TRUMP Breaks Out: 8.43% Surge to $15.02 Sets Sights on $18

TRUMP surged 8.43% to $15.02, breaking a descending wedge and indicating strong buying momentum. RSI stands at 59.20 points indicating mild upward strength although MACD signals possible market consolidation or a correction phase may occur. TRUMP can drive its price towards $18.00 and beyond if support stays above $13.44 despite market volatility.

- TRUMP surged 8.43% to $15.02, breaking a descending wedge and indicating strong buying momentum.

- RSI stands at 59.20 points indicating mild upward strength although MACD signals possible market consolidation or a correction phase may occur.

- TRUMP can drive its price towards $18.00 and beyond if support stays above $13.44 despite market volatility.

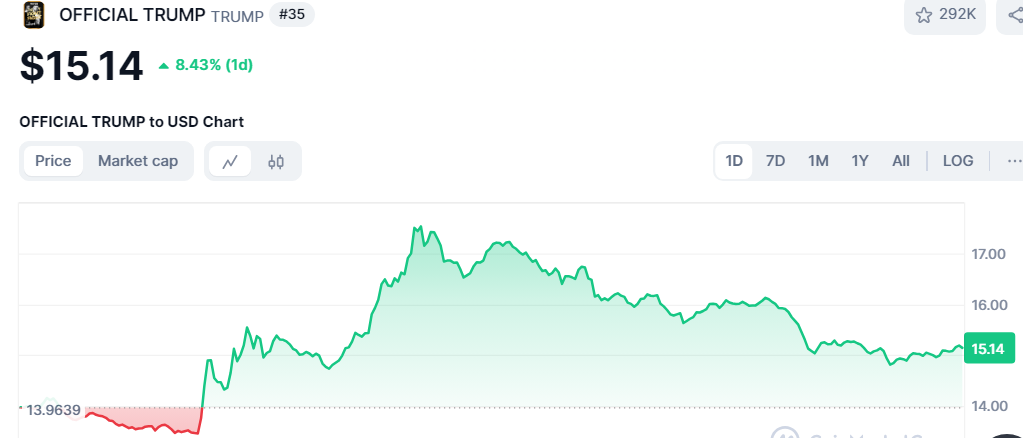

Official Trump (TRUMP) experienced a substantial price increase after its market breakout revealed another significant uptrend in the cryptocurrency sector. Official Trump rose to $15.14 dollars as its value increased by 8.43% during the previous 24 hours.

Source: Coinmarketcap

Source: Coinmarketcap

The cryptocurrency has now established its bullish trend by achieving its high point of $17.46 during this time period. TRUMP displayed significant market volatility through its 24-hour low value at $13.44.

Technical Indicators Confirm Bullish Breakout

A technical analysis of cryptocurrency prices demonstrates that the TRUMP/USDT exchange experienced a descending wedge pattern before its price rose. The asset maintained its trading position inside a limited area before a breakout created a 30% increase.This movement confirms strong buying momentum and suggests that TRUMP has successfully breached key resistance levels.

Source: WorldOfCharts(X)

Source: WorldOfCharts(X)

The price action shows that after touching the resistance level near $17.46, TRUMP encountered slight retracement, consolidating around $15.02. If support holds above $13.44, further upward movement may occur. However, failure to sustain current levels could result in a retest of lower support zones.

TRUMP/USDT 1-Hour Chart Show Mixed Signals

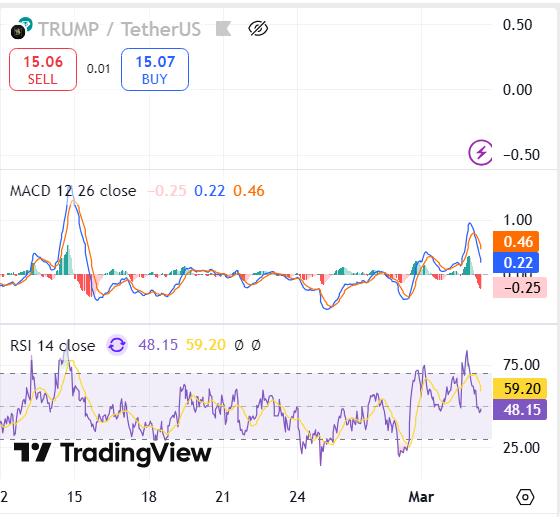

The TRUMP/USDT 1-Hour chart shows mixed signals based on MACD and RSI indicators. The MACD is trading below the signal line indicating recent bearish momentum.

Source: Trading View

Source: Trading View

The RSI is at 59.20, slightly below the overbought threshold implying mild bullish strength but potential consolidation. If RSI stays above 50, further upside is possible. However, a MACD bearish crossover could lead to short-term corrections.

Market Implications and Future Trends

TRUMP’s rapid price appreciation highlights increased investor interest and favorable sentiment surrounding the token. The 8.43% increase aligns with broader market activity, where several altcoins have experienced bullish breakouts.

The continuation of this trend could drive TRUMP toward higher resistance zones near $18.00 and beyond. However, the market remains volatile, and traders should monitor volume trends and price stability before making further decisions.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Was $1.4K Ethereum’s ‘generational bottom?’ — Data sends mixed signals

Traders say ETH price fell to a “generational bottom,” but historical and network activity data suggest that this is not the case.

Bitcoin is holding above $90K, so why is ‘greed’ sentiment slipping?

The Crypto Fear & Greed Index has returned to flash “Greed” as Bitcoin has remained steady above $90,000 over the past two days.

SOL Strategies Commits $500M to Fuel Solana Ecosystem with Fresh Capital

Research Report | DeepBook Project Overview & DEEP Market Cap Analysis