Ethereum Staking Surges Despite Price Struggles: A Sign of Long-Term Confidence?

Despite Ethereum’s recent price drop, staking activity has surged, suggesting long-term confidence among investors. However, declining ETF inflows hint at bearish sentiment in the broader market.

Ethereum’s price has remained under significant pressure over the past month, yet staking activity has surged.

On-chain data shows a notable increase in the amount of ETH locked in staking contracts, even as the altcoin struggles to regain upward momentum.

ETH Staking Grows While ETF Outflows Hit $524 Million

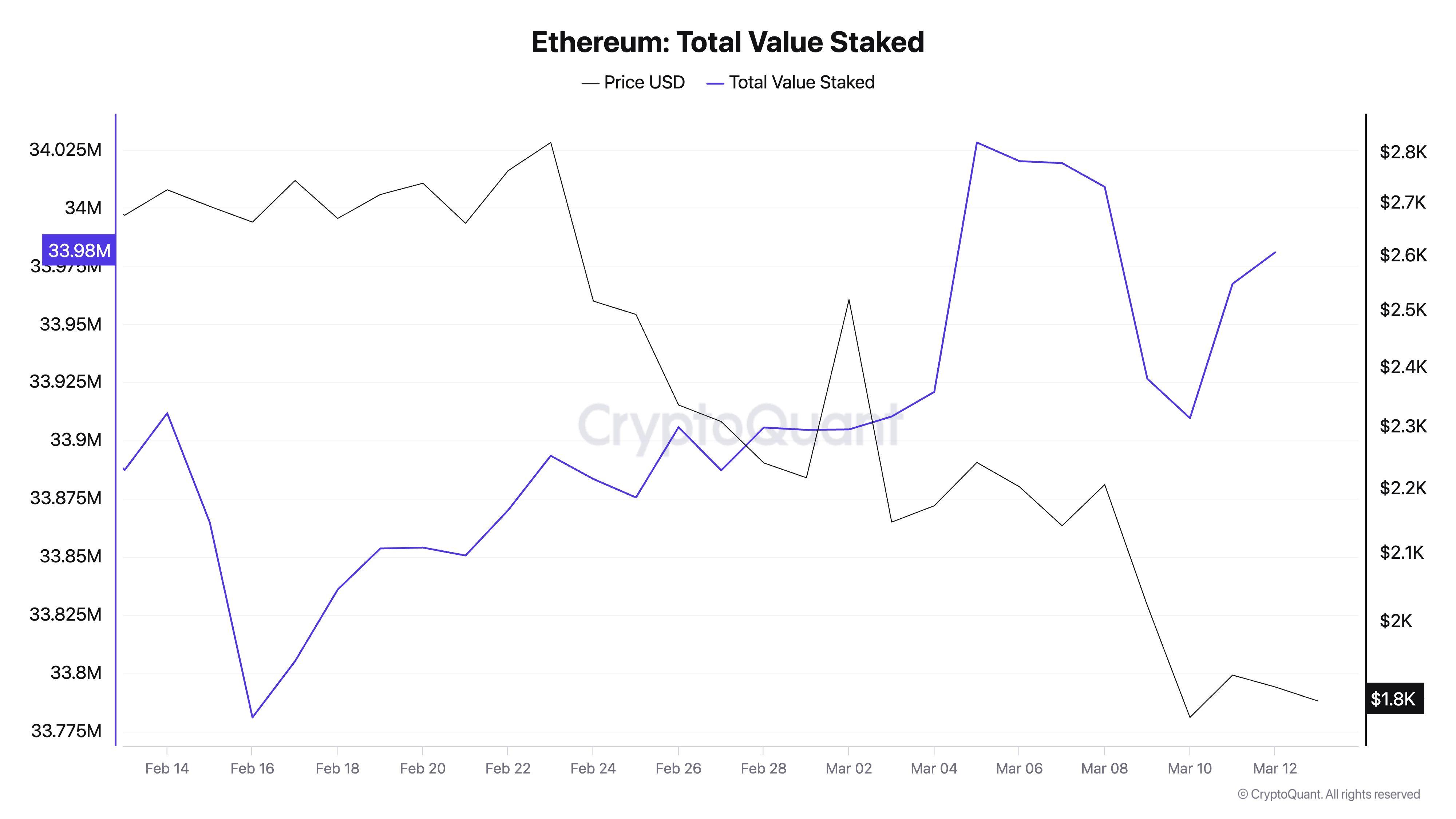

Since plummeting to its year-to-date low on February 16, the amount of staked ETH has risen. With 33.98 million ETH currently locked in staking contracts, this figure has gone up by 1% over the past month.

ETH Total Value Staked. Source:

CryptoQuant

ETH Total Value Staked. Source:

CryptoQuant

This has happened despite the significant drop in ETH’s value in the past 30 days. Trading at $1,897 at press time, ETH’s price has plummeted by 30% since February 16.

The divergence suggests that many investors continue to see the coin as a long-term asset rather than a short-term trading opportunity. They demonstrate confidence in ETH’s future price performance by locking up their coins instead of selling amid recent headwinds.

Moreover, this increased staked ETH could indicate growing institutional and retail interest in passive yield, even as short-term price action remains unimpressive.

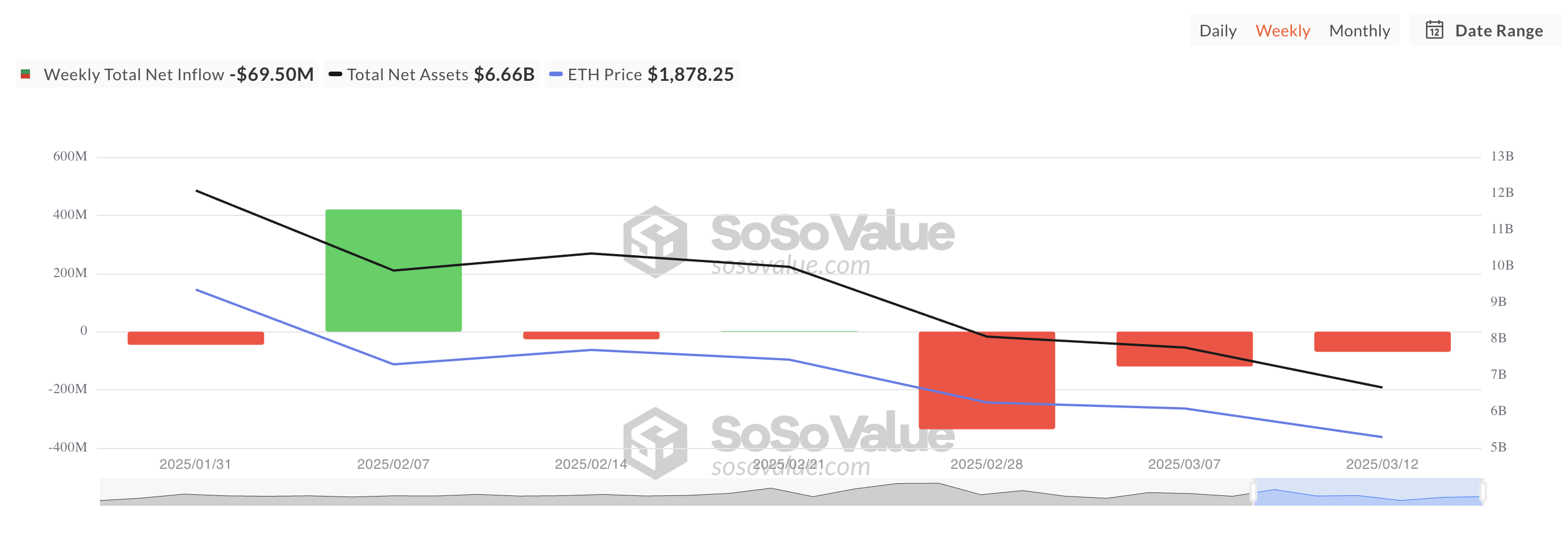

However, this bullish stance contrasts with the recent decline in spot ETH exchange-traded fund (ETF) inflows, raising questions about broader market sentiment. Data from SosoValue shows that these funds have recorded outflows totaling $524.68 million in the past three weeks.

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

When ETH ETFs see net outflows like this, investors are withdrawing more funds than they are putting in. This indicates a bearish sentiment toward the coin and puts more downward pressure on its price.

Ethereum’s Eyes Deeper Pullback—Or a Bullish Reversal?

ETH trades at $1,897 at press time, breaking below the key support formed at $1,924. The negative readings from its Balance of Power (BoP) reflect the ongoing selling activity among ETH holders.

As of this writing, this indicator, which compares the strength of the bulls against the bears, is below zero at -0.27. When an asset’s BoP is negative, its sellers exert more control over price action, confirming the downward pressure on price.

If this trend persists, ETH could continue its decline to trade at $1,758.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

On the other hand, if sentiment flips and becomes fully bullish, it could drive ETH’s price above the $1,924 resistance and toward $2,224.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating crypto exposures in a volatile world

While BTC’s year-to-date price drop resembles that of the S&P 500, some crypto stocks have fared way worse

SOL remains bullish amid broader market stagnation

The asset surged over the past seven days to reach its highest-ever weekly close on the SOL/ETH pair

Ripple XRP vs.SEC Legal Case to Close Soon

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?