CPI Inflation Data in Focus: What It Means for Crypto

The U.S. CPI inflation data for February is set to be released on Wednesday, offering crucial insights into the inflation rate and its impact on financial markets.

Investors are closely watching this Consumer Price Index (CPI) report, as it could influence the Federal Reserve’s next move on interest rates and shape sentiment in both traditional and crypto markets.

What to Expect from the CPI Inflation Data?

Economists forecast a 0.3% monthly increase in CPI inflation data, a slowdown from January’s 0.5% rise.

Sponsored

On a yearly basis, the inflation rate is expected to drop to 2.9% from 3.0%, marking the first time inflation has fallen below 3% since early 2023.

Despite this moderation, inflation remains above the Fed’s 2% target, keeping investors on edge.

Wage growth continues to exceed expectations, while costs for services are easing and demand in key industries is softening. This mixed economic picture complicates forecasts for future inflation trends.

Adding to market anxiety, President Donald Trump’s proposed tariffs on imports from Canada, Mexico, and China have raised concerns about renewed price pressures.

If trade barriers push prices higher, the Fed may need to keep interest rates elevated for longer, which could weigh on risk assets like stocks and cryptocurrencies.

How CPI Inflation Data Could Impact Crypto Markets

The crypto market is highly sensitive to inflation trends, and the latest CPI report will play a crucial role in shaping sentiment.

A lower-than-expected CPI inflation data reading would suggest cooling inflation, raising the likelihood of Federal Reserve rate cuts—a bullish signal for Bitcoin and altcoins.

If the inflation rate remains high, markets may fear prolonged monetary tightening, which could put pressure on speculative assets.

“This could be a strong catalyst for the bull market,” said financial podcaster Brian Rose. “Small caps and crypto could start pumping if the inflation numbers come in positive.”

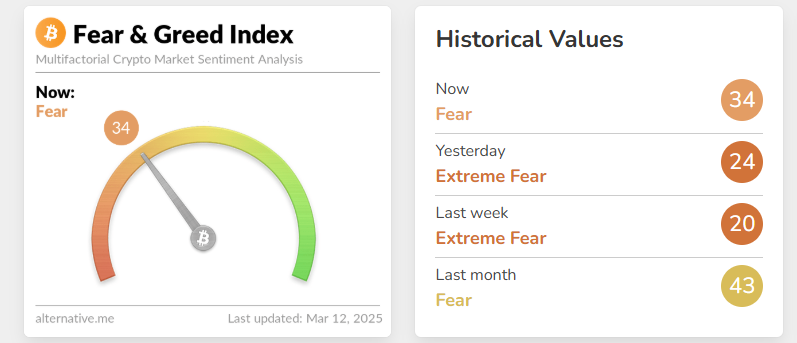

Currently, the Crypto Fear and Greed Index stands at 34 (Fear territory)—a notable improvement from yesterday’s Extreme Fear level of 20.

The Crypto Fear and Greed Index has moved out of Extreme Fear territory.

The Crypto Fear and Greed Index has moved out of Extreme Fear territory.

Source: Alternative

While the overall crypto market capitalization has edged up 1% in the past 24 hours, trading volume has declined by 27% , reflecting cautious investor sentiment.

On The Flipside:

- The CPI report isn’t the only major economic indicator this week. On Thursday, the Producer Price Index (PPI) and weekly jobless claims will also be released, providing additional insight into inflation trends and labor market conditions.

Why This Matters

The February CPI report is a pivotal moment for investors, as it could determine whether the Fed continues its restrictive policy or shifts toward rate cuts. For the crypto market, a positive inflation reading could provide the bullish momentum traders have been waiting for. However, uncertainty remains, especially with inflation risks from tariffs and upcoming economic data.

Check out DailyCoin’s popular crypto stories:

Is UAE Considering Shiba Inu For Strategic Crypto Reserve?

Meteoric Bitcoin ETF Outflows Punch Bitcoin Price Below $80K

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating crypto exposures in a volatile world

While BTC’s year-to-date price drop resembles that of the S&P 500, some crypto stocks have fared way worse

SOL remains bullish amid broader market stagnation

The asset surged over the past seven days to reach its highest-ever weekly close on the SOL/ETH pair

Ripple XRP vs.SEC Legal Case to Close Soon

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?