Date: Sun, March 16, 2025 | 09:36 AM GMT

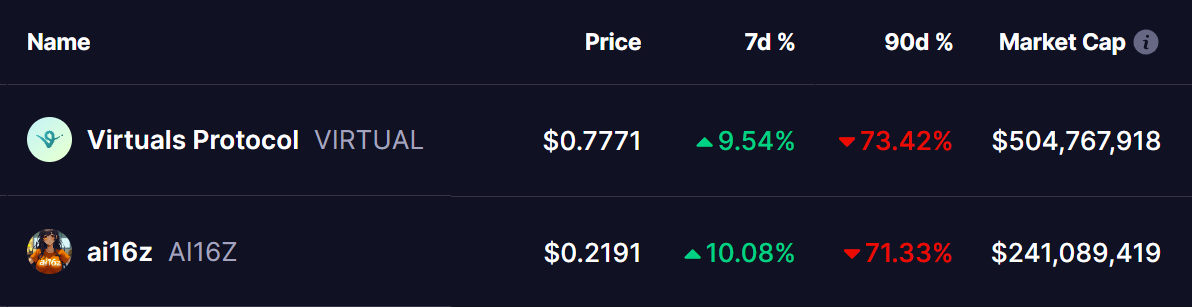

The crypto market is beginning to show signs of recovery, with Bitcoin (BTC) bouncing back from this week’s low of $76K to its current level around $84K. After the initial hype surrounding AI Agents-related tokens drove explosive rallies, a harsh correction soon followed. Among the hardest hit were Virtuals Protocol (VIRTUAL) and ai16z (AI16Z), both of which saw over 70% declines over the past 90 days.

Source: Coinmarketcap

Source: Coinmarketcap

However, as the market stabilizes, both tokens have shown encouraging signs of a rebound. In the past week, they have posted notable gains after holding strong at key support zones.

Interestingly, both are now forming a V-bottom pattern—a classic bullish reversal structure that often marks the beginning of a trend shift. The big question now is: can this be the start of a sustainable recovery?

Virtuals Protocol (VIRTUAL) Analysis

VIRTUAL was one of the earliest tokens to ride the AI wave, surging 1232% to reach its all-time high of $5.12 shortly after launch. The rally was fueled by intense retail excitement and speculative momentum. But the euphoria faded fast, and VIRTUAL entered a deep correction phase, plummeting 89% from its peak.

The token eventually found strong footing at $0.48, a crucial support zone marked in green. This level became the base for a rebound, as buyers slowly regained control. VIRTUAL is now trading around $0.77, showing early signs of recovery.

Technically, this rebound has taken the shape of a V-bottom, indicating a possible shift in market sentiment. However, the real test lies ahead. The 50-day moving average (50 MA) and the $1.20 level are acting as key resistance zones. If VIRTUAL can break above this area decisively, it would serve as a strong confirmation of recovery and could trigger fresh buying interest.

ai16z (AI16Z) Analysis

AI16Z had an even more dramatic rise, rallying 1734% to an all-time high of $2.49 during its initial run. Much like VIRTUAL, the surge was largely driven by speculative interest in AI-focused tokens. But once the momentum dried up, the correction was swift and brutal. AI16Z nosedived 93%, eventually finding a bottom at a key support zone around $0.15.

Since then, the token has shown signs of strength, bouncing back to trade around $0.2191. This recovery is also taking the form of a V-bottom pattern, signaling a potential reversal in the trend.

Just like with VIRTUAL, the next crucial resistance for AI16Z is the 50-day moving average, followed by the $0.45 level, both of which currently act as dynamic barriers. A strong breakout above these zones could give bulls the confidence to push higher, potentially confirming the V-bottom reversal and opening the door for a sustained recovery.

Final Thoughts

Both VIRTUAL and AI16Z have suffered steep corrections but are now trying to reclaim lost ground. The formation of V-bottom patterns on both charts suggests that the worst might be over—but confirmation is still needed. The key lies in breaking above the 50-day moving average, which would signal a shift in momentum and validate the recovery structure.

Until then, caution is warranted. But if bulls take charge from here, both tokens could be on the path to a stronger recovery phase in the coming weeks.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.