Unpacking ‘the great recalibration’ in global markets

Bridgewater Associates CIO Greg Jensen claimed “it’s a dangerous time to be overexposed to US assets, and almost everyone is”

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe .

The law of unintended consequences is a premise in social sciences that shines a light on the outcomes of a purposeful — but not intended or foreseen — action.

As I think through the second and third order effects of Trump’s policies thus far, this notion feels increasingly crucial to consider.

In a recent op-ed in the Wall Street Journal, Bridgewater Associates CIO Greg Jensen claimed that “it’s a dangerous time to be overexposed to US assets, and almost everyone is.”

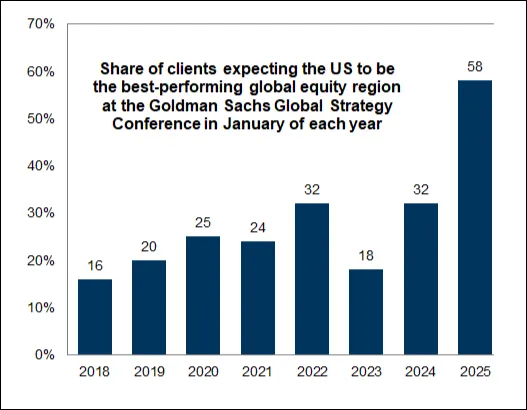

Jensen is right. Heading into 2025, nearly all of Wall Street was on board for the US exceptionalism trade and the idea of hiding out in Mag 7 stocks:

As we begin to unpack the effects of Trump’s trade policies , I’m starting to see a major recalibration of global capital flows unfold that I don’t think was fully anticipated by the president and his team.

