Crypto Market Struggles As Outflows Hit $6.4B Over Five Weeks

Digital asset investment products experience $1.7 Billion weekly outflows. Total outflows reach $6.4 Billion over five consecutive negative weeks. Bitcoin accounts for majority of outflows while XRP bucks the trend.

Cryptocurrency investment products are struggling through their most prolonged period of investor withdrawals on record, according to the latest CoinShares report. The crypto market seems to be at a crucial stage as crypto prices appear less shaky.

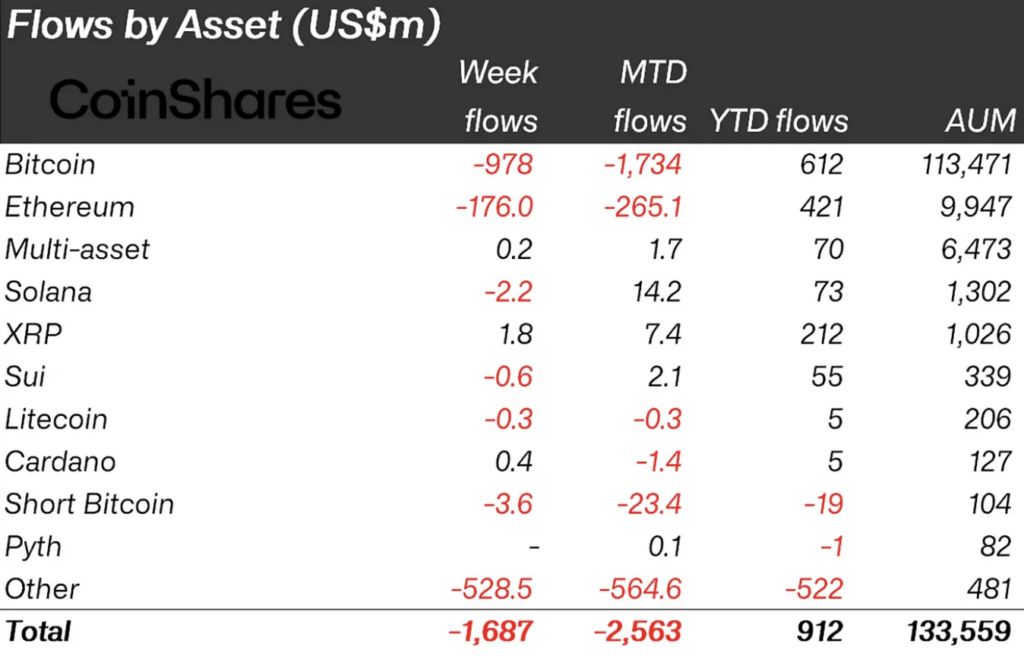

Data shows digital asset funds have experienced outflows for the fifth consecutive week. The latest weekly figure reached $1.7 Billion, pushing the five-week total to $6.4 Billion.

This marks 17 straight days of outflows. This is the longest negative streak since CoinShares began tracking this data in 2015. Despite the sustained exodus of capital, year-to-date inflows remain positive at $912 Million.

Bitcoin Accounts for Largest Share of Crypto Market Outflows

Bitcoin investment products experienced the largest share of outflows, with an additional $978 Million leaving BTC-focused funds last week.

This brings Bitcoin’s five-week outflow total to a substantial $5.4 Billion. Despite these withdrawals, Bitcoin products still maintain the largest position in the crypto investment sector with $113.47 Billion in assets under management.

CoinShares’ data reveals that iShares ETFs suffered the largest weekly outflow at $401 Million, while 21Shares AG experienced $534 Million in withdrawals.

Fidelity Wise Origin Bitcoin Fund also saw outflows of $317 Million, with Grayscale Investments losing $134 Million.

Source: CoinShares

Source: CoinShares

Even short-Bitcoin positions, which usually benefit during price declines, saw investors exiting with outflows of $3.6 Million.

This suggests a general reduction in Bitcoin exposure across both long and short strategies rather than a simple rotation from bullish to bearish positioning.

The data shows that all major Bitcoin ETF issuers are experiencing withdrawals, with total weekly outflows across all providers reaching $1.69 Billion.

Despite the negative sentiment, several providers maintain substantial assets under management. Particularly iShares ETFs hold $50.42 Billion and Grayscale Investments manage $24.32 Billion.

ARK 21 Shares, which saw $68 Million in weekly outflows, still maintains $3.74 Billion in assets. Meanwhile, ProShares ETFs stand at $3.30 Billion despite $13 Million in weekly withdrawals.

Regional Trends Show Concentrated Selling Pressure

The geographical distribution of crypto outflows shows a highly concentrated pattern. As per the data, the United States accounted for the vast majority of withdrawals.

American investors pulled $1.16 Billion from digital asset products last week. This is 93% of all outflows during this negative streak.

Switzerland came out with the second largest source of outflows, with $527.7 Million exiting Swiss-listed products.

However, CoinShares attributes this primarily to “the exit of a seed investor” rather than broader market sentiment among Swiss investors.

In contrast to the selling trend, Germany showed modest resilience with $8 Million in inflows. Other countries with positive weekly flows included Brazil ($4.2 Million), Australia ($1.6 Million), and Hong Kong ($0.7 Million).

The United States maintains its position as the dominant market for crypto investment products with $100.48 billion in assets under management, despite the recent withdrawals. This is approximately 75% of the global total of $133.56 Billion in crypto fund assets.

Switzerland holds the second position with $5.31 Billion in AUM, followed by Canada with $4.94 Billion and Germany with $4.77 Billion.

Ethereum and Other Altcoins Showcase Outflows

Beyond Bitcoin, other cryptocurrencies showed different investor behavior. Ethereum experienced the second-largest outflows at $176 Million and maintains $9.95 Billion in assets under management despite the recent withdrawals. Solana-focused products saw a modest $2.2 Million in outflows, maintaining their position with $1.3 Billion in AUM.

In contrast to the broader negative trend, some altcoins attracted positive investor interest. XRP products recorded $1.8 Million in inflows. Similarly, Cardano funds saw a small positive flow of $0.4 Million.

A notable development highlighted in the CoinShares report concerns Binance-branded investment products, which “saw almost all its AuM wiped out by a seed investor exit, leaving just $15 Million AuM left.”

Traditional equity products with blockchain exposure also experienced negative sentiment, with blockchain equities seeing outflows totaling $40 Million last week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.