“Made in USA” Coins Suffer the Worst Damage of Trump’s Tariffs and Recession Fears

As the crypto market heads into a bear phase, Made in USA tokens, especially those tied to Trump’s policies, are experiencing steeper losses. Meanwhile, non-US projects like BNB and Bitget fare better, highlighting macroeconomic impacts.

As the crypto industry heads for a bear market, Made in USA tokens are posting disproportionate gains. This includes tokens with direct and indirect ties to President Trump alongside totally unaffiliated projects.

The entire crypto market has experienced price corrections in recent weeks, but utility-driven network tokens outside the US are performing much better than their American counterparts. These trends could stifle technological innovation in crypto.

Made in USA Coins Face Losses Under Trump

Since President Trump announced his US Crypto Reserve, a lot of chaotic price actions have taken place in the market. Despite campaign promises to establish a Bitcoin-only Reserve, Trump expanded this to several “Made in USA” coins, which generally performed well.

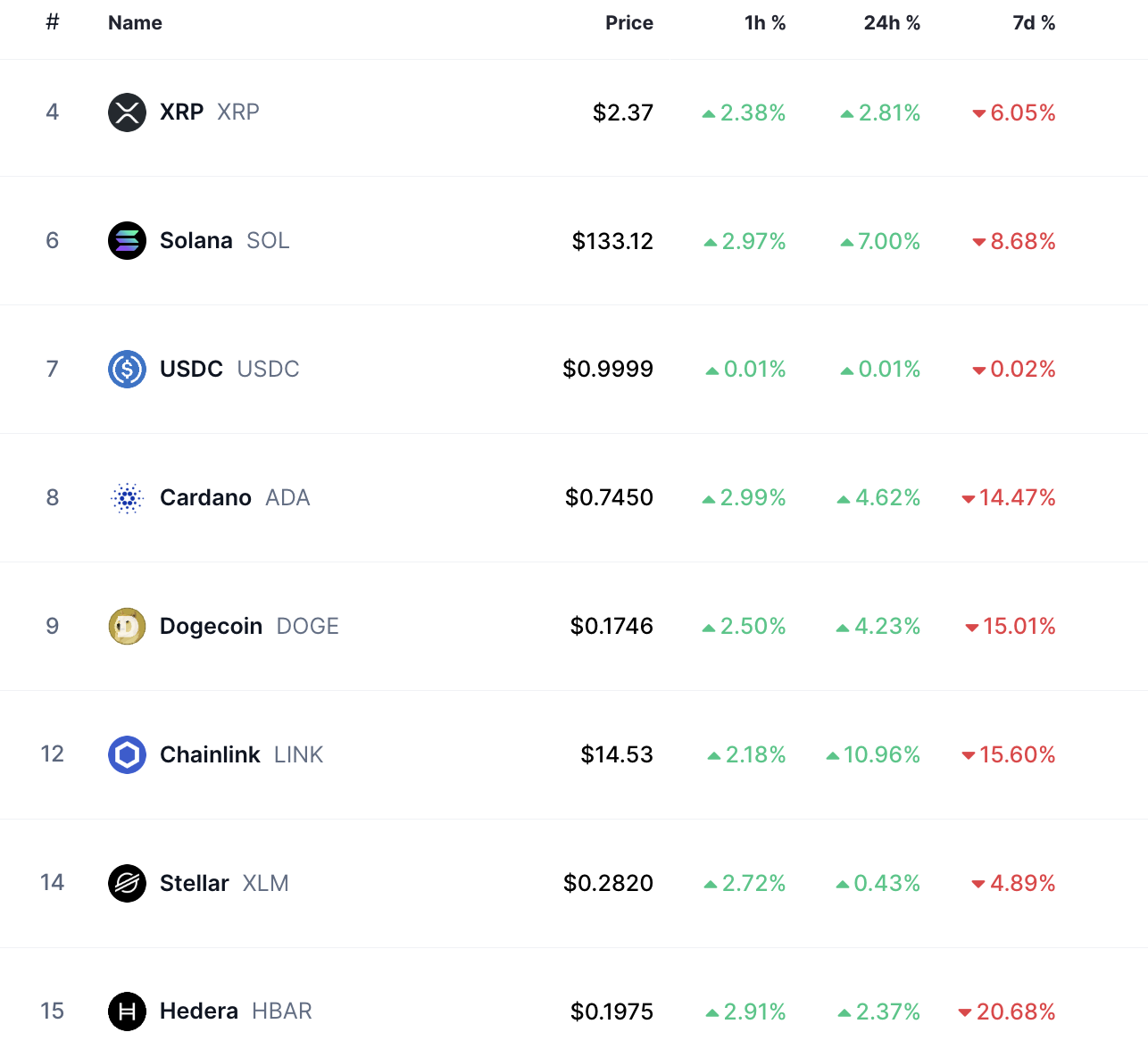

However, these tokens are falling, and most of the top performers had double-digit drops this week.

Made in USA Tokens Decline. Source:

CoinMarketCap

Made in USA Tokens Decline. Source:

CoinMarketCap

In fairness, it isn’t only these assets that are falling. As fears of a US recession keep building, the entire crypto market is down. Yet, on-chain data shows a close association with President Trump, and his wider orbit is hurting these quote-unquote USA coins.

Since his Crypto Summit received a harsh response from the community, the trend is becoming clearer.

Several Made in USA tokens have affiliated themselves with the Trump Family-backed World Liberty Financial. WLFI made major investments into LINK and AAVE and followed up with partnerships with SUI and ONDO. After last Friday’s summit, all these assets fell nearly 20%.

Generally, these smaller WLFI-affiliated tokens fell harder after the Summit compared to the tokens named in Trump’s Crypto Reserve. However, the larger projects began posting massive losses well before this event took place.

Cardano, for example, fell nearly 40% in the immediate aftermath of the Crypto Reserve announcement.

Conversely, utility-driven projects outside the US, such as BNB, Mantra, and Bitget’s BGB token, saw minor losses between 2% and 5% during the same period.

On a side note, many of these US-based cryptocurrencies are also utility-driven projects with great innovative potential, such as Sui and Chainlink. However, it’s rather clear that these tokens are now associated with the “US/Trump brand.”

So, any macroeconomic conditions linked to Trump or America will likely impact these tokens more.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Canada Set to Launch North America’s First Spot Solana ETFs: An Exciting Milestone for Altcoin Adoption

XRP gains 32% as ETF deadlines approach

Canada launches Solana ETFs with staking and high yields

Ethena offers up to 23 percent APY with reinsurance pools