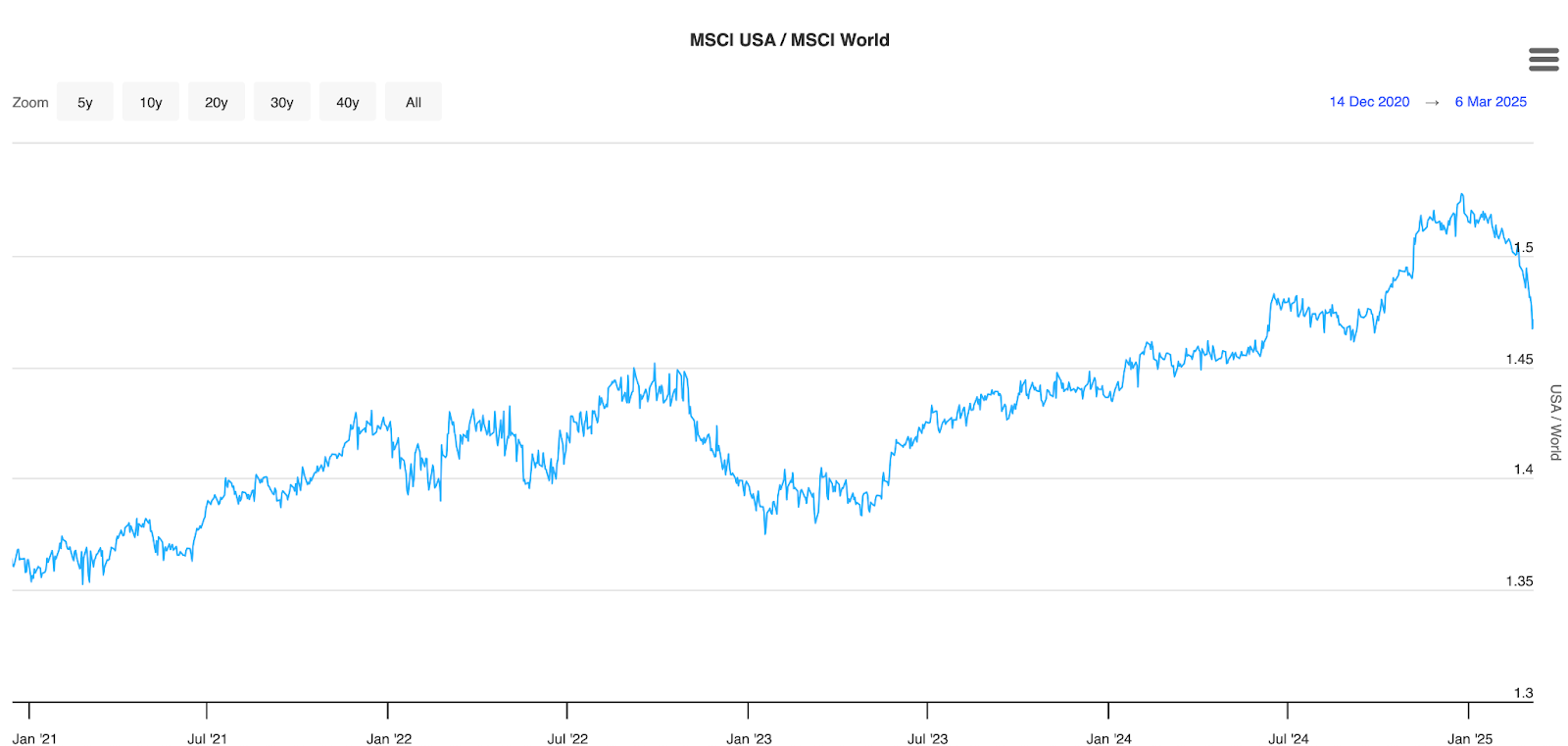

If you compare the MSCI USA index to MSCI World, we can see how, over the past couple of years, the US surged higher — driven by outsized fiscal deficits — while the rest of the world was experiencing a despondent economy. However, since Trump began his trade policy dealmaking and pursuit of lower deficits, this ratio has been falling apart:

Let’s unpack what’s driving this by looking at some of the major economies and how they’re evolving.

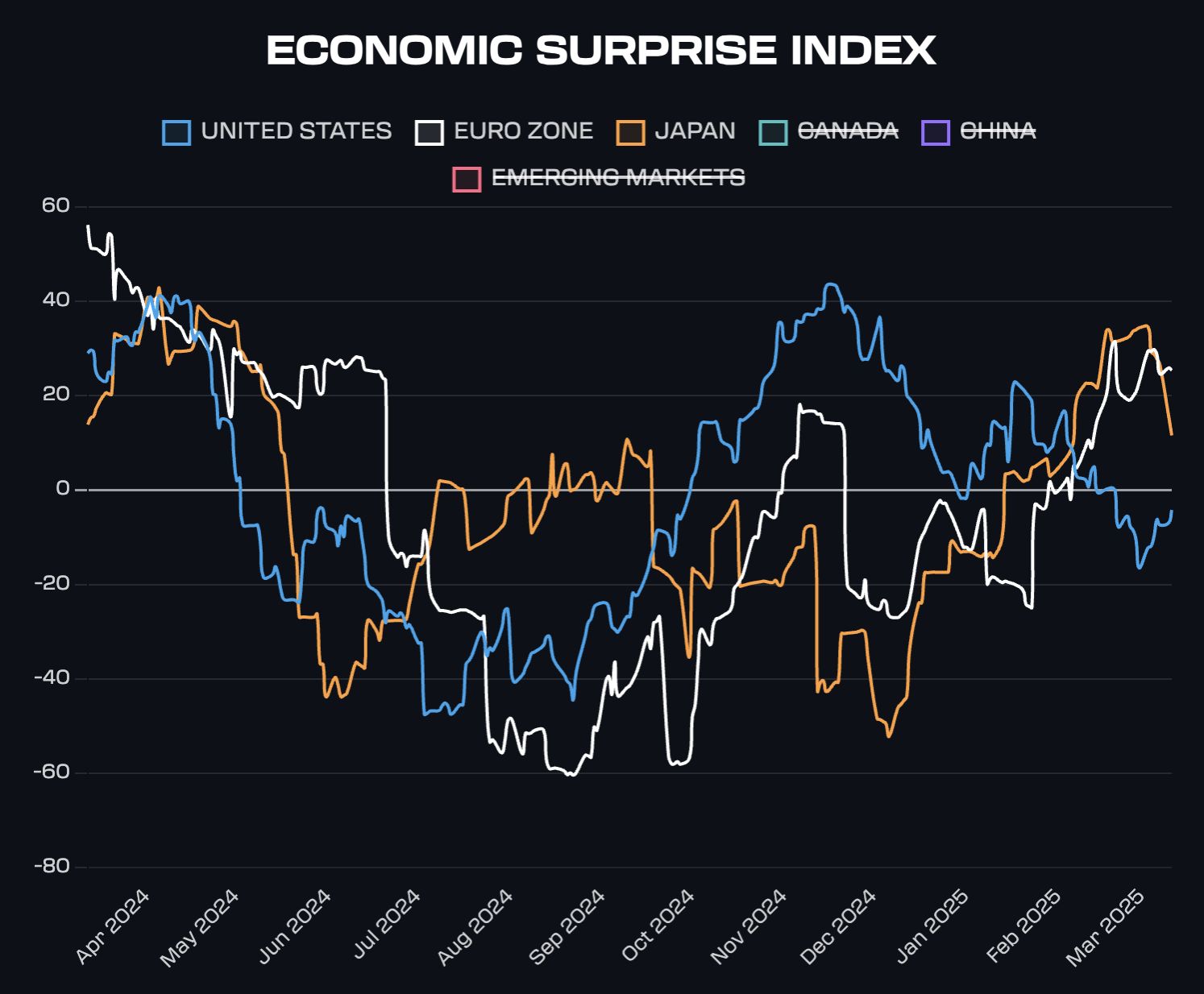

Comparing cross-border economic surprise indexes is a great way to examine which direction economies are trending, as they measure in real-time whether economic data is surprising to the upside/downside.

