After Bitcoin’s Sub-$80K Fall: 4 Chip Cryptos Investors Are Watching

- The increase in whale transactions on AAVE indicates that investors increasingly trust its lending features.

- The growing social engagement and network expansion at MKR indicate positive business potential for the future.

- The user activity increase and whale accumulation in both UNI and LINK shows promising signs for growth in the future.

Following Bitcoin’s recent drop below $80,000, investors are closely monitoring certain blue-chip cryptocurrencies demonstrating resilience and potential for recovery. Notably, AAVE, SKY (formerly MKR), UNI, and LINK have emerged as focal points due to their robust performance metrics and increasing market interest. These assets’ exceptional adaptability and innovative platforms position them as significant contenders in the evolving digital asset landscape.

Aave(AAVE): A Superior DeFi Lending Platform

Current Price:$174.47

Market Cap:$2.63B

The decentralized finance (DeFi) protocol AAVE has experienced an enormous surge of whale transactions which now exceeds 267% in recent times. The increased activity points towards the developing self-assurance of major investors which may hint at future market price improvement. AVE’s remarkable adaptability and superior platform continue to attract attention within the crypto community.

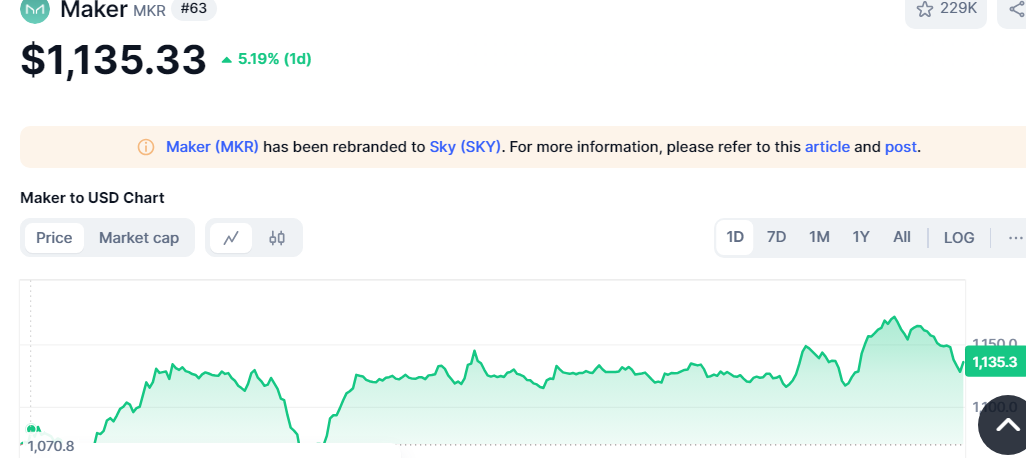

Maker(MKR): A Groundbreaking Asset with Rising Social Engagement

Source: Coinmarketcap

Source: Coinmarketcap

MKR has experienced a significant rise in social volumes, indicating increased discussions and interest among investors. It attracts heightened investor attention because its network grows significantly while earning $4 million in profits that demonstrates its potential for future profitability. Within the DeFi field, MKR demonstrates an innovative method that makes it a valuable asset for observers to track.

Uniswap(UNI): An Unparalleled Decentralized Exchange Token

The total number of people active on Uniswap through its UNI token increased recently with the coin trading at $ 5.90 with a price decline of 2.24%. This increase in platform usage indicates rising user commitment to the platform which suggests the potential end of negative trends. The decentralized exchange model of UNI persists in making the platform a top asset in the crypto market.

Chainlink(LINK): A Phenomenal Oracle Network Token

Current Price: $12.84

Market Cap:$8.19B

LINK token social activity growth has driven whale investors to purchase 2 million LINK during four consecutive days. High-yield digital investors keep purchasing LINK as they see promising performance prospects ahead which confirms LINK’s position as a profitable crypto investment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ronin Bridge CCIP Migration Begins with Chainlink-Powered Security

Celo and Bando Makes Crypto Easy for Buying Gift Cards and Data

VeChain Partners with 4ocean to Advance Ocean and Land Sustainability with Blockchain

Inflation Isn’t Slowing Down and BlackRock CEO Knows Why