Bittensor (TAO) Testing Crucial Support Amid Major Decline – Will This Pattern Spark a Recovery?

Date: Tue, March 11, 2025 | 10:18 AM GMT

The past week has been eventful in the cryptocurrency market, with major developments such as U.S. President Trump unveiling the Crypto Strategic Reserve, signing executive orders for a Bitcoin Strategic Reserve, and hosting a White House Crypto Summit. Despite these bullish catalysts, the broader crypto market remains under pressure, as the post-November rally correction continues to weigh on prices.

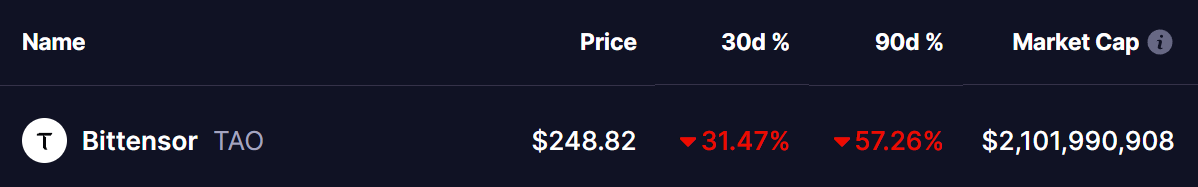

This extended downturn has put significant bearish pressure on altcoins , including Bittensor (TAO), an AI-focused blockchain token that has suffered a steep 31% decline in the past month, extending its 90-day drop to 56%.

Source: Coinmarketcap

Source: Coinmarketcap

This sharp selloff has dampened investor sentiment, raising concerns about whether TAO can stage a recovery—or if further downside remains on the horizon.

Testing Crucial Support

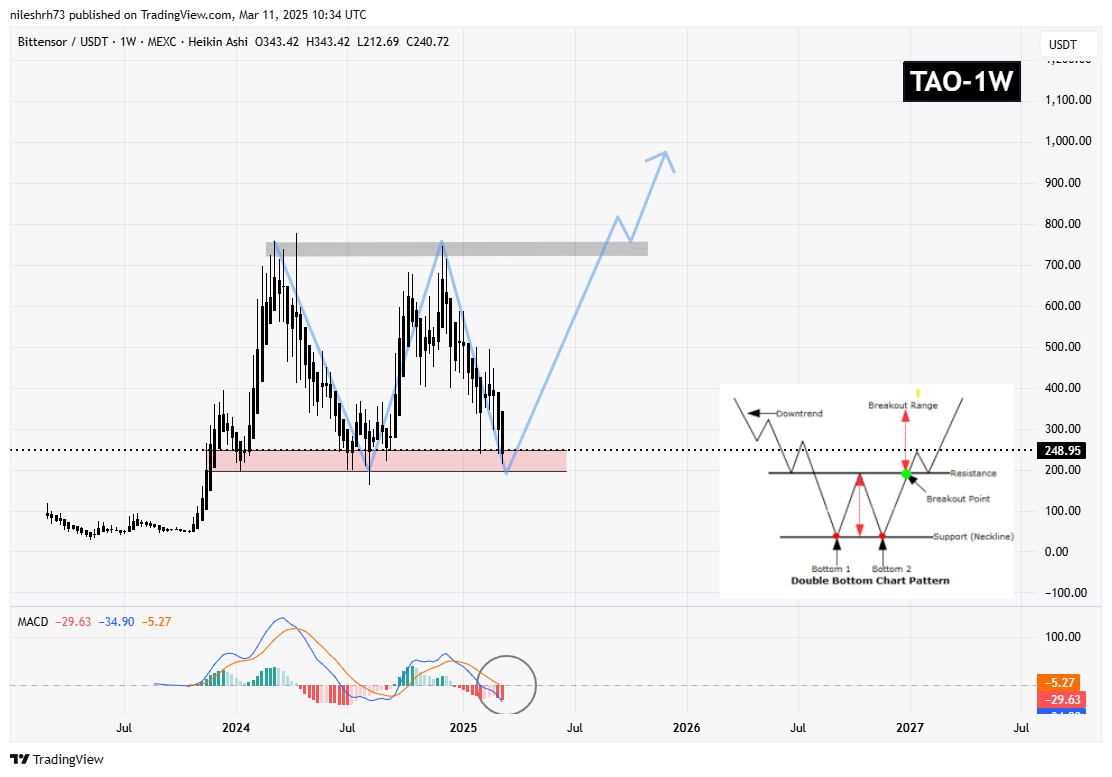

The weekly chart of TAO suggests that the price may be forming a double bottom pattern, a classic bullish reversal structure that often signals the end of a prolonged downtrend.

This pattern began after TAO failed to break above the $744 neckline resistance in early December 2024. The strong rejection from that level led to a sharp correction, pushing the price back into a crucial support range of $200–$250—a historical demand zone where buyers have stepped in before.

Bittensor (TAO) Weekly Chart/Coinsprobe (Source: Tradingview)

Bittensor (TAO) Weekly Chart/Coinsprobe (Source: Tradingview)

At the time of writing, TAO is trading at $248, showing early signs of stabilization around this key level.

The MACD indicator on the weekly chart is hinting at a weakening bearish momentum, as the histogram bars are shrinking and the MACD line is attempting to cross above the signal line. This suggests that selling pressure might be losing steam, increasing the probability of a trend reversal.

Will This Pattern Spark a Recovery?

If TAO holds this $200–$250 support zone and successfully forms a double bottom breakout, a move toward the $744 resistance neckline could be on the horizon. A breakout above this level would likely trigger a significant rally, potentially propelling TAO back into a bullish trajectory.

However, failure to hold this support could invalidate the bullish setup, exposing TAO to further downside risks.

For now, traders and investors are closely watching this key level, as a decisive move in either direction could set the tone for TAO’s next major trend.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List GOMBLE(GM) in the Innovation and GameFi Zone.

Whales Have Sold Over 29,000 Bitcoins Since April 9