For the past couple of years, most economies have been in sync. But a major divergence is unfolding, with the US surprising lower and other countries surprising higher:

Adding to that, Trump’s threats of tariffs have awoken the fiscal beast in many countries, namely across Europe.

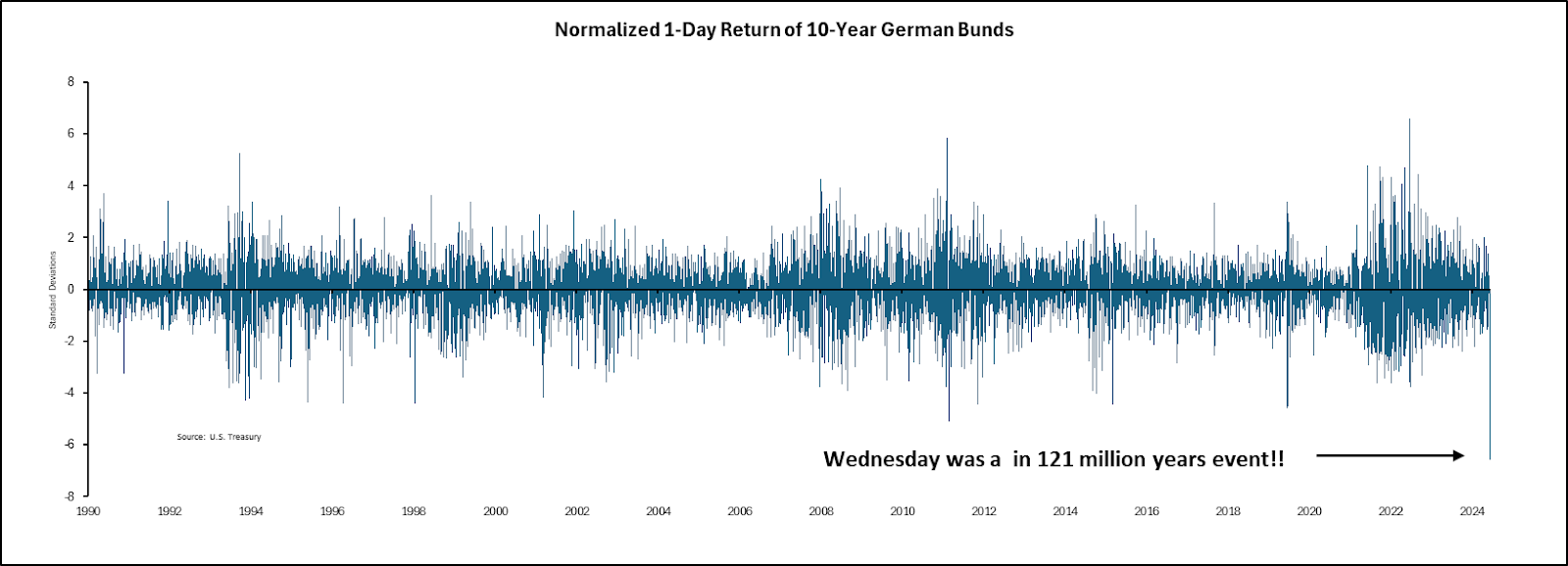

As seen in this chart from my recent interview with Vincent Deluard, in the face of Trump’s threats to stop supporting the NATO security apparatus, Germany now plans to invest $500 billion into its defence and infrastructure — a development that sent Bund yields soaring:

This led to a surge in the euro/USD to 1.088 and a mirrored decline in the USD.

This was a fiscal unshackling moment by the country that has been at the forefront of pursuing austerity. This reversal has sent Europe stocks soaring as capital flows out of US stocks and into European equities.

