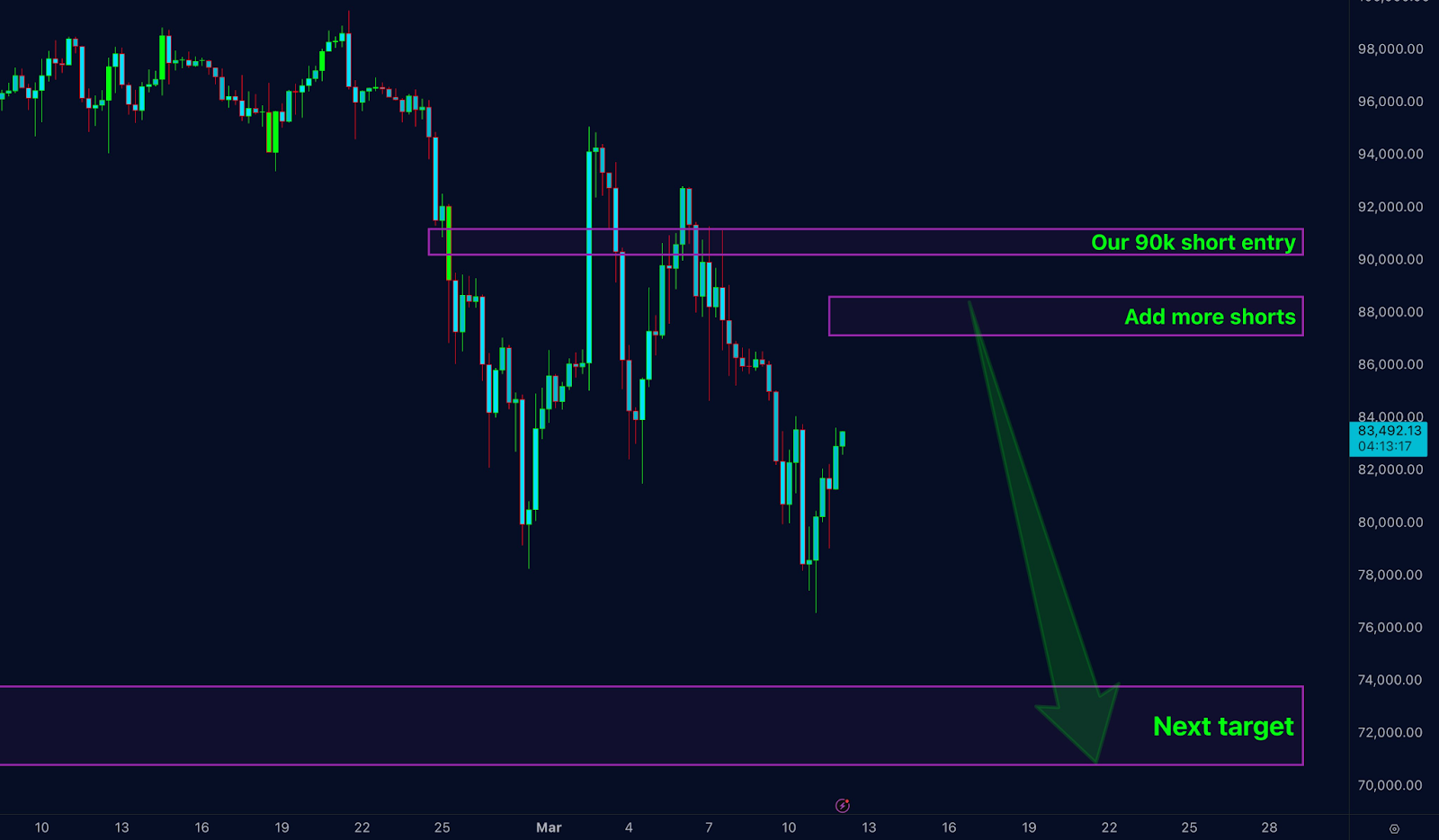

Bitcoin Faces Bearish Pressure as Market Awaits Key Levels

- Bitcoin faces bearish pressure, with traders eyeing $72K–$74K as the next target after resistance in the $86K–$88K zone.

- Market sentiment remains bearish, with no clear reversal signals; short traders are reinforcing positions amid continued downward pressure.

- Bitcoin’s reaction to Trump’s terms varied—volatile in the first, steady gains in the second, reflecting shifting investor sentiment.

Prominent analyst Doctor Profit has reaffirmed his bearish stance on Bitcoin, placing short orders within the $87K–$88K range. The market previously hit two of his targets at $83K and $78K. Now, the next target sits between $72K and $74K, reinforcing the prevailing bearish sentiment.

Source: Doctor Profit

Bitcoin’s Bearish Structure and Key Levels

Bitcoin initially traded near $90K before experiencing a sharp decline. This movement confirmed bearish momentum, with lower highs and lower lows defining the trend. A minor recovery emerged around the $83K mark, but it faced resistance within the critical $86K–$88K zone. This area now serves as a prime opportunity for traders to reinforce short positions.

The market sentiment remains bearish due to sustained downward pressure. Additionally, no significant bullish reversal patterns are visible. If Bitcoin revisits the shorting zone, it could signal another drop towards the anticipated $72K–$74K range. Traders are keenly watching for further confirmations before executing additional trades.

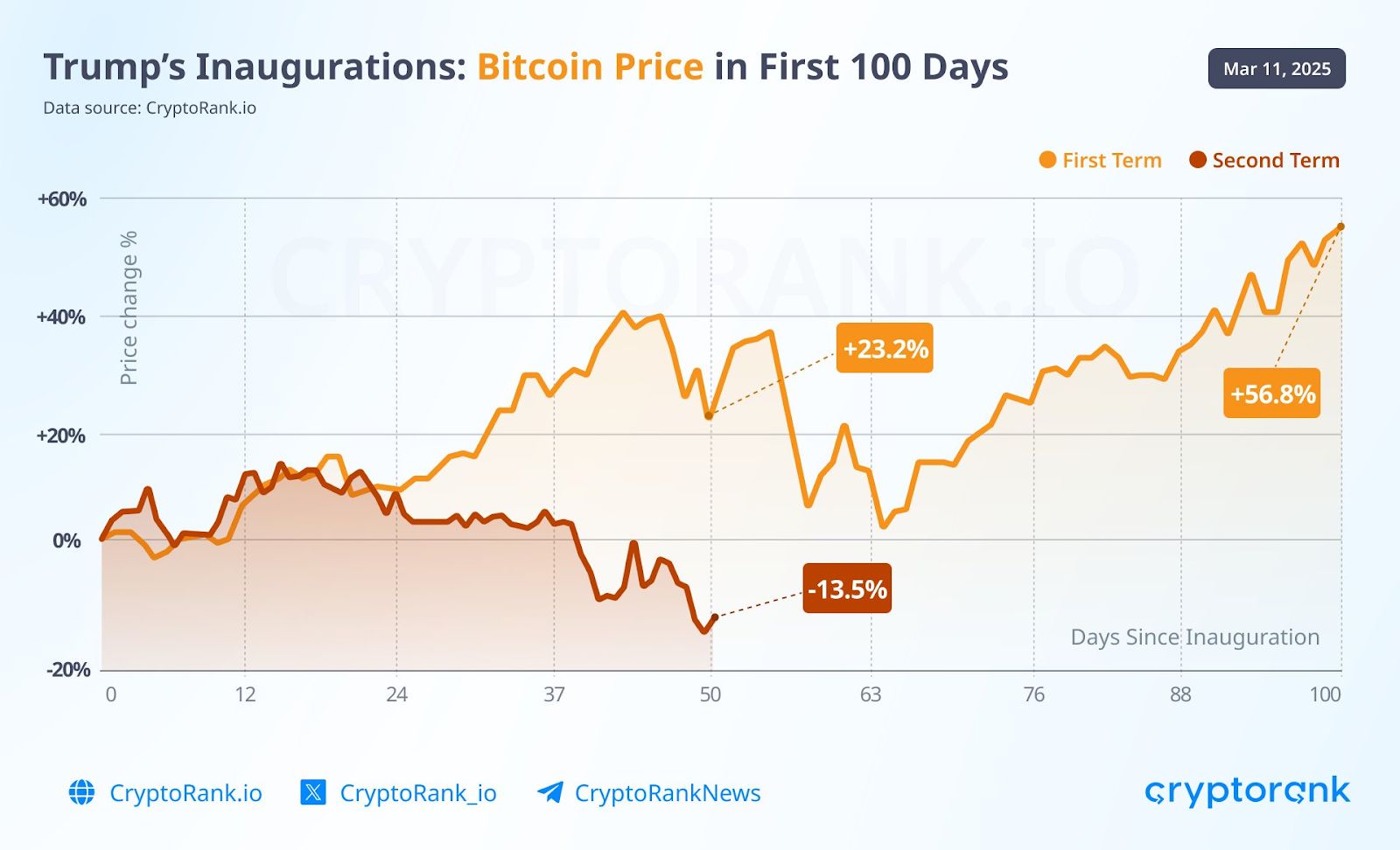

Market Reaction to Trump’s Second Term

During Donald Trump’s presidency, Bitcoin’s performance has displayed divergent patterns . Bitcoin first rose 23.2% in 50 days during his first tenure. But a steep correction ensued, which led to a 13.5% drop. Price levels had a difficult time regaining momentum throughout the slow recovery phase.

Source: CryptoRank

On the other hand, there was a robust and consistent rally during Trump’s second term. The price of Bitcoin steadily increased , rising 56.8% on day 100. The volatility seen throughout the first term was in stark contrast to this bullish run. The discrepancy shows how market circumstances and investor sentiment changed throughout the two time periods.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitdeer Expands Bitcoin Holdings to 1,445.8 BTC

Bitdeer Expands Bitcoin Holdings by 36.9 BTC

Michael Saylor Predicts Bitcoin’s Future Value at $21 Million

Dogecoin Edges Near $0.22 Amid Market Speculation