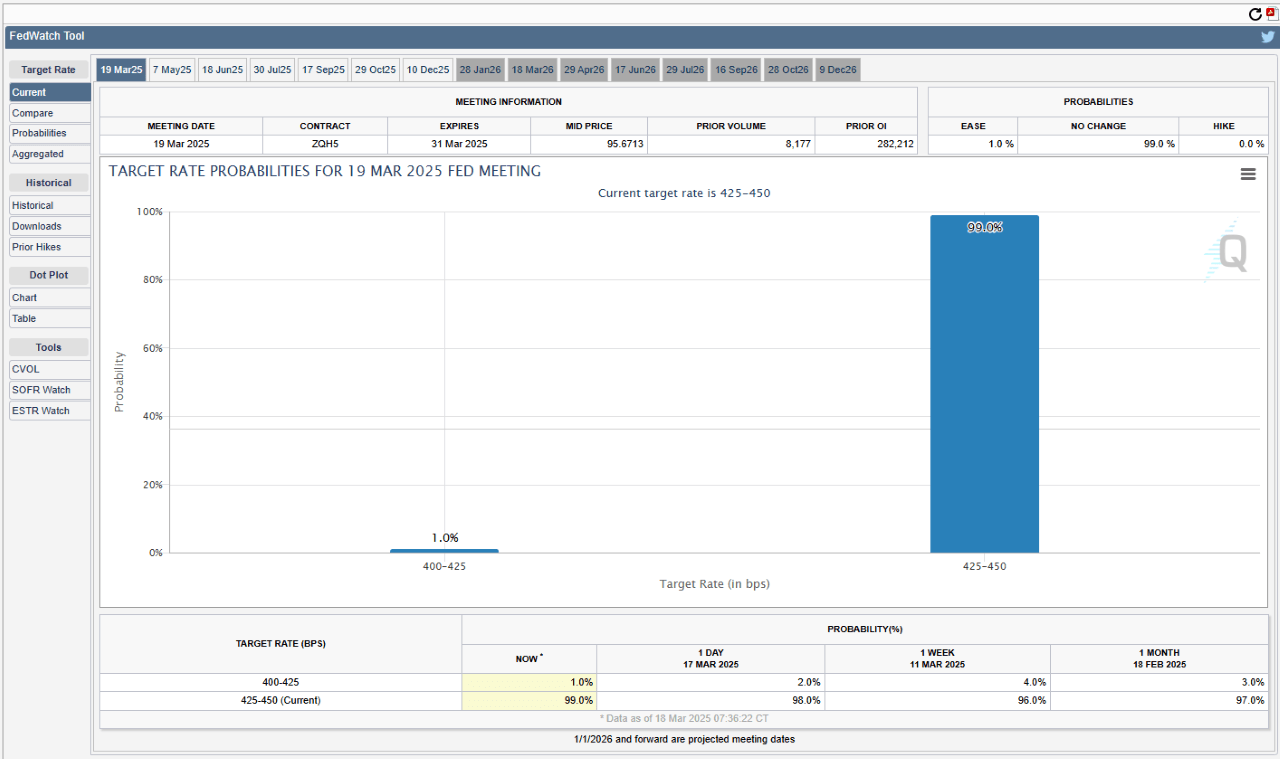

According to the CME Fedwatch tool, there is a 99% probability that interest rates will remain at the 4.25-4.50% level. While no rate hike is expected, the Fed’s commentary on economic conditions and future policy decisions will likely influence bitcoin’s trajectory in the coming days.

(CME Fed Watch tool / cmegroup.com)

Bitcoin’s recent price action suggests a cautious market, with traders holding their positions ahead of the Fed’s announcement. While BTC remains above the $82,000 level, a clear breakout or further decline may largely depend on how investors react to the Fed’s economic outlook. Should risk appetite grow, bitcoin may regain bullish momentum; however, lingering macroeconomic concerns could limit upside potential in the near term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Update on the pump.fun (PUMP) Token Sale Results

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots