USDC to USDT Arbitrage Bot Suffers $215,000 Sandwich Loss, How Does MEV Attack Stablecoin Trades?

Is anything truly secure?

Original Article Title: Crypto trader gets sandwich attacked in stablecoin swap, loses $215K

Original Article Author: Brayden Lindrea, Cointelegraph Author

Original Article Translation: ChatGPT

Editor's Note: This article covers a sandwich attack incident that occurred in a cryptocurrency trade, where a trader lost over $215,000 during a stablecoin exchange. The article provides a detailed account of the attack, including how MEV bots profited through frontrunning and discusses potential money laundering activities. Additionally, it mentions the protective measures taken by the Uniswap platform to prevent such attacks and clarifies initial criticisms.

Below is the original content (slightly rephrased for better readability):

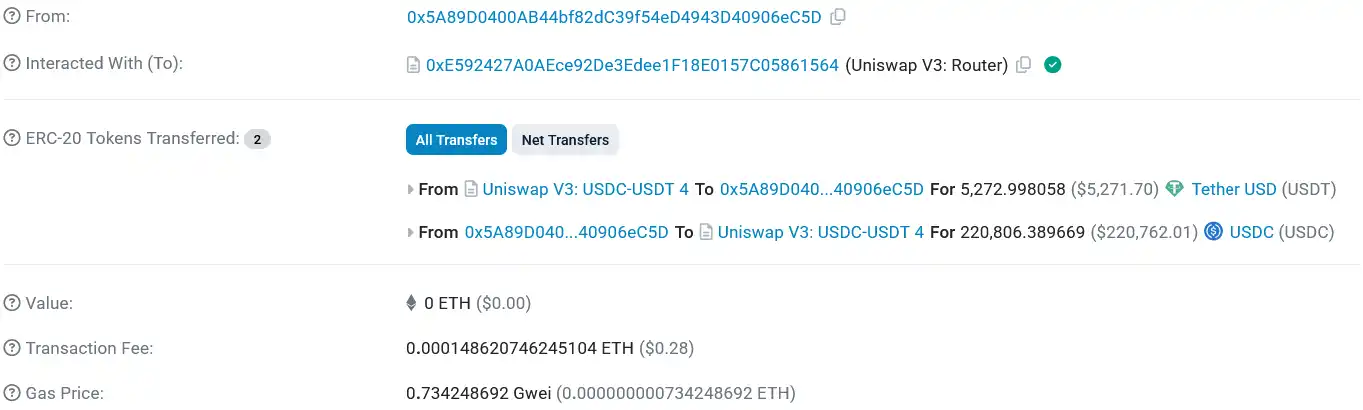

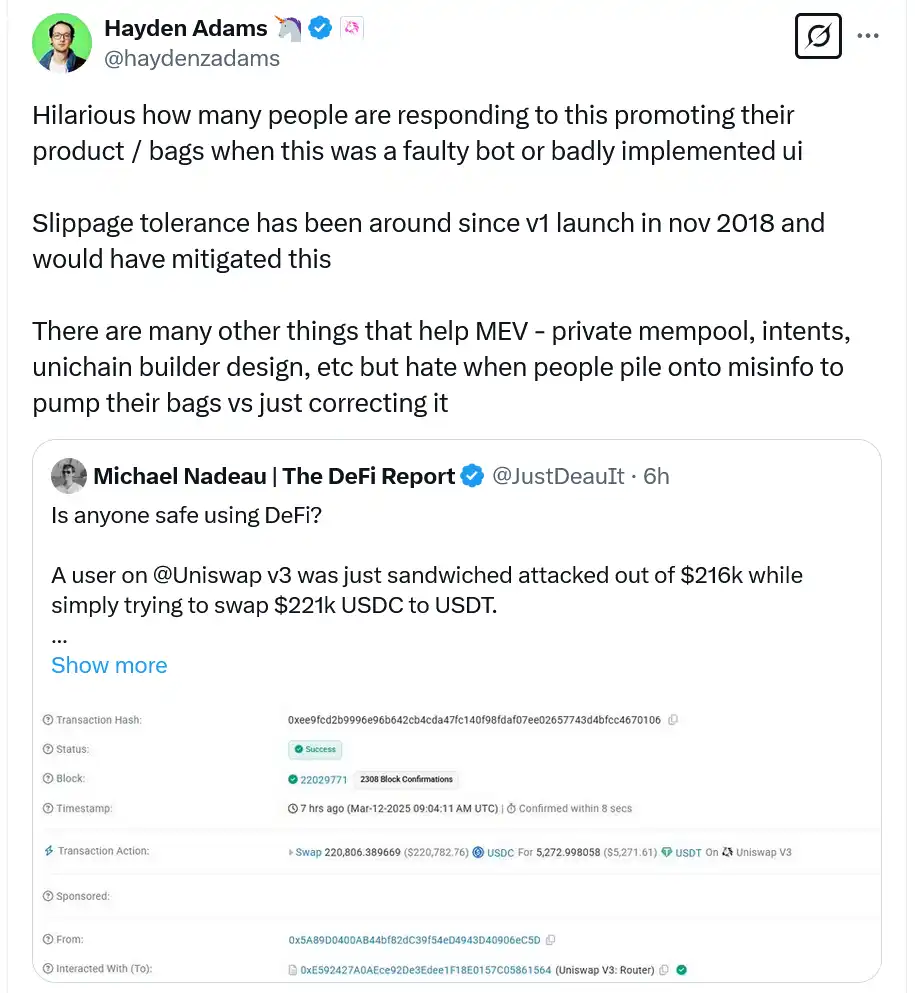

On March 12, a crypto trader fell victim to a sandwich attack while transferring $220,764 in stablecoins, losing nearly 98% of its value, amounting to $215,000, which was captured by a MEV bot.

A $220,764 USDC stablecoin value was swapped to $5,271 Tether USDT within 8 seconds, as the MEV bot successfully front-ran the transaction, profiting over $215,500 from it.

Data from the Ethereum block explorer shows that this MEV attack occurred in the USDC-USDT liquidity pool of the decentralized exchange Uniswap v3, with assets worth $19.8 million locked in the pool.

Details of the Sandwich Attack Transaction Source: Etherscan

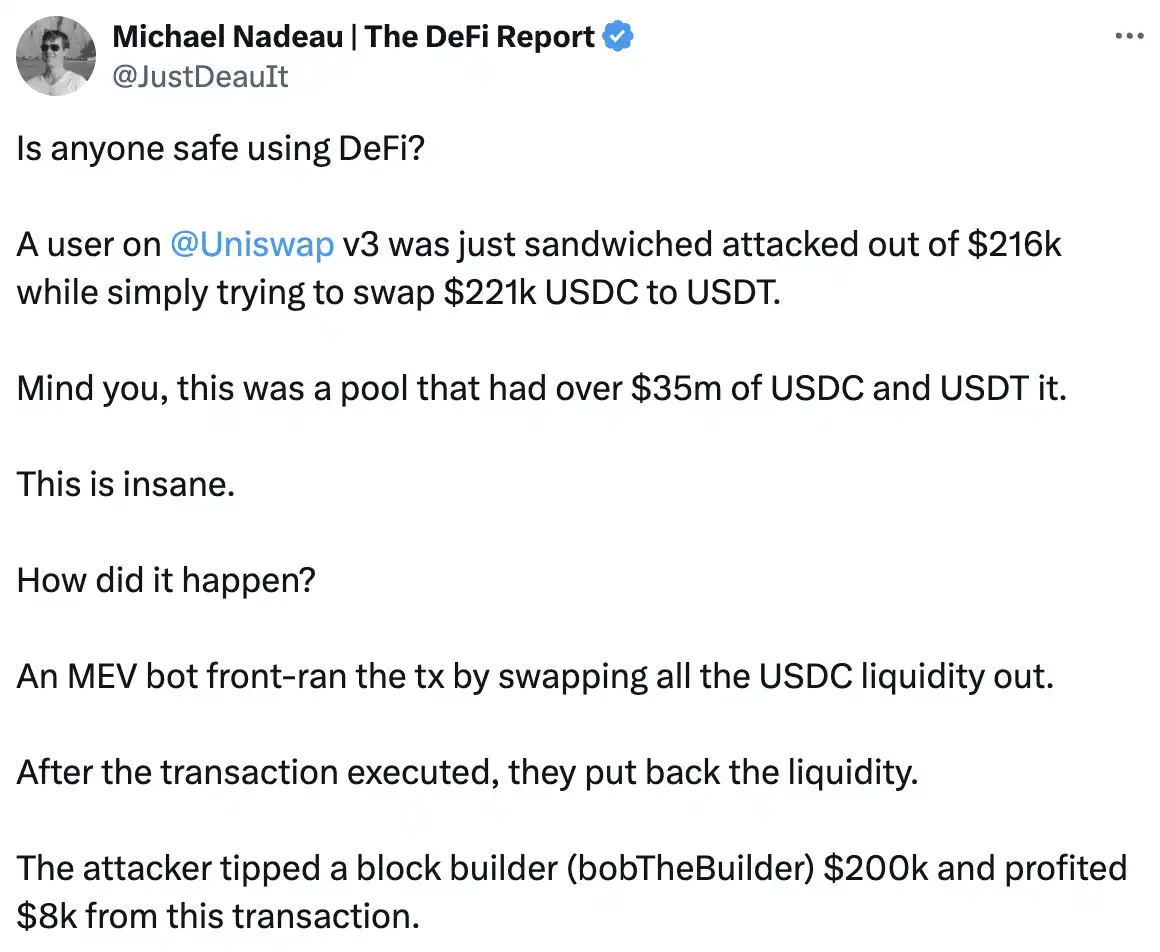

According to Michael Nadeau, the founder of The DeFi Report, the MEV bot front-ran by swapping out all USDC liquidity from Uniswap v3's USDC-USDT pool and then putting it back after the transaction execution.

Nadeau stated that the attacker paid a $200,000 fee to the Ethereum block builder "bob-the-builder.eth" from the $220,764 transaction and pocketed $8,000 for themselves.

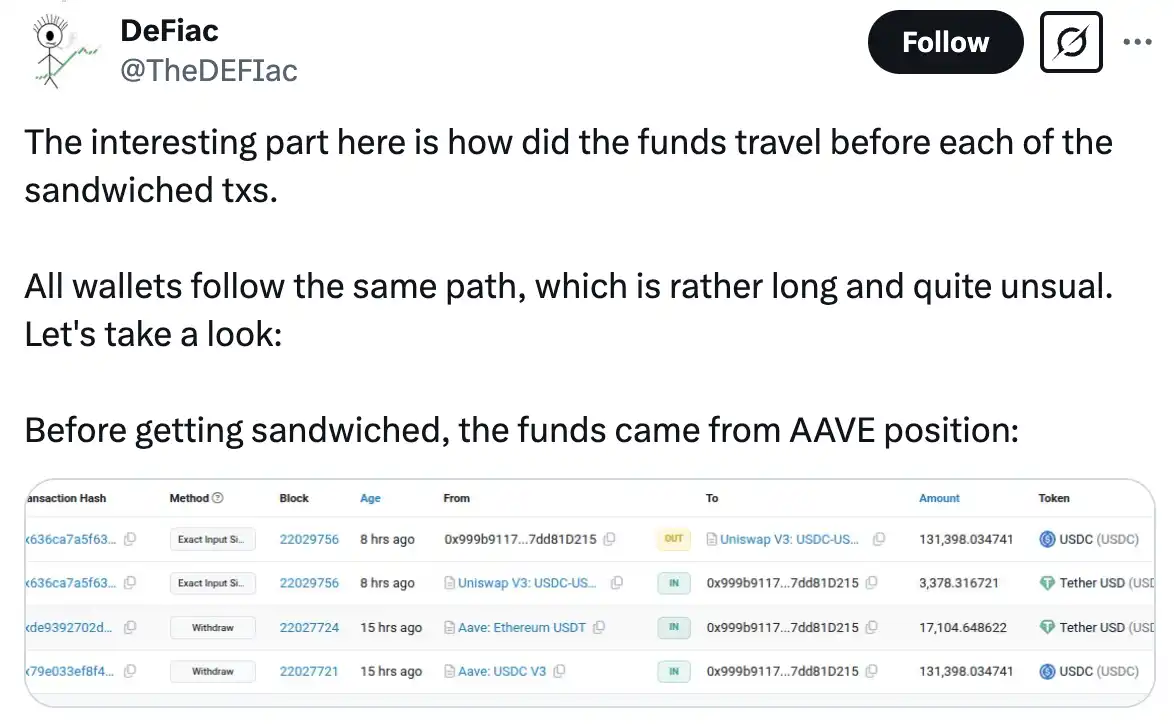

DeFi researcher "DeFiac" speculated that the same trader using different wallets may have experienced a total of six sandwich attacks, citing "internal tools" as evidence. They noted that all funds were sourced from the Aave lending protocol before being deposited into Uniswap.

Two wallets fell victim to MEV sandwich attacks around 9 a.m. UTC on March 12th. Ethereum wallet addresses "0xDDe…42a6D" and "0x999…1D215" were sandwich attacked in transactions that occurred three to four minutes apart, resulting in losses of $138,838 and $128,003, respectively.

These two traders conducted trades in the Uniswap v3 liquidity pool similar to a trader exchanging $220,762.

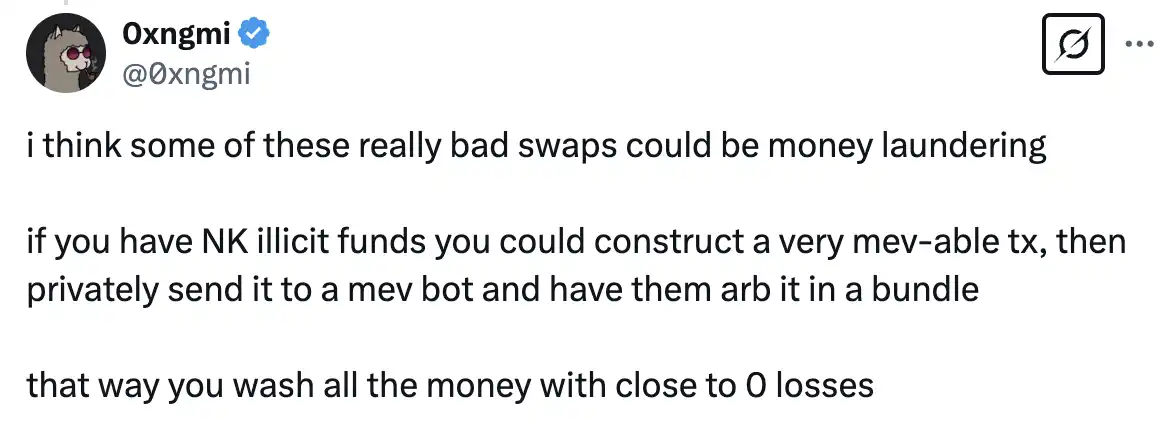

Speculation arose that these transactions might be related to money laundering.

0xngmi, the founder of the crypto data dashboard DefiLlama, stated, "If you have NK illicit funds, you can construct a transaction that is very easily exploited by MEV and privately send it to an MEV bot, allowing them to arbitrage in a bundle. This way, you can wash all the money with close to zero loss."

While Nadeau initially criticized Uniswap, he later acknowledged that these transactions did not originate from Uniswap's frontend, which has MEV protection and default slippage settings.

After Uniswap CEO Hayden Adams and others clarified the protective measures taken by Uniswap to prevent sandwich attacks, Nadeau retracted those criticisms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

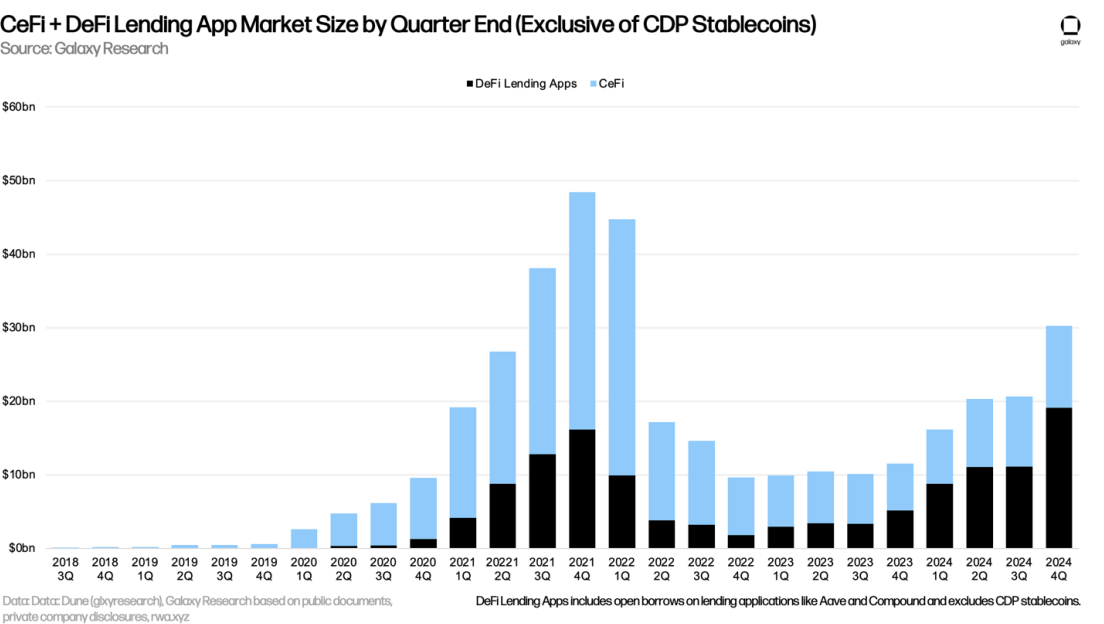

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

USDC’s ‘fueling’ stablecoin market cap rise: Wintermute

Taking a look at the biggest stablecoin players and where they stand

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection