Celestia (TIA) Price Heads Towards Consolidation After 31% Rally

Celestia has bounced back with a 31% rally to $3.60, but signs of consolidation loom as Bollinger Bands squeeze and weak investor inflows slow momentum. A breakout above $3.83 could trigger more gains, while the altcoin remains stuck in a narrow range for now.

Celestia (TIA) has shown a recent recovery, reaching $3.60 after a 31% rise in the past 48 hours. This price action helped the altcoin recover most of its recent losses.

However, despite the positive movement, further gains might be challenging as signs point to potential consolidation in the near future.

Celestia Is Heading In No Direction

The Bollinger Bands are closing in on a squeeze, signaling that volatility in Celestia’s price could be coming to an end. Historically, such squeezes have often been followed by periods of price stabilization, where the price moves sideways.

This suggests that while TIA has seen some positive movement, it may struggle to pick a clear direction in the short term. During this time, TIA might hover between the support and resistance levels, awaiting stronger market cues to spark a breakout in either direction.

Celestia Bollinger Bands. Source:

TradingView

Celestia Bollinger Bands. Source:

TradingView

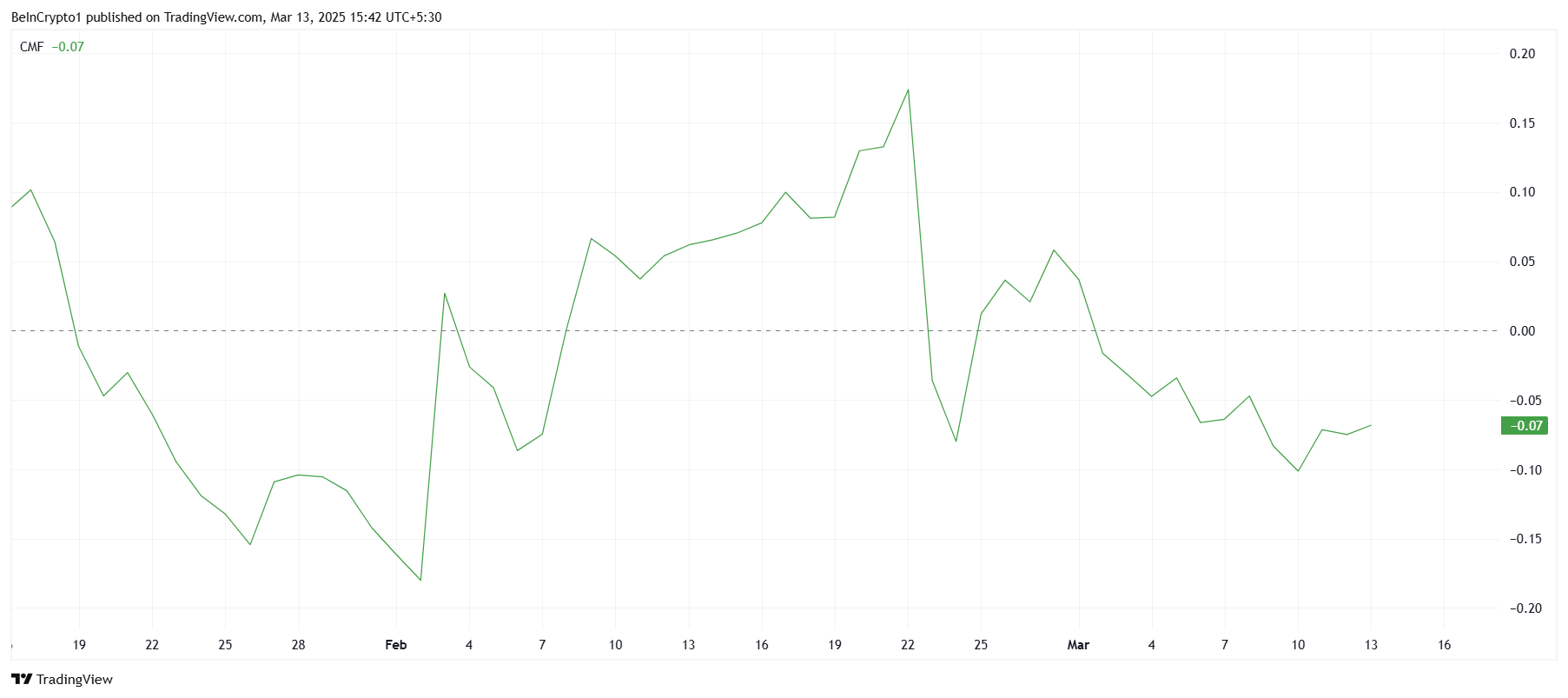

In terms of macro momentum, Celestia’s market sentiment is being influenced by the Chaikin Money Flow (CMF), which has remained below the zero line for the past few days. This indicator shows that capital inflows into Celestia have been relatively weak.

While the CMF’s position below the zero line typically signals bearish sentiment, the absence of strong volatility could prevent further declines. This lack of momentum may keep TIA from experiencing a sharp drop, but it also limits its ability to build on recent gains.

Celestia CMF. Source:

TradingView

Celestia CMF. Source:

TradingView

TIA Price Needs A Push

At the time of writing, Celestia’s price is holding steady at $3.60, comfortably above the $3.50 support level. However, it is still under the resistance of $3.83, which has historically been a challenging barrier for the altcoin. Despite the 31% rise over the last 48 hours, this resistance may continue to pose challenges for Celestia’s upward movement.

Given the current market conditions, Celestia is likely to face some struggle beneath the $3.83 resistance. The price could consolidate within a range between $3.83 and $3.50 until stronger market signals prompt a breakout. The consolidation phase may keep the price contained, delaying further price movement for the time being.

Celestia Price Analysis. Source:

TradingView

Celestia Price Analysis. Source:

TradingView

On the other hand, if Celestia successfully breaches the $3.83 resistance level, it could pave the way for further recovery, potentially driving the price to $4.50. A successful breakout beyond this level would invalidate the bearish-neutral outlook and could trigger a new phase of growth for Celestia.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

FIL Price Forecast: Explosive Growth Likely After Filecoin (FIL) v1.32.2 Upgrade

Teucrium CEO Endorses XRP as Essential for Future Financial Infrastructure

EURC Hits New Record as Demand Grows Across Blockchains

Strategy₿ Resumes Bitcoin Acquisitions, Buys $285.8M in BTC