Hyperliquid loses $4M after $200M Ethereum trade liquidation

Hyperliquid (CRYPTO:HYPE), a decentralised trading platform, lost $4 million in its Hyperliquid Provider (HLP) vault after a highly leveraged Ethereum (CRYPTO:ETH) trade was liquidated.

A whale trader using wallet "0xf3f4" opened a 50x leveraged long position worth $200 million, backed by a $4.3 million USDC margin.

The trader withdrew funds from the margin, lowering the collateral below the maintenance requirement and triggering liquidation.

This resulted in a $1.8 million profit for the trader but left Hyperliquid's HLP vault with significant losses.

"This user had unrealised PNL, withdrew, which lowered their margin, and was liquidated. They ended with ~$1.8M in PNL. HLP lost ~$4M over the past 24h," Hyperliquid clarified that no exploit or hack occurred.

Despite the setback, Hyperliquid noted that HLP has maintained an all-time profit of approximately $60 million.

To mitigate future risks, Hyperliquid announced leverage reductions, lowering Bitcoin’s maximum leverage to 40x and Ethereum’s to 25x.

These changes aim to increase maintenance margin requirements and prevent similar scenarios.

The incident sparked speculation about possible manipulation of Hyperliquid's liquidation mechanics, but no conclusive evidence has been found.

Following the liquidation, Hyperliquid's native token, HYPE, briefly fell from $14 to under $13 but quickly recovered.

The event highlights the risks of high-leverage trading and its impact on decentralised platforms and market stability.

At the time of reporting, the Hyperliquid (HYPE) price was $12.90, and the Ethereum (ETH) price was $1,893.71.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

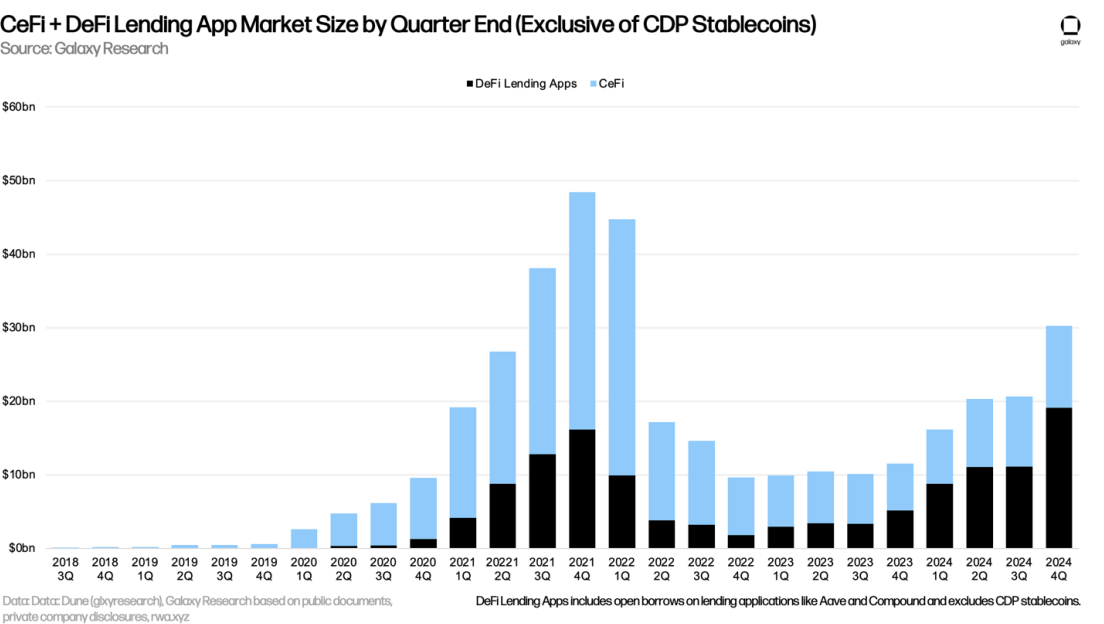

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

USDC’s ‘fueling’ stablecoin market cap rise: Wintermute

Taking a look at the biggest stablecoin players and where they stand

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection