- Metaplanet’s Bitcoin holdings reach $253.7 million with a 53.2% YTD yield.

- Metaplanet plans further Bitcoin purchases through JPY 2 billion bond issuance.

- Bitcoin whales accumulate over 65,000 BTC amid recent market corrections.

Metaplanet has continued its Bitcoin acquisition strategy by purchasing 162 Bitcoins worth $13.5 million. The latest acquisition takes the company’s total Bitcoin holdings to 3,050 BTC, valued at approximately $253.7 million as of March 12, 2025.

The purchase was made at an average price of $83,123 per Bitcoin, confirming Metaplanet’s strong commitment to Bitcoin as a future store of value. This latest addition further solidifies the company as a significant BTC owner and adds to its expanding cryptocurrency treasury.

The latest acquisition is part of Metaplanet’s strategy to strengthen its Bitcoin holdings. The company’s total Bitcoin assets have reached $253.7 million, with an average purchase price of $83,180 per BTC.

This approach has been highly effective in generating returns, as Metaplanet’s Bitcoin holdings have provided a 53.2% year-to-date yield.

Related: Strategy (Formerly MicroStrategy) Launches $2.1 Billion Share Sale to Fund Further Bitcoin Acquisitions

Metaplanet Plans More Bitcoin Purchases with Bond Issuance

Beyond direct acquisitions, Metaplanet is taking measures to fund future Bitcoin purchases.

The company announced that its Board of Directors has approved issuing its 8th Series of Ordinary Bonds to EVO FUND, amounting to JPY 2 billion (approximately $18.2 million).

The proceeds are intended for further Bitcoin acquisitions, following the regulations in Metaplanet’s January 28, 2025, notice regarding stock acquisition rights. This move echoes similar efforts by other companies in the space, including MicroStrategy, which recently disclosed plans to raise $21 billion for Bitcoin purchases.

These acquisitions often result in reduced circulation, creating upward price pressure as demand persists. Despite facing some selling pressure in recent weeks, Bitcoin has seen accumulation by large holders.

Over the past 30 days, according to CryptoQuant data , Bitcoin whales have added more than 65,000 BTC to their positions, showing continued interest in the cryptocurrency despite short-term market corrections.

Bitcoin’s Current Market Performance

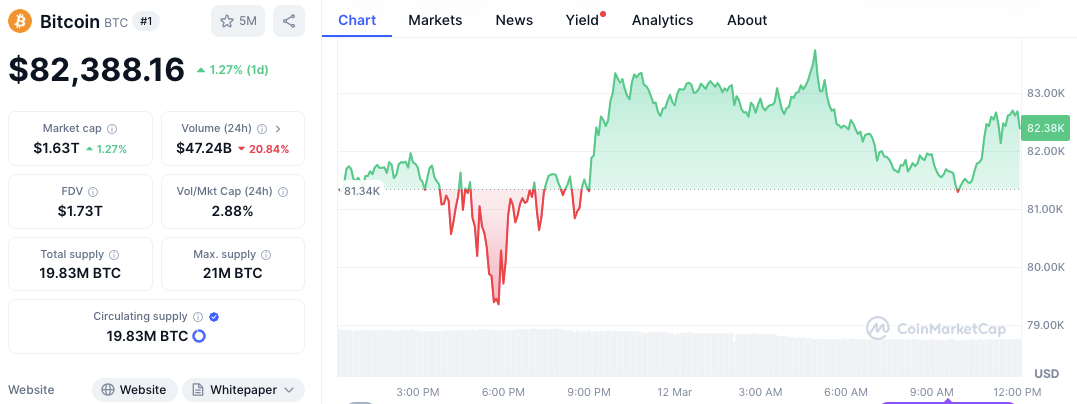

As of the time of writing, Bitcoin was trading at $82,388.16, marking a 1.27% increase over the last 24 hours. The market capitalization stands at $1.63 trillion, with a trading volume of $47.24 billion, a 20.84% decrease from the previous period.

Source: CoinMarketCap

Source: CoinMarketCap

Related: Metaplanet’s Stock is Up 3,600% Thanks to Bitcoin

Further, Bitcoin’s circulating supply is 19.83 million BTC, with a total supply cap of 21 million BTC, highlighting its scarcity.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.