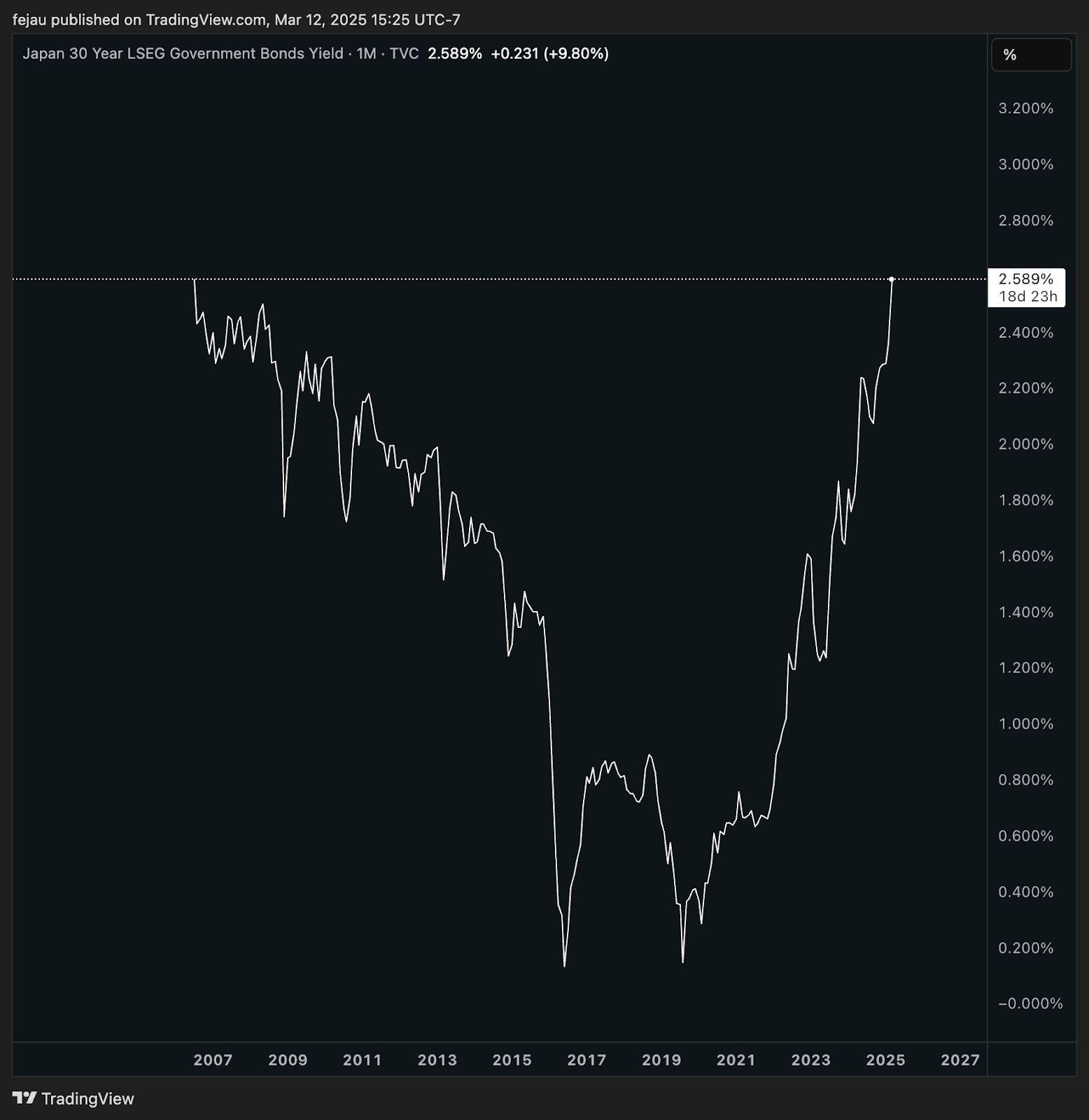

In Japan, the theme of surging yields is similar. The Japanese 30-year bond yield just surged to a 20 year high:

As yields in countries that have predominantly moved capital into US bonds and equities continue to rise, it puts pressure on the calculus that makes owning US assets worth it — turning them into net-sellers as global capital flows back home.

This is why Jensen, as CIO of the world’s largest hedge fund, says it’s a dangerous time to be overexposed to US assets. The marginal buyers of the last 30 years are becoming marginal sellers as capital becomes more attractive back home, largely catalyzed by Trump’s policies.

I believe this trend in global capital flows is only just beginning. Yes, a lot of big moves have already occurred across the board, but the big money cannot shift in just a few weeks. Those megaships take years to turn.

Get the news in your inbox. Explore Blockworks newsletters:

- Blockworks Daily : The newsletter that helps thousands of investors understand crypto and the markets, by Byron Gilliam.

- Empire : Start your morning with the top news and analysis to inform your day in crypto.

- Forward Guidance : Reporting and analysis on the growing intersection of crypto and macroeconomics, policy and finance.

- 0xResearch : Alpha directly in your inbox. Market highlights, data, degen trade ideas, governance updates, token performance and more.

- Lightspeed : Built for Solana investors, developers and community members. The latest from one of crypto’s hottest networks.

- The Drop : For crypto collectors and traders, covering apps, games, memes and more.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ronin Bridge CCIP Migration Begins with Chainlink-Powered Security

Celo and Bando Makes Crypto Easy for Buying Gift Cards and Data

VeChain Partners with 4ocean to Advance Ocean and Land Sustainability with Blockchain

Inflation Isn’t Slowing Down and BlackRock CEO Knows Why