Bitcoin ETFs Break Seven-Day Outflow Streak With $13 Million Inflow, Ether ETFs Continue Decline

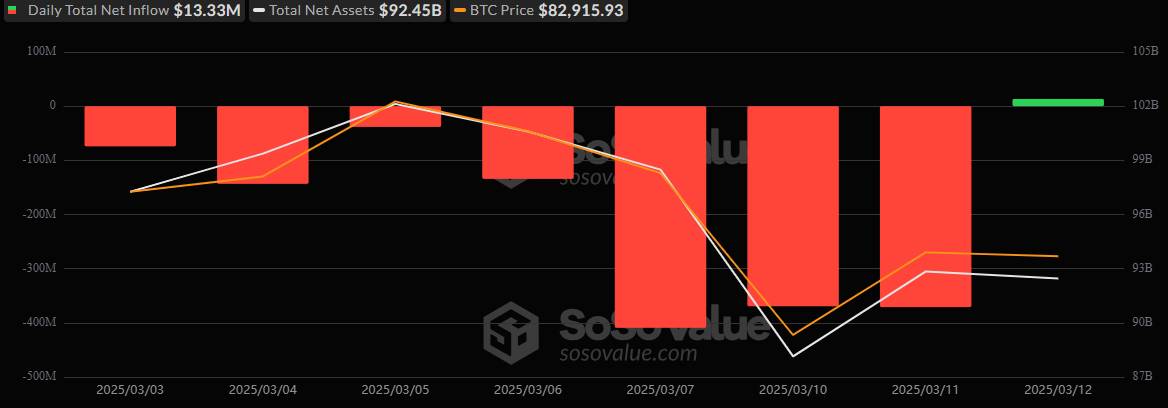

After a challenging week marked by persistent outflows, bitcoin exchange-traded funds (ETFs) experienced a modest resurgence on Wednesday, March 12, with net inflows totaling $13.33 million.

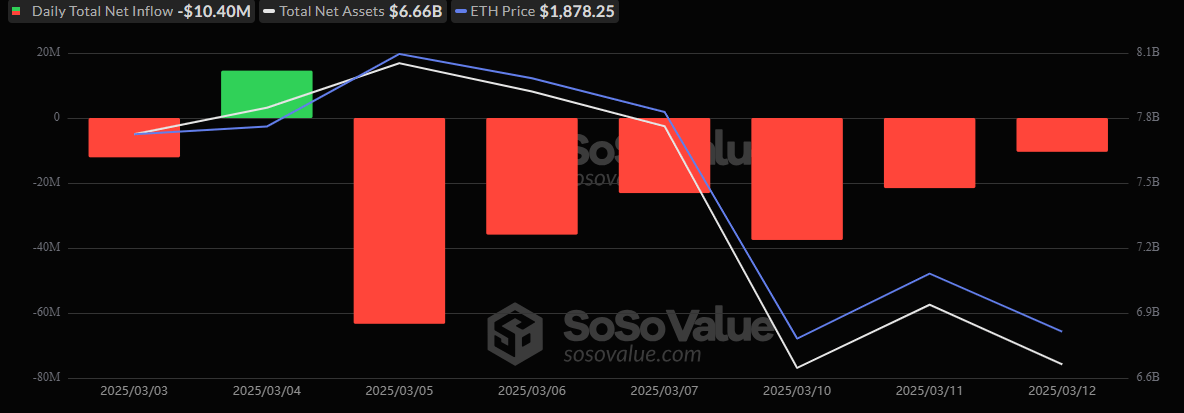

This uptick breaks a seven-day streak of consecutive outflows, offering a glimmer of optimism to investors. Conversely, ether ETFs continued their downward trajectory, recording net outflows of $10.40 million, extending their successive outflows to six days.

Four funds reported outflows among the 12 U.S. spot bitcoin ETFs, while two registered inflows. Ark 21Shares’ ARKB led the inflows, attracting a substantial $82.6 million, signaling renewed investor confidence in the fund’s strategy and performance. Grayscale’s BTC also saw positive movement, with an inflow of $5.51 million.

On the outflow side, Blackrock’s IBIT experienced a significant withdrawal of $47.05 million, reflecting ongoing investor caution. Invesco’s BTCO and Grayscale’s GBTC weren’t spared either, with outflows of $12.41 million and $11.81 million, respectively. Wisdomtree’s BTCW also saw a modest outflow of $3.51 million.

These movements brought the total net assets for bitcoin ETFs to $92.45 billion, a slight rebound from previous lows but still indicative of a market in recovery.

In contrast, ether ETFs faced another challenging day, with outflows affecting several major funds. Fidelity’s FETH led the downturn, with investors pulling out $3.75 million. Grayscale’s ETH followed closely, experiencing a $3.54 million outflow. 21Shares’ CETH and Franklin’s EZET weren’t immune, recording outflows of $1.69 million and $1.43 million, respectively.

These continued outflows have reduced the total net assets for ether ETFs to $6.66 billion, underscoring a persistent trend of investor retreat from ether-focused funds.

The modest inflows into bitcoin ETFs may suggest a tentative return of investor confidence, possibly driven by recent market stabilization or strategic repositioning within portfolios. However, the continued outflows from ether ETFs could indicate a shift in investment preferences.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating crypto exposures in a volatile world

While BTC’s year-to-date price drop resembles that of the S&P 500, some crypto stocks have fared way worse

SOL remains bullish amid broader market stagnation

The asset surged over the past seven days to reach its highest-ever weekly close on the SOL/ETH pair

Ripple XRP vs.SEC Legal Case to Close Soon

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?