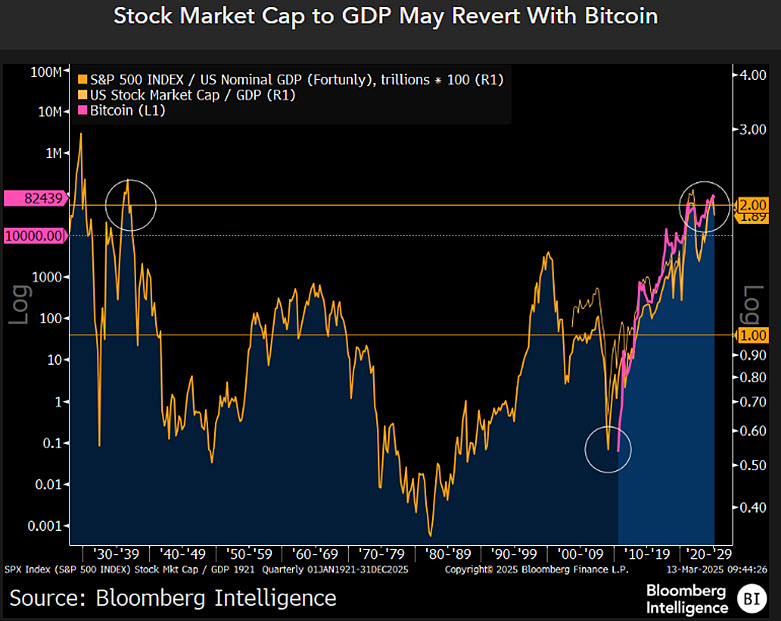

Bloomberg Analyst Mike McGlone Issues Bitcoin Alert, Says BTC Could Crash 88% As Stocks Plummet

Senior Bloomberg analyst Mike McGlone is warning investors that Bitcoin ( BTC ) could crater nearly 90% from its current price due to the conditions of the gold and stock markets.

In a new thread on the social media platform X, McGlone tells his 66,900 followers that the top crypto asset by market cap could free fall to just $10,000 as traders start to heavily favor gold over it.

“$100,000 Bitcoin might lose a zero, favoring gold – Bitcoin was born about when the stock market bottomed in 2009 and has been a leader of one of the greatest risk-asset rallies in history, which may suggest what matters.”

Source: Mike McGlone/X

Source: Mike McGlone/X

According to McGlone, there’s currently nothing stopping BTC’s downward trajectory, as gold has outperformed the flagship digital asset thus far in 2025.

“Bitcoin Back to $10,000? Peak leveraged beta risks, rising gold. Gold is up about the same amount in 2025 to March 13 – about 15% – that Bitcoin is down. But with Bitcoin at about $80,000, what stops those trajectories? About a 6% decline in the SP 500 could suggest what matters.

The biggest exchange-traded fund (ETF) launch in history, President Donald Trump’s shift to highly volatile and speculative cryptos, and reelection could prove peak-bubble akin to about 25 years ago.”

Source: Mike McGlone/X

Source: Mike McGlone/X

Bitcoin is trading for $84,899 at time of writing, a fractional increase on the day. A drop to McGlone’s level would represent about an 88% drop for the crypto king.

The analyst goes on to note that investors’ shifting their appetite from BTC to gold is apparent when looking at ETF data.

“Bitcoin/Gold cross may have peaked, with implications – after four years of outflows, gold ETFs have turned decisively to inflows in 2025, which may signal a shift in risk appetites.”

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Jorm S

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DoraHacks officially launches BUIDL AI, opening automated payment service for hackathons

TRON Breaks Key Resistance, Eyes Additional 450% Price Increase

Obol Collective may launch OBOL token on May 15