The user doesn't want VC coins or meme coins, so what does the user want?

What Will Be the Theme of the Next Bull Run?

Original Title: "Users Don't Want VC Coins or Meme Coins, So What Do They Want?"

Original Author: Fu Shaoqing, SatoshiLab, Wanwu BTC Studio

1. Prologue

Not only has the phenomenon of VC coins and meme coins sparked more reflection, but many well-known figures in the industry have also raised similar questions, all striving to find solutions. For example, in a Twitter Space event answering questions about girlfriend coins, Jason (Chen Jian) raised the issue of whether tokens listed on Binance have mechanisms to address the problem of project teams selling coins upfront and then going flat. Additionally, CZ's recent publication titled "A Crazy Idea for Token Issuance" attempts to find ways to address these issues.

I believe that all teams truly working on projects hope to be rewarded by the market for their real contributions, rather than allowing Ponzi schemes, scammers, speculators, and others to take advantage of the industry's dividends and disrupt its development.

Because VC coins and meme coins serve as good case studies, this article still analyzes these two phenomena.

2. The Past and Present of VC Coins

VC coins did not emerge out of thin air; their existence has historical reasons. Although VC coins may not seem perfect now, they played a significant role in the past, with key projects in the industry having VC participation.

2.1. The Chaos of the 2017 ICO - Dancing with Demons

2017 was a key year for the first outbreak of Initial Coin Offerings (ICOs) in the blockchain field, with ICO funding exceeding $5 billion that year. In addition to the classic ICO projects mentioned below, I also participated in the ICOs of some small projects and fully experienced the madness of that time, which can be aptly described as dancing with demons.

Back then, whenever a project's token was about to undergo an ICO, there would be promoters, and with a well-written whitepaper thrown into some groups, it would be immediately snapped up in a frenzy. People were irrationally crazy at that time. To exaggerate, even if a piece of shit was thrown into a group, it would be snapped up like crazy. If you don't believe it, search for the token situation of MLGB (Ma Le Ge Coin). (This also reflects the immense power of ICOs)

Regarding the outbreak, through discussions with DeepSeek and ChatGPT, as well as my own understanding, I have summarized the following:

(1)Maturation of Coin Issuance Technology: Especially with the launch of Ethereum, developers were able to easily create smart contracts and decentralized applications (DApps), driving the rise of ICOs.

(2)Other reasons include several factors: market demand, the nascent concept of decentralization, instilling hopeful expectations, and low-barrier entry investments.

During this period, several classic cases emerged:

(1)Ethereum: Although Ethereum's ICO took place in 2014, in 2017 Ethereum's smart contract platform was widely used for the ICOs of many new projects, including Ethereum itself. Overall, this project has been quite successful and has grown to become the second in the Crypto world.

(2)EOS: EOS raised nearly $4.3 billion through a year-long, phased ICO in 2017, becoming one of the largest ICOs that year. This project has now all but disappeared, partly due to taking the wrong technical direction and partly due to insufficient control over market demand.

(3)TRON: TRON also raised a large amount of funds through its 2017 ICO. During its development, controversial practices such as token swaps, plagiarism, and more were prevalent. However, TRON experienced rapid subsequent growth and attracted a lot of attention. In this regard, compared to projects that exit-scammed, isn't what Sun Yuchen did quite good? His grasp of market demand has been very precise, such as with the Tron stablecoin revenue. TRON's strong contrast with EOS in terms of technical implementation and market demand control is evident. The achievements in TRON's development are quite impressive. If the initial coin swapped had left behind the portion that swapped to Tron, the returns would have been higher than his own project.

(4)Filecoin: In 2017, Filecoin successfully raised over $250 million, and its concept of distributed storage garnered significant attention. The project team led by Juan Benet was relatively prestigious. It's hard to categorize this project as a success or failure, but the question remains whether the project can develop healthily.

Personally, the author feels that there are more non-classic cases, which have had a more significant impact, and this is also a major historical reason for the emergence of VC coins.

Exposed Issues

(1) Lack of Regulation: Due to the rapid growth of the ICO market, many projects lack regulation or have no regulation at all, exposing investors to high risks. There are a large number of scams and Ponzi schemes, with almost 99% of projects engaging in exaggeration and fraudulent behavior.

(2) Market Bubble: Numerous projects raised enormous funds in a short period of time (funds that were poorly managed), but many of these projects lack real value or have scenarios that are entirely unattainable, leading even legitimate projects to exit scam or fail.

(3) Lack of Investor Education, Difficulty in Judgment: Many retail investors lack understanding of blockchain and cryptocurrency, making them easy targets for misinformation, resulting in faulty investment decisions. These investors often have no way to assess a project or to monitor its progress.

2.2. Entry of VCs and Endorsement of Reputation

From the above description, we can see the chaos following ICOs. At this point, Venture Capitalists (VCs) stepped in to address the issues. VCs, leveraging their own reputation and resources, provided more reliable support to projects, helping to mitigate many of the early ICO's issues. Additionally, this had the side effect of aiding users in a layer of vetting.

Role of VCs

(1) Addressing the Grassroots Financing Flaws of ICOs

· Reducing Fraud Risk: VCs filter out "air projects" through "rigorous due diligence" (team background, technical feasibility, economic model) to prevent widespread whitepaper fabrications from the ICO era.

· Standardizing Fund Management: Utilizing staged funding (based on milestones) and token lock-up clauses to prevent team cashouts and exits.

· Long-Term Value Alignment: VCs typically hold project equity or long-term locked tokens, deeply aligning with project development to reduce short-term speculation.

(2) Empowering Project Ecosystem

· Resource Integration: Connecting projects with key resources such as trading platforms, developer communities, compliance advisors, etc. (e.g., Coinbase Ventures aiding projects in listing).

· Strategic Guidance: Assisting in designing tokenomics (e.g., token release mechanisms) and governance structures to avoid economic system collapses.

· Credibility Endorsement: The brand effect of well-known VCs (such as a16z, Paradigm) can enhance market trust in the project.

(3) Driving Industry Compliance

VCs drive projects to proactively comply with securities laws (such as the U.S. Howey Test), adopting compliance financing frameworks like SAFT (Simple Agreement for Future Tokens) to reduce legal risks.

VC intervention is a direct solution to early ICO model issues.

Overall, VCs play a crucial role in the success of Web3 projects, helping projects overcome many early ICO challenges through funding, resources, credibility, and strategic guidance, indirectly assisting the public in initial screening.

2.3. Issues with VC Coins

The emergence of new things is always to solve some old problems, but when this new thing develops to a certain stage, it also begins to present a series of issues. VC coins are such a case, showing many limitations in the later stage.

Mainly reflected in:

(1) Conflict of Interest

VCs are investment institutions that profit through investments. They may drive projects towards excessive tokenization (such as high-volume unlock dumping) or prioritize serving their own portfolios (such as exchanges favoring "in-house" projects backed by VCs).

(2) Unable to solve subsequent project development issues.

(3) Colluding with project teams to deceive retail investors (some project teams and VCs operate this way; well-known VCs are relatively better).

VC institutions only complete early-stage investments and profit-taking exits, and they are neither obligated nor capable nor willing to engage in the later-stage development of projects. (Would imposing an extended lockup period on VCs be beneficial?)

The main issue with VC coins is that once the project's tokens are listed, there is a lack of ongoing motivation for development. Both VCs and project teams tend to cash out and exit once the tokens are listed. This phenomenon has made retail investors resent VC coins, but the fundamental reason is the lack of effective supervision and management of the project, especially the matching of funds and outcomes.

3. The Manifestation of Fair Launches and Memecoin Phenomenon

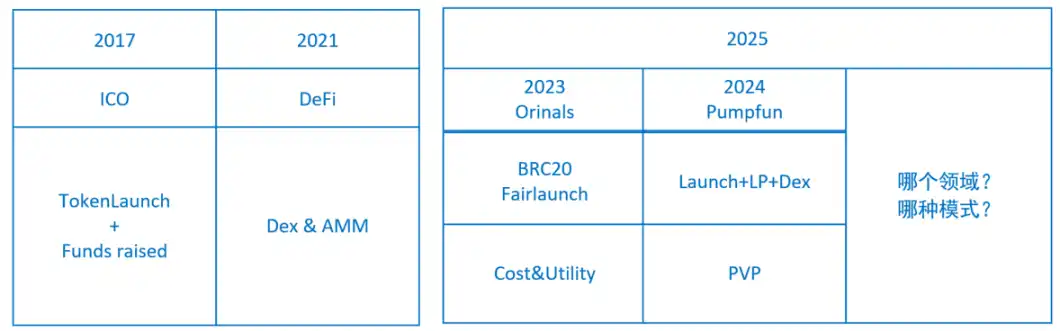

The emergence of Fair Launches in 2023 and the pump-and-dump pattern of memecoins in 2024 revealed some phenomena and exposed some issues.

3.1. Emergence of Inscriptions and Fairlaunch

In 2023, two significant trends emerged in the blockchain field: the explosion of Inscriptions technology and the popularization of the Fair Launch model. Both of these phenomena stem from a reflection on early fundraising models (such as ICOs and VC dominance). In the Inscriptions field, many VCs universally expressed a lack of opportunity to participate in the primary market, and were hesitant to invest heavily even in the secondary market. This reflects users' and communities' pursuit of decentralization and fairness.

The Inscriptions first exploded on the Bitcoin blockchain, represented by BRC 20, giving rise to important Inscriptions like ORDI and SATS. The emergence of Inscriptions has several reasons: the need for innovation in the Bitcoin ecosystem; users' demand for censorship resistance and decentralization; low barriers to entry and the wealth effect; resistance to VC coins; and the attractiveness of a fair launch.

However, the Inscriptions also brought about some issues:

· Pseudo-fairness, as many participating addresses could actually be a disguise for a few institutions or whales;

· Liquidity challenges, with significant transaction costs and time costs for Inscriptions use on the Bitcoin mainnet;

· Value loss, as the substantial transaction fees generated by Inscriptions creation are all taken by miners (resulting in lost anchor assets), without empowering the ecosystem of this token with a closed loop;

· Application scenario issues, as Inscriptions fail to address the ongoing development of a token and these Inscriptions lack a "useful" application scenario.

3.2. Emergence of Pumpfun and the Memecoin Phenomenon

The origin of Memes dates back to an earlier cultural phenomenon. The real-world translation of the NFT concept proposed by Hal Finney in 1993 is considered the earliest origin. The driving force behind the emergence of NFTs was Counterparty, founded in 2014, which created Rare Pepes based on popular meme sad frog as an NFT application. Meme is translated as a "meme," equivalent to an emoji, a phrase, or even a video segment or GIF.

Since Memes have already risen in the NFT field and, with the maturity of some technologies, have begun to form memecoins. In 2024, the Pump.fun platform based on the Solana chain quickly rose to become the core site for memecoin issuance. The platform's simple and complete token service process (ICO+LP+DEX) and speculative trading mechanism allowed memecoins to have a significant impact in 2024. The author believes that Pumpfun's significant contribution is that the platform combines three separate services into a complete loop: token issuance, liquidity pool construction, and the launch of a decentralized exchange platform, Dex.

The early-stage Token-to-dex ratio (referred to in the industry as graduation rate) on Pumpfun was very low, only 2%-3%. This also indicates that the early emphasis on Pumpfun was more on entertainment rather than trading, which aligns with the meme nature. However, during the peak period, the Token graduation rate often exceeded 20%, transforming it into a pure hype machine.

An analysis data on Twitter also effectively illustrates the issues with the memecoin model. (The author has not verified the reliability of this data.)

Pumpfun's total revenue approached $6 billion, to the extent that former U.S. President Trump and his family also issued their own token, highlighting the eruption and climax of memecoins. According to analysis on Dune, memecoins are also undergoing a cycle from inception, to growth, to eruption.

Main Issues with Memecoins

(1) Systemic Fraud and Trust Collapse: According to Dune data, around 85% of tokens on Pump.fun were scams, with founders cashing out on average in just 2 hours.

(2) Rampant False Advertising: Project teams engage in fake endorsements from Key Opinion Leaders, inflate trading volume (via wash trading bots), such as the token MOON claiming endorsement from Musk, which was actually a Pump and Dump scheme.

(3) Distorted Market Ecosystem: Liquidity vacuum effect, where memecoins consume a significant amount of on-chain resources, crowding out space for legitimate projects to grow (e.g., Solana on-chain DeFi protocol TVL dropped by 30%). These factors result in genuine users being expelled, regular investors gradually exiting the market as they cannot compete against Bots and insider trading. There are even project teams looking to manipulate a memecoin with the investment funds raised, with the intention of arbitrage and exit.

From the early emphasis on entertainment, memecoins evolved into a Player versus Player (PVP) stage in the mid to late period, eventually developing into Player versus Bot (PVB), becoming a tool for a few experts to exploit retail investors. The lack of effective value injection into memecoins is a significant issue. Failing to address this problem will ultimately lead memecoins to decline.

4. What Do Users or the Market Want in a Project?

By reviewing the development history of Web3 projects, we understand the historical reasons and pros and cons of VC coins, and also briefly analyze epitaphs and the memecoin phenomenon driven by pumpfun. They are all products of this industry's development, and through this analysis, we see that there are still some key issues in the current development of web3 projects.

Note: Do VC coins and meme coins reveal all the issues? Or do they reveal the main issues currently?

4.1. Summary of Existing Issues

From the previous content, we summarized the current issues of Web3 projects:

1. Projects should have continuous development incentives, with no one receiving too much money too early, token holders and downstream developers should receive continuous rewards, rather than suppression and deceit.

2. Eliminate or reduce PVP, to a large extent, be more fair, reduce whale manipulation, so true fair launch is more valued, but after going on dex, it is still a race to be faster because the pool's value is fixed, benefiting those who got in early.

How to address the above issues:

1. Project Management Issue: Do not allow the project party or VCs to receive a large amount of funding too early, or to use funds under regulatory conditions, or to distribute funds to contributing and developing teams.

2. Sustainable External Value Injection: This can solve the PVP problem, reward medium- to long-term token holders and developers. Sustainable external value injection can provide funding support to project teams that truly want to build, give token holders medium- to long-term growth expectations, and also reduce the issue of early cash-out and exit scams.

These simple conclusions are not easy to clearly describe the issues. For project management issues, it is necessary to analyze stakeholders in a project ecosystem and dynamically analyze potential issues that may arise from different stages of the project (issuance, circulation, governance).

4.2. Different Stakeholders in Projects and Management Issues in Different Stages

1. Different Stakeholders

The most relevant part of a Web3 project is its economic model design. The stakeholders in the project generally include the project team, investors, foundations, users and community, miners, exchanges, liquidity providers, or other participants in the project ecosystem. An economic model is needed to plan the token allocation and contribution incentives to different stakeholders at various stages. The economic model generally includes the proportion of tokens allocated to stakeholders, token release rules, incentive methods, and other content. The specific proportions and release rules will be determined based on the actual situation of each project and the level of contribution of each stakeholder; there are no fixed numbers. Outside the project, there is another group of onlookers (speculators, rug pull teams, scammers, etc.).

Within different interest groups, it is necessary to prevent one party within the ecosystem from taking too much benefit. For example, in a VC-backed coin project, where the project team and investors take away most of the token value, there may be a lack of ongoing development motivation later on. It is also important to prevent external parties from taking undue advantage, as seen in meme coin projects where speculators are involved.

2. Analyzing Issues from Various Aspects such as Issuance, Circulation, and Governance

(1)Token Issuance

There are various ways in which digital currencies are issued. Apart from the Proof of Work (PoW) mining-based issuance, there are methods such as ICOs, STOs, IBOs, and even airdrops like in the case of Ripple's XRP. Regardless of the method used, the main purposes of digital currency issuance are twofold: to raise funds and to distribute the digital currency to users to encourage wider adoption.

(2)Token Circulation and Management

In contrast to the early days of Web3 projects, there are now various methods for token issuance, leading to a significant amount of digital currencies entering circulation. In the circulation of tokens, issues arise due to insufficient demand and limited means of managing token liquidity. Many token management practices involve providing different applications to achieve their objectives. For example, token transfer functionality, token staking, membership requirements (such as token quantity or ownership of NFTs), and application-related expenses (e.g., gas fees on public chains, ENS registration fees, and renewal fees).

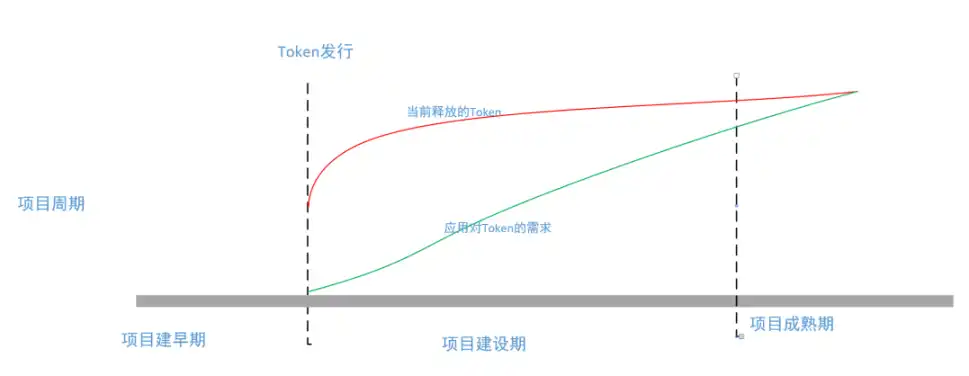

Tokens released too early in a project, those lying between the red line and green line, need to utilize liquidity locking mechanisms to prevent any one party from withdrawing prematurely. These locked tokens and the project progress during the development phase raise management concerns.

3. Project Governance Issues

In Web3 projects, direct control is achieved through the design of consensus mechanisms and economic models. The token within the economic model is used to control resource supply and consumption. The design of the economic model plays a significant role in Web3 projects; however, its scope is limited. When the economic model falls short and cannot fulfill certain functions, complementary methods are needed. Community governance mechanisms serve as a functional complement to areas where the economic model may not excel.

The blockchain world, due to its decentralized nature and network-based rules enforced through programming, has given rise to community organizations known as DAOs and DACs, which can be compared to the centralized structures and corporate governance of traditional companies in the real world.

This form of management, combining the DAO and foundation models, can better handle fund and ecosystem management while also providing sufficient flexibility and transparency. DAO management members must meet certain criteria, ideally including key stakeholders and third-party entities as soon as possible. If a listing exchange is considered a third party, could it adopt Jason's proposal, giving the exchange a certain supervisory and notarial role? In fact, during the recent market-making sell-off event involving GoPlus and Myshell, Binance played such a role.

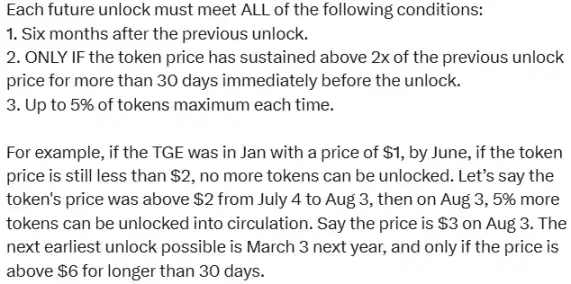

Could this management structure also better implement CZ's model proposed in "A Crazy Idea for Token Issuance"? Let's analyze this management concept based on CZ's article, as shown in the figure below:

(1) Initially, 10% of the tokens are unlocked and sold on the market. The proceeds will be used for project team development, product/platform, marketing, salaries, etc. (This design is good, but who will oversee and supervise it? Should this work be entrusted to the project's DAO organization, using a treasury and third-party supervision?)

(2) Each future unlock must meet several predetermined conditions. (This design is aimed at the post-initial period, ongoing work, and later token liquidity management. If handed over to DAO management, the effect will be better.)

(3) The project team has the right to postpone or reduce the scale of each unlock. If they do not wish to sell more, they are not required to do so. However, each time they can sell a maximum of 5%, and then they must wait at least six months for the price to double again. (This design must be handled by a third-party entity like DAO, transferring the team's rights to the DAO's decision-making authority. Since the project team is also a key member of the DAO, there should not be too many side effects.)

(4) The project team does not have the right to shorten or increase the scale of the next unlock. The tokens should be held in an intelligent contract locked by a third-party control key. This prevents new tokens from flooding the market during price downturns and encourages the project team to focus on long-term development. (This design further illustrates the need for a third-party entity for better control and management than a smart contract. In fact, CZ has subconsciously proposed the concept of a DAO.)

Of course, this is just a case study, and real project governance includes many other aspects. I believe that as web3 has developed to this day, it will gradually improve and broaden the implementation of such solutions, continuously correcting issues and finding better specific methods in practice.

4.3. Long-Term Project Development (Value Capture and Value Injection)

If not accompanied by technological and application innovation, various projects in the current industry relying on shilling alone will not last long. Eventually, the issue of VC coins and meme coins will reappear. In fact, Pumpfun provides a framework that can be referenced, and its explosion and subsequent demise were due to a missing key element: Token Empowerment (also known as Value Capture and Value Injection). As shown in the figure below

Based on the above figure, we can see that after the VC coin is listed on a trading platform, the project team receives a relatively generous return, leading to a lack of motivation for further development. Because later-stage development not only carries a considerable risk but also lacks sufficient return, laying low is the best option. However, there are some teams with ideals and capabilities that will continue to develop, although the number of such teams is relatively small. The Pumpfun memecoin model itself does not have subsequent Token empowerment, so they are all in a race to pump quickly. Why can memecoins like Dogecoin continue to rise? The author believes there are multiple reasons, which will be elaborated on in the future when there is an opportunity.

How can there be long-term value injection? What are the ways to empower?

Looking back at previous Web3 project cases, for example, how DeFi protocols capture value through liquidity mining, how NFT projects inject external value through royalty mechanisms, or how DAOs accumulate value through community contributions. As web3 technology matures, there will be more "application scenarios" that can generate value, leading to an increasing number of convergence points of value.

Value capture and external value injection are the two main pillars of the Web3 economic model, with the former focusing on retention and the latter on introduction. More popular terms such as "value accumulation" and "flywheel effect" better reflect the dynamic combination of the two, while "token empowerment" and "positive externality" enter from a functional design perspective.

The core challenge lies in balancing short-term incentives with long-term value and avoiding falling into a "paper model" and Ponzi scheme loop.

5. Analysis of the First Two Crypto Bull Markets and Analysis of the Possibility of the Next Breakout

The previous content analyzed the issues present in the industry's current focus on VC coins and meme coins. Will resolving these issues drive the next bull market's breakout? Let's first review the two bull markets of 2017 and 2021.

NOTE: The following content is based on online research, insights from discussions with DeepSeek and ChatGPT, as well as the author's personal experience of the bull markets in 2017 and 2021. Additionally, our team is currently developing products within the Bitcoin ecosystem, so the article includes some personal reflections and assessments.

5.1. The ICO Craze of 2017

The bull market in the blockchain space in 2017 was the result of various factors working together, including technological breakthroughs, ecosystem development, and external macroeconomic factors. Based on professional analysis within the industry and classic literature, the reasons can be roughly summarized as follows:

(1) ICO (Initial Coin Offering) Craze

The Ethereum ERC-20 standard lowered the barrier for coin issuance, leading to a large number of projects raising funds through ICOs (raising over $50 billion throughout the year).

(2) Bitcoin Forks and Scalability Debate

The Bitcoin community's disagreement on scalability solutions (SegWit vs. big blocks) led to forks. In August 2017, Bitcoin Cash (BCH) forked, drawing attention to Bitcoin's scarcity and technological advancement. The price of BTC surged from $1,000 at the beginning of the year to a historical high of $19,783 in December.

(3) Rise of the Ethereum Smart Contract Ecosystem

Smart contract and DApp development tools matured, attracting a wave of developers. The concept of Decentralized Finance (DeFi) emerged, and early DApps like CryptoKitties triggered user participation.

(4) Global Liquidity Easing and Regulatory Gaps

In 2017, global low-interest-rate policies led funds to seek high-risk, high-return assets. Regulatory frameworks for ICOs and cryptocurrencies were not yet robust, allowing speculative activities to proceed unchecked.

The 2017 bull market laid the foundation for the industry's infrastructure (such as wallets, exchanges), attracted tech talents, and onboarded more new users. However, it also exposed issues like ICO fraud and regulatory shortcomings, prompting the industry to shift towards compliance and technological innovation (e.g., DeFi, NFTs) after 2018.

5.2. The DeFi Summer of 2021

The bull market in the blockchain field in 2021 was the result of the resonance of multiple factors such as industry ecology, macroeconomics, technological innovation, and institutional participation. Based on professional analysis and classic literature in the industry, the reasons can be roughly summarized as follows:

(1)The Eruption and Maturity of DeFi (Decentralized Finance)

The maturity of Ethereum smart contracts, as well as the testing and launch of Layer 2 scaling solutions (such as Optimism, Arbitrum), have reduced transaction costs and latency.

· Led to Application Explosion: DeFi protocols such as Uniswap V3, Aave, Compound, etc., saw their Total Value Locked (TVL) increase from $1.8 billion at the beginning of the year to $250 billion by the end of the year, attracting a large amount of capital and developers.

· Yield Farming: High Annual Percentage Yield (APY) attracted retail and institutional arbitrage funds. The YF (Yield Finance, commonly known as "Auntie" in the industry) at that time once had a price higher than BTC.

(2)NFT (Non-Fungible Token) Breakthrough and Mainstream Adoption

Beeple's NFT artwork "Everydays: The First 5000 Days" was auctioned at Christie's for $69 million. NFT projects such as CryptoPunks, Bored Ape Yacht Club (BAYC), etc., saw their market value surpass $10 billion. NFT trading platforms like Opensea emerged.

(3)Large-Scale Institutional Capital Inflow

Tesla announced the purchase of $1.5 billion in Bitcoin and acceptance of BTC payments. MicroStrategy continued to accumulate Bitcoin (holding 124,000 BTC by the end of 2021). Canada approved the first Bitcoin ETF (Purpose Bitcoin ETF in February 2021). Coinbase went public on Nasdaq (with a valuation of $86 billion).

(4)Global Macroeconomics and Monetary Policy

· Liquidity Overflow: The Federal Reserve maintained a zero interest rate and quantitative easing policy, leading to funds flowing into high-risk assets.

· Inflation Expectations: The US CPI saw a year-on-year increase of over 7%, with some investors viewing Bitcoin as "digital gold" to hedge against inflation.

(5) Increased Mainstream Social Acceptance

· Expansion in Payment Scenarios: PayPal supports users to buy and sell cryptocurrency, Visa allows settlement using USDC. El Salvador adopted Bitcoin as legal tender (September 2021).

· Celebrity Effect: Public figures like Musk, Snoop Dogg, etc., frequently mention cryptocurrency and NFTs.

(6) Multi-Chain Ecosystem Competition and Innovation

· Rise of New Public Chains: High-performance chains such as Solana, Avalanche, Polygon attract users and developers due to low fees and high TPS.

· Cross-Chain Technology Breakthrough: Cross-chain protocols from Cosmos, Polkadot promote asset interoperability.

(7) Meme Coins and Community Culture

· Phenomenal Projects: Memecoins like Dogecoin (DOGE) and Shiba Inu (SHIB) surged due to social media hype (DOGE saw over a 12,000% yearly increase).

· Retail Investor Frenzy: Reddit's WallStreetBets (WSB) and TikTok drive retail investors into the space.

Impact on future markets

The 2021 bull market propelled cryptocurrency institutionalization, compliance, and technological diversification, but also exposed issues like DeFi hacks, NFT speculation, etc.

Subsequent Industry Focus:

· Regulatory Compliance: The U.S. SEC enhances scrutiny of stablecoins and tokenized securities.

· Sustainable Development: Ethereum's shift to PoS (merger plan), Bitcoin mining explores clean energy.

· Web3 Narrative: Concepts like Metaverse, DAOs (Decentralized Autonomous Organizations) become new focal points.

5.3. When Is the Next Bull Market? 2025? What Will Be the Theme?

Below is a predictive analysis of the potential bull market drivers in the cryptocurrency market for 2025, combining current industry trends, technological innovations, and macroeconomic background, based on professional analysis and classic literature in the industry, summarizing reasons roughly as follows:

(1) Mass Adoption of Web3 and Rise of User Sovereignty

· Use Case Implementation: Decentralized Social Media (such as Nostr, Lens Protocol), Blockchain-based Games (AAA-grade GameFi), and Decentralized Identity (DID) becoming mainstream, shifting the ownership of user data and revenue distribution away from the traditional internet.

· Key Developments: Tech giants like Meta, Google integrating blockchain technology, enabling cross-platform migration of user data.

· Related Technologies: Zero-Knowledge Proofs (ZKP) and Fully Homomorphic Encryption (FHE) maturing to ensure privacy and compliance.

(2) Deep Integration of AI and Blockchain

· Decentralized AI Networks: Blockchain-based computing power marketplaces (such as Render Network) and AI model training data ownership (like Ocean Protocol) address the monopolistic nature of centralized AI.

· Autonomous Governance Economy: AI-driven DAOs (such as AutoGPT) automatically execute on-chain transactions and governance, enhancing efficiency and creating new economic models.

(3) Global Central Bank Digital Currencies (CBDC) and Stablecoin Interoperability

· Policy Drivers: Major economies launching CBDCs (like Digital Euro, Digital Dollar) forming a hybrid payment network with compliant stablecoins (such as USDC, EUROe).

· Cross-Chain Settlement: The Bank for International Settlements (BIS) leads the establishment of a CBDC interoperability protocol, with cryptocurrencies becoming a key component of cross-border payment channels.

(4) Bitcoin Ecosystem Revitalization and Layer 2 Innovation

· Bitcoin Layer 2 Surge: The Lightning Network continues to innovate with record capacity and the emergence of the TaprootAssets protocol. The RGB protocol supports on-chain asset issuance on the Bitcoin network, and the Stacks ecosystem introduces smart contract capabilities.

· Institutional Custody Upgrades: BlackRock, Fidelity launch Bitcoin ETF options and collateralized lending services, unlocking Bitcoin's financial tool attributes.

(5) Clarity in Regulatory Frameworks and Comprehensive Institutional Entry

· Global Compliance: The US and Europe pass the Market in Crypto-Assets Regulation (MiCA) bill-like regulations, defining token classifications and exchange platform licensing regimes.

· Traditional Finance Integration: JPMorgan Chase, Goldman Sachs launch crypto derivatives and structured products, pension funds allocate over 2% to cryptocurrency.

(6)Geopolitical Conflict and De-dollarization Narrative

· Safe Haven Demand: Escalation of geopolitical risks such as Russia-Ukraine conflict, Taiwan Strait situation, with cryptocurrency emerging as a neutral settlement tool.

· Reserve Asset Diversification: BRICS nations jointly issue blockchain-based trade settlement tokens, some countries price their national bonds in Bitcoin.

(7)Meme Culture 3.0 and Community DAO-ification

· Next-gen Meme Coins: Meme projects combining AI-generated content (AIGC) and dynamic NFTs (such as AI-driven "Eternal Dog" character), with the community deciding on IP development direction through DAO voting.

· Fan Economy Chain Reform: Top-tier celebrities like Taylor Swift, BTS issue fan tokens, unlocking exclusive content and participating in revenue sharing.

Note: In order to not miss out on relevant possibilities, the above analysis data is kept relatively abundant.

Through a summary of the bull markets in 2017 and 2021, as well as an analysis of the possibilities for 2025, we can make some rough judgments based on the figure below.

Regarding Patterns:

The inscription in 2023 and the pumpfun phenomenon in 2024 are some phenomena that may lead to the outbreak of a bull market. If the issues surrounding the inscription and pumpfun themselves can be resolved, a more complete pattern emerges, which could potentially trigger a bull market in certain areas. It is highly likely still related to asset issuance and asset trading.

Regarding Areas:

These generally occur in two areas: (1) the pure Web3 field; (2) the combined field of AI and web3.

Specific Analysis:

For (1) the widespread application of Web3 and the rise of user sovereignty, I personally judge that the infrastructure is not yet mature enough, the wealth effect is not so strong, making it difficult to become the main factor or domain of the bull market alone, or it may not be the primary factor of this bull market.

Regarding (2) The Deep Integration of AI and Web3, almost everyone has experienced the power of AI. Will this field become a supporting factor for a bull market? It's really hard to judge... I personally tend to be a bit early. But in this field, it's hard to say. Phenomena like DeepSeek and Manus that can quickly take off are not unusual in the AI field. How will DeFi empowered by AI perform?

Regarding (4) Bitcoin Ecosystem Revival and Layer 2 Innovation, Bitcoin has shown very good price performance in the bull markets of 2017 and 2021. Currently, Bitcoin's market value accounts for 60% of the crypto market, and the wealth effect is strong enough. If this field has a good model + good technical implementation, the probability of a bull market is very high.

Regarding (7) Meme Culture 3.0 and Community DAO-ification, if meme culture solves the PVP problem and has sustained external value injection, could it become a driving force for a bull market? Judging from the wealth effect, it is quite challenging.

Others (3), (5), (6) are likely to accelerate change and have a positive impact on the bull market, but individually they are not strong enough direct factors to generate a bull market.

If 2025 is a bull market, the most likely factors are:

Bitcoin ecosystem and Layer 2 innovation, based on new asset issuance and transactional patterns

The field of AI and Web3 integration, transaction patterns empowered by AI

In addition to judgment on fields and patterns, as for when the bull market will erupt, external macroeconomic factors also need to be considered.

The above judgment is purely my personal reflection and does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Traders could be prepping to buy as USDT activity hits a 6-month high

Bitcoin Falls with Stocks Following Trump’s Trade War – Fed’s Next Move?

New Rule for Bitcoin and Altcoin Investments from South Korea!

South Korea has announced plans to issue comprehensive guidelines for institutional cryptocurrency investments by the third quarter.

BREAKING: There Are Claims That The Ripple-SEC Lawsuit May Be Concluded Soon – Here’s The Latest Information