Avalanche (AVAX) Jumps as Trump’s World Liberty Accumulates – Is a Breakout on Horizon?

Date: Sun, March 16, 2025 | 03:48 AM GMT

In the cryptocurrency market today, Avalanche (AVAX) is back in the spotlight with a noticeable price jump of over 5%, fueled by key accumulation and early signs of broader market stabilization. This comes after a heavy downtrend that followed the late 2024 rallies, during which AVAX suffered a steep drop of more than 60% over the past 90 days.

Source: Coinmarketcap

Source: Coinmarketcap

However, with this fresh accumulation and the current technical setup, AVAX could now be gearing up for a potential recovery in the days ahead.

Accumulation by World Liberty Financial

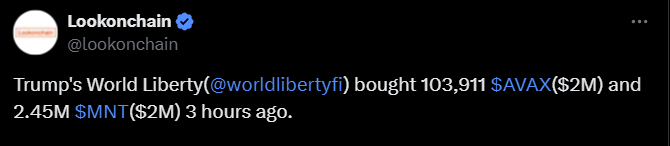

AVAX’s recent surge is largely fueled by significant institutional buying from Donald Trump’s financial initiative, World Liberty Financial (WLF). On-chain data from Lookonchain shows that WLF recently purchased 103,911 AVAX ($2M) and 2.45M MNT ($2M), signaling strong confidence in Avalanche’s long-term potential.

Source: @lookonchain (X)

Source: @lookonchain (X)

The growing interest from WLF suggests that major players see AVAX as an undervalued asset. If this accumulation trend continues, it could act as a key catalyst for further price appreciation, helping AVAX enter a recovery phase after its prolonged correction.

Is a Breakout on the Horizon?

A look at AVAX’s daily chart reveals a falling wedge pattern, a classic bullish reversal setup. This pattern started forming after AVAX was rejected from the December 4 high of $55. The prolonged downtrend saw AVAX plunge over 72%, reaching a low of $15.33 on March 11. However, that level appears to have sparked a bounce.

Avalanche (AVAX) Daily Chart/Coinsprobe (Source: Tradingview)

Avalanche (AVAX) Daily Chart/Coinsprobe (Source: Tradingview)

Currently, AVAX is trading around $19.68, climbing towards the upper resistance of the falling wedge. A successful breakout and retest could see AVAX targeting the next key resistance at $27, which aligns with the 50-day moving average (50D MA).

A decisive breakout above this level could push AVAX toward the 200-day moving average (200D MA) and the $36 price zone, marking a potential 84% increase from current levels.

Final Thoughts

AVAX is showing signs of strength after a heavy downtrend, with institutional accumulation and technical patterns hinting at a potential breakout. While the price remains in a falling wedge, a breakout above $27 could trigger a significant recovery. However, failure to break resistance may result in further consolidation before any major move.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Surge Fueled by Leveraged Traders, Glassnode Reports

Total Spot Bitcoin ETF Volume Reaches $6.3 Billion High

Bitcoin Reaches New Heights Amid Altcoin Surges

The White House’s Strategic Bitcoin Reserve Initiative