My Top 3 Takeaways From Fidelity And Voltage’s Recent Lightning Report

In a report released this Wednesday, Fidelity Digital Assets in collaboration with Lightning payment provider Voltage released a report on the state of the Lightning Network.

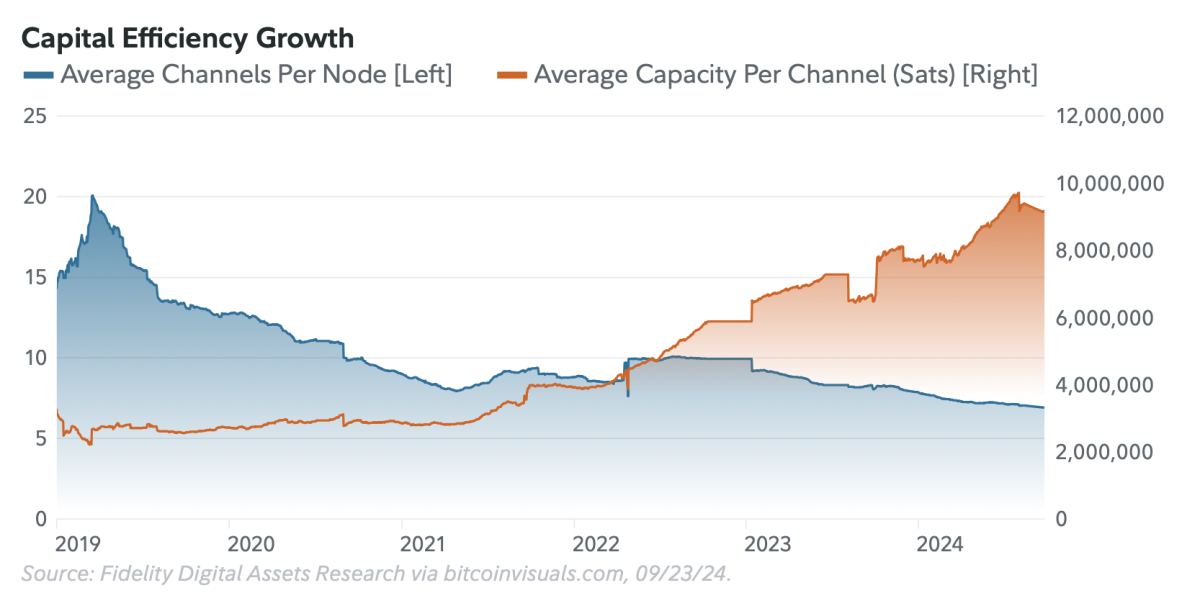

The report details the many ways in which the Lightning Network has grown since its launch in 2018.

It also illustrates how more businesses have begun incorporating Lightning in 2024 than any year prior, that larger channels are forming on the network and that more Lightning nodes are coming online.

Some key stats from the piece include the following:

- Total Lightning capacity denominated in U.S. dollars has increased by 2,767% since 2020

- Its bitcoin-denominated capacity has grown by 384% in the same period

- Currently, almost all payments over Lightning below 1,000,000 sats processed in less than 1.1 seconds

While these stats made me optimistic, it was other information in the report that really resonated with me and made me rethink how I view Bitcoin and Lightning.

Below were top three takeaways from the report:

- Lightning payments are gaining traction on Nostr (the world’s largest bitcoin circular economy), as Nostr users have sent over 3.6 million individual zaps in the last six months

- Projects like ARK, another Bitcoin Layer 2 protocol, illustrate that Lightning has use cases beyond just peer-to-peer channels (ARK allows users to share virtual UTXOs (vUTXOs) with a larger group instead of on a one-to-one basis) can can be built upon in ways many didn’t initially anticipate

- The “HODL” mentality is one the things still slowing Lightning adoption; in other words, if Bitcoin enthusiasts don’t spend their bitcoin, Lightning growth may stagnate, which could hurt Bitcoin’s value proposition

So, as we’re here at the beginning of 2025, a year that many think will be big for Lightning, I can’t help but be optimistic to see what sort of traction Lightning gains in the next 10 months.

It’s high time bitcoin is used more as a medium of exchange — the way Satoshi intended for it to be.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Subscribe to UNITE Savings and enjoy up to 15% APR

Subscribe to UNITE Savings and enjoy up to 15% APR