Bitcoin May Experience Price Bounce as Traders Begin Accumulating Amid Reduced ETF Outflows

-

The recent recovery signals for Bitcoin suggest traders are optimistic, indicating potential price momentum in the near future.

-

With a substantial decrease in outflows from Bitcoin exchange-traded funds, there is renewed confidence among investors.

-

In the words of a recent analysis from COINOTAG, “Accumulation strategies point towards an anticipated bullish trend as investor sentiment shifts.”

This article explores Bitcoin’s price dynamics, focusing on declining ETF outflows and significant liquidity inflows, suggesting a potential bullish trend.

Spot ETF Outflows Slow Down Significantly

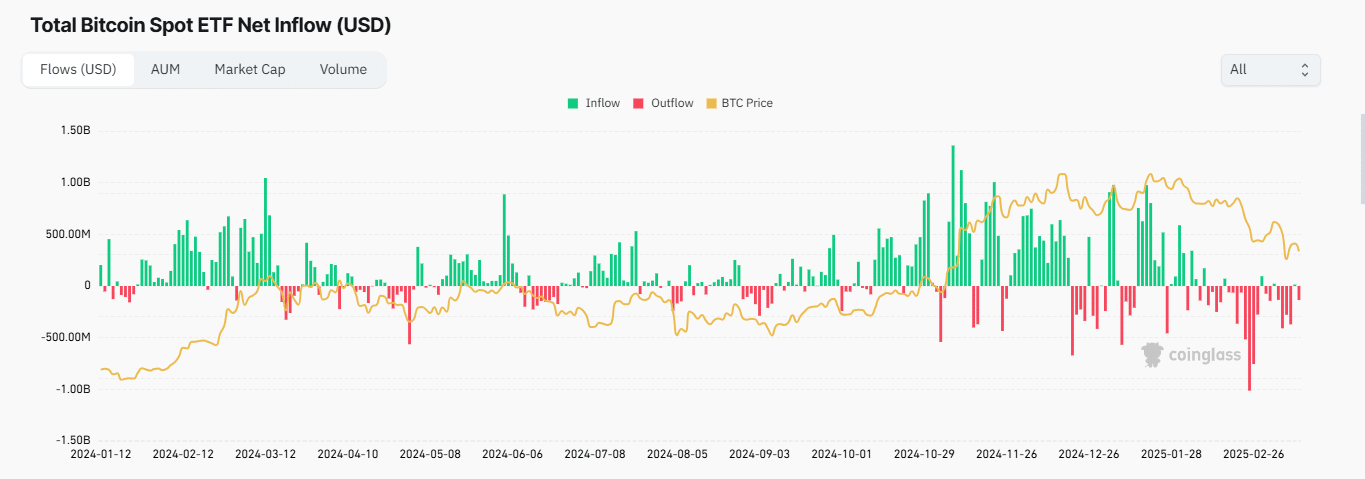

Recent market data highlights a marked decline in Bitcoin outflows from exchange-traded funds (ETFs), reflecting a potential shift in investor sentiment.

As of the most recent figures, Bitcoin outflows peaked at $1.01 billion on February 25, with total sales reaching $2.039 billion in a short time frame. However, selling pressures appear to be easing, with only $135.20 million withdrawn in the last 24 hours. This reduced activity sees assets under management remaining robust at $97.62 billion.

Source: Coinglass

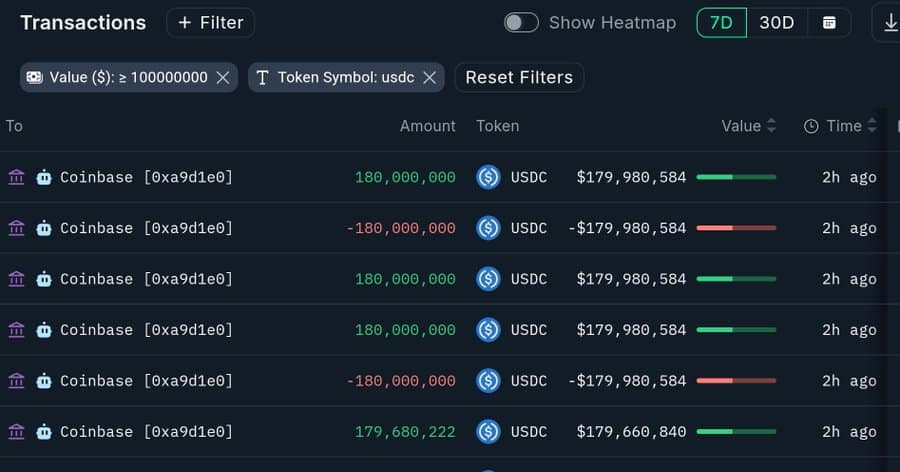

The slowdown in BTC Spot ETF sell-offs is complemented by significant liquidity inflows into major exchanges like Coinbase. The past week alone has seen a remarkable influx of 719 million USDC, indicative of investors accumulating Bitcoin amid a stagnant price environment.

Source: Nansen

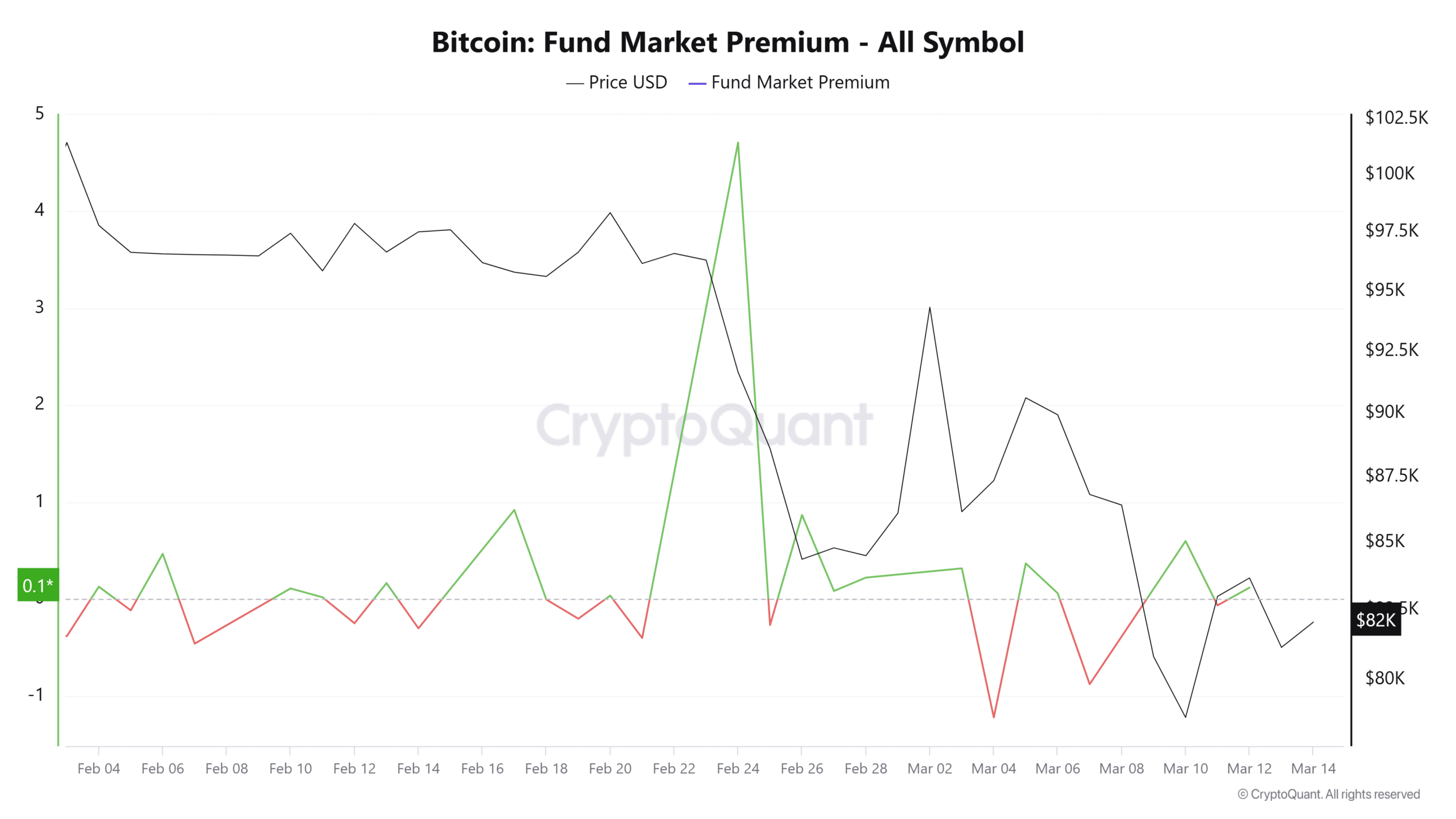

Furthermore, data on Bitcoin’s exchange netflows corroborates this buying activity, with traders acquiring around $57 million worth of Bitcoin in just two days, resulting in negative netflows. In market terminology, this indicates a purchasing trend rather than selling pressure. Institutional investors are exhibiting similar behavior, as evidenced by a recent funds market premium reading of 1.03, suggesting a strong buying interest at this point.

Source: CryptoQuant

Notably, the funds market premium is a crucial indicator of institutional demand for Bitcoin. A premium above 1 indicates strong buying tendencies, while readings below 1 signify selling pressure.

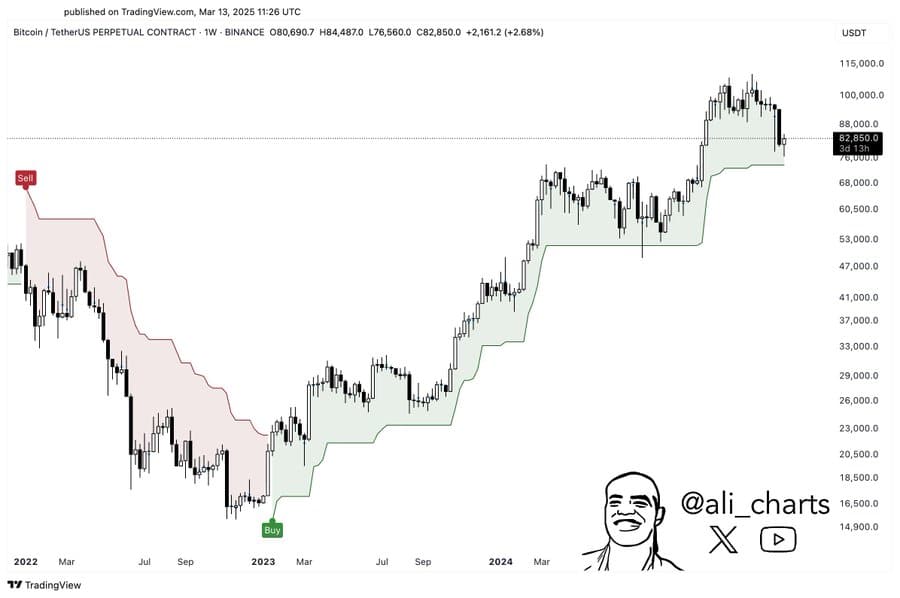

Weekly Support Remains Crucial for Bitcoin

Amidst Bitcoin’s gradual recovery, the pivotal weekly support level at $74,000 remains a crucial factor in shaping market dynamics. This support has been a stronghold since January 2023, facilitating significant market rallies during bullish phases.

Source: TradingView

If Bitcoin successfully maintains its position above this critical support level, it could pave the way for a substantial upward rally. However, a breach below this level might indicate a shift toward bearish sentiment, potentially driving prices lower.

Overall, the market sentiment is currently poised for an upswing, contingent upon sustaining bullish activity among traders and institutional investors.

Conclusion

In summary, Bitcoin’s market positioning demonstrates promising signs of potential recovery, bolstered by reduced ETF outflows and significant liquidity inflows. Should bullish sentiment continue and maintain the vital support levels, traders can anticipate a positive trajectory for Bitcoin prices in the coming days. Staying updated with market trends and investor behavior remains essential for assessing future movements in this dynamic crypto landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DoraHacks officially launches BUIDL AI, opening automated payment service for hackathons

TRON Breaks Key Resistance, Eyes Additional 450% Price Increase

Obol Collective may launch OBOL token on May 15