Risk-on Fades as Bitcoin Dips—Retreat Signals Massive Shift in Market Sentiment

Markets, once electrified by the early enthusiasm surrounding U.S. President Trump’s tenure, have since taken a turn for the worse. Equity benchmarks succumbed to downward pressure Thursday afternoon as the S&P 500 tumbled into its most significant pullback in nearly two years.

The New York Stock Exchange slipped nearly 1% during the day’s trading, while the Dow Jones Industrial Average dropped 1.3% and the Nasdaq 100 closed the session 1.9% weaker. Rounding out the day, the Russell 2000 fell by 1.62%.

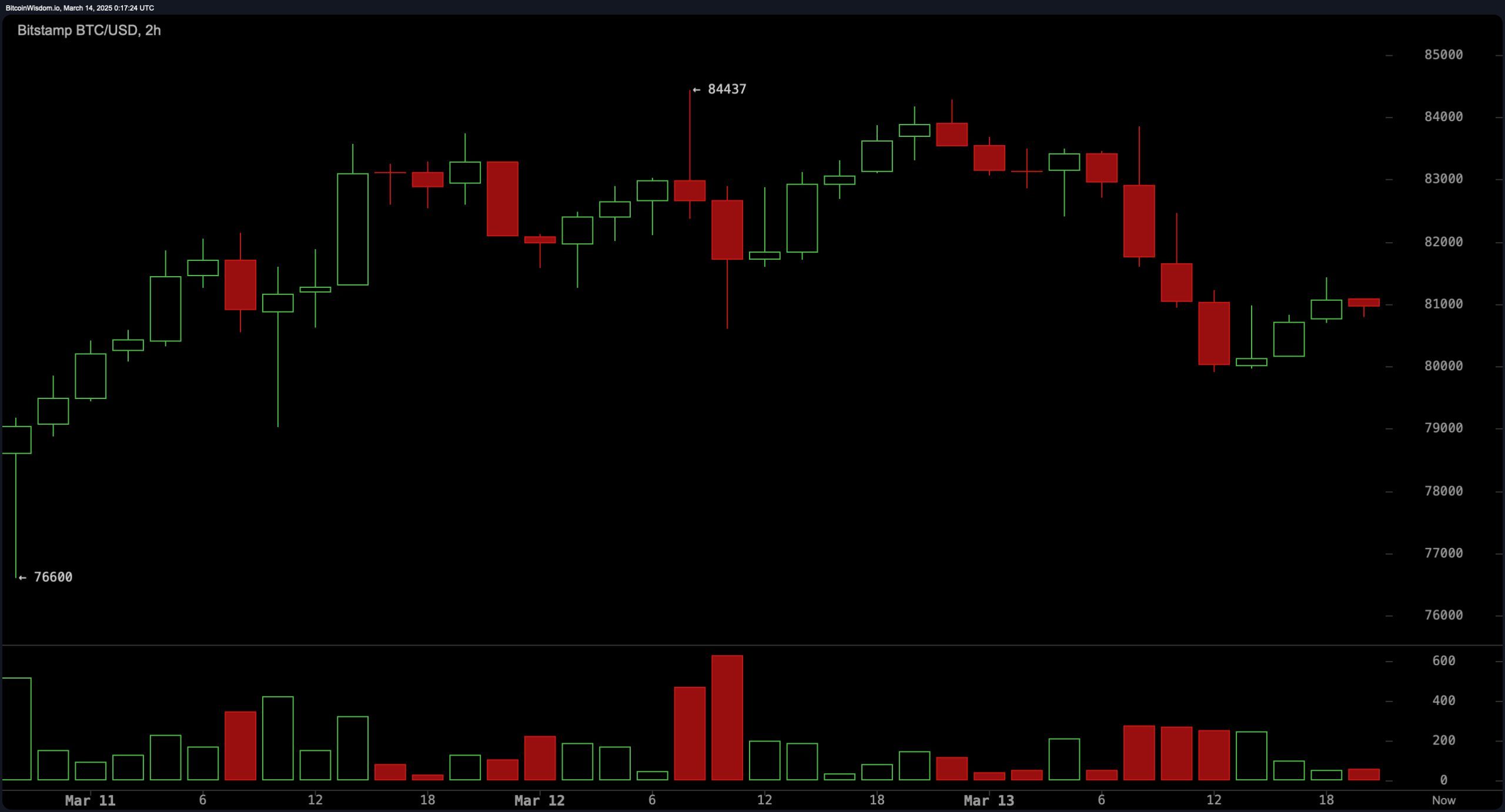

The crypto market saw a similar downturn, with the global market cap declining 2.13% to $2.63 trillion. Bitcoin (BTC) currently hovers just below the $81,000 mark at $80,988, retreating 2.7% against the U.S. dollar. Ethereum (ETH) stands at $1,861 per coin, marking a 1.8% drop by Thursday evening around 8:17 p.m. ET.

At the time of writing, among the top ten cryptocurrencies, cardano (ADA) experienced the steepest decline today, falling 4.2%. Global crypto trade volume remains subdued, totaling $92.09 billion over the past 24 hours—a decline of nearly 12%. The primary catalyst behind today’s market downturn appeared to be Trump’s tariff policies.

His latest threats have propelled gold to fresh highs, while capital floods into the Treasury market at an extraordinary pace. The U.S. dollar index (DXY) hovered near 103.5, maintaining stability after modest gains in the previous session.

This steadiness reflects investor apprehension as global trade tensions intensify. With uncertainty pushing capital toward the dollar, gold, and Treasuries, a disciplined strategy—anchored in margin of safety—provides a rational framework amid financial turbulence.

The week’s shift toward risk aversion illustrates the delicate balance between seizing opportunities and exercising caution. While tariff-related headlines inject short-term volatility, a value-driven approach cuts through the noise. Just as excessive valuations warrant restraint, undervaluation presents opportunities for conviction.

This dual perspective cultivates resilience, transforming geopolitical uncertainty into strategic entry and exit points—demonstrating that discipline, rather than emotion, guides lasting success in volatile markets. Put simply, major market players and large-scale whales thrive in this environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DoraHacks officially launches BUIDL AI, opening automated payment service for hackathons

TRON Breaks Key Resistance, Eyes Additional 450% Price Increase

Obol Collective may launch OBOL token on May 15