Ethereum transaction fees plummet 70%, hitting lowest levels since 2020

Quick Take The record-low Ethereum fees signal weak demand amid onchain volume decline. The following is an excerpt from The Block’s Data and Insights newsletter.

The 7-day moving average (7DMA) of transaction fees on the Ethereum network fell to $0.77 on Feb. 15. This figure stood at $2.57 just a week prior, marking a 70% week-over-week drop.

This drop pushed transaction costs to their lowest levels in dollar terms in over four years, which means the last time it was this cheap to transact on Ethereum was July 2020. Meanwhile, Bitcoin network activity recently hit a 12-month low as transactions dropped 55% from their peak.

The median gas price on Ethereum, measured in Gwei, further confirms this trend. Over the past week, the daily median gas price averaged 1.61 GWEI, with its lowest figure coming in at 1.19 GWEI on Saturday, Feb. 15, the lowest reading since The Block began tracking this metric in January 2020. Moreover, this is just one of two instances where this figure has stooped this low since January 2020, with the other occurring in September 2024.

While falling fees typically encourage user activity, the extent of this drop, represented by a prolonged decline, suggests a broader lack of demand rather than improved network efficiency, as seen with a recent slowdown in Ethereum’s onchain activity. The 7DMA of Ethereum’s onchain volume fell to just $4.19 billion on Saturday, a 46% decline from the previous week. This represents Ethereum’s lowest daily volume since Nov. 7, right after the U.S. presidential election.

We’ve talked about Ethereum’s woes extensively in recent weeks, and just when you thought things could not look any worse from the perspective of the blockchain’s activity, these unpleasant surprises continue to display themselves every week.

This is an excerpt from The Block's Data Insights newsletter . Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

