On-chain Activity Collapse: Is Ethereum In Danger?

Until today, the price of Ethereum remains locked below the $2,000 mark. It fluctuates between $1,810 and $1,960. According to several crypto analysts, this level of resistance seems insurmountable in the short term due to several converging factors. All the details in the following paragraphs!

Ethereum’s on-chain activity collapses: a bad signal for ETH crypto

Many expert analysts in cryptography agree on this point: the current dynamics of Ethereum resemble previous decline cycles. This indeed marks the 17th consecutive day of capital exits, the longest negative sequence since 2015.

According to the data , the Ethereum crypto network is experiencing a sharp slowdown:

- The trading volume on DEX has dropped by 30% over a week. It reached $16.8 billion;

- Ethereum’s TVL has lost 9.3% this month. It stands at $46.37 billion, which is 47% less than in January.

Some key crypto blockchain protocols are also showing a sharp decline:

- Maverick Protocol: -85%;

- Dodo: -45%;

- Lido: -30%;

- EigenLayer: -30%.

This reduction in Ethereum on-chain activity shows a gradual disinterest from users, but not only that! It also limits ETH’s ability to regain a bullish momentum.

Investor flight: Ethereum ETFs in crisis

The Ethereum ETFs are also experiencing a worrying financial hemorrhage. Over the past 7 days, these digital assets have indeed suffered cumulative outflows of $265.4 million.

- Outflows from Ethereum spot ETFs: $265.4 million;

- Outflows from other Ethereum products: $176 million;

- Total outflows of Ethereum ETP since early March: $265 million (the worst level ever recorded)

This capital outflow reflects an increased risk aversion among investors. This is likely related to:

- The persistent volatility of the crypto market;

- Macroeconomic uncertainties.

Bearish flag Ethereum: towards a drop to $1,530?

The technical analysis of the ETH price highlights the formation of a bearish flag. This pattern is characterized by a temporary upward channel in a downtrend. Specifically, it suggests a possible break below $1,880.

Crypto experts are considering two scenarios:

- Bearish scenario: If the $1,880 support is breached, ETH could drop to $1,530. This represents a decline of 20% from its current price.

- Bullish scenario: To avoid this drop , ETH needs to break the resistance at $1,970. This threshold coincides with the 50-day moving average.

With a RSI of 48, it confirms a neutral to bearish trend. This indicates that sellers are in control.

Is Ethereum at the end of a bearish cycle or on the verge of a new correction? The market evolution this week will provide crucial answers, particularly in light of this catastrophic scenario that worries experts .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

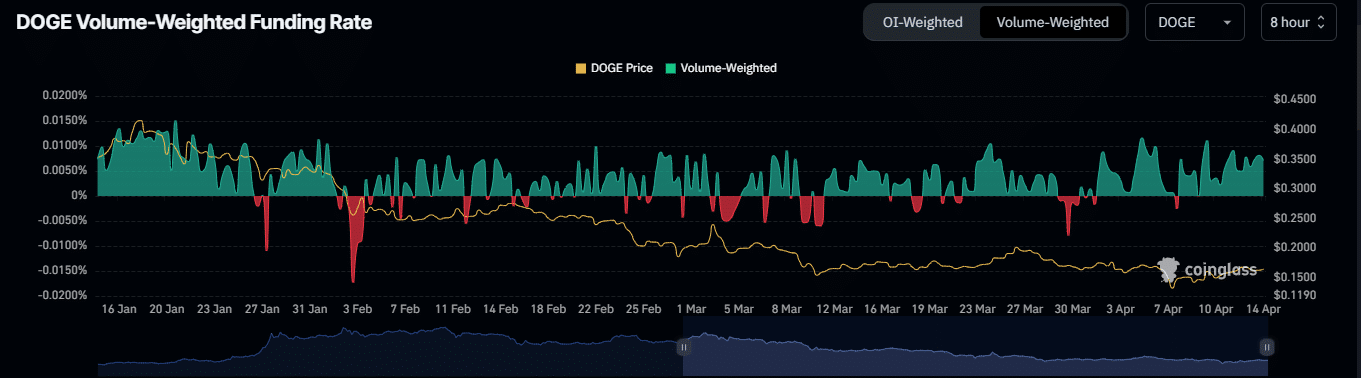

Potential Dogecoin Rally Ahead as Key Support Level and Increased Buying Interest Emerge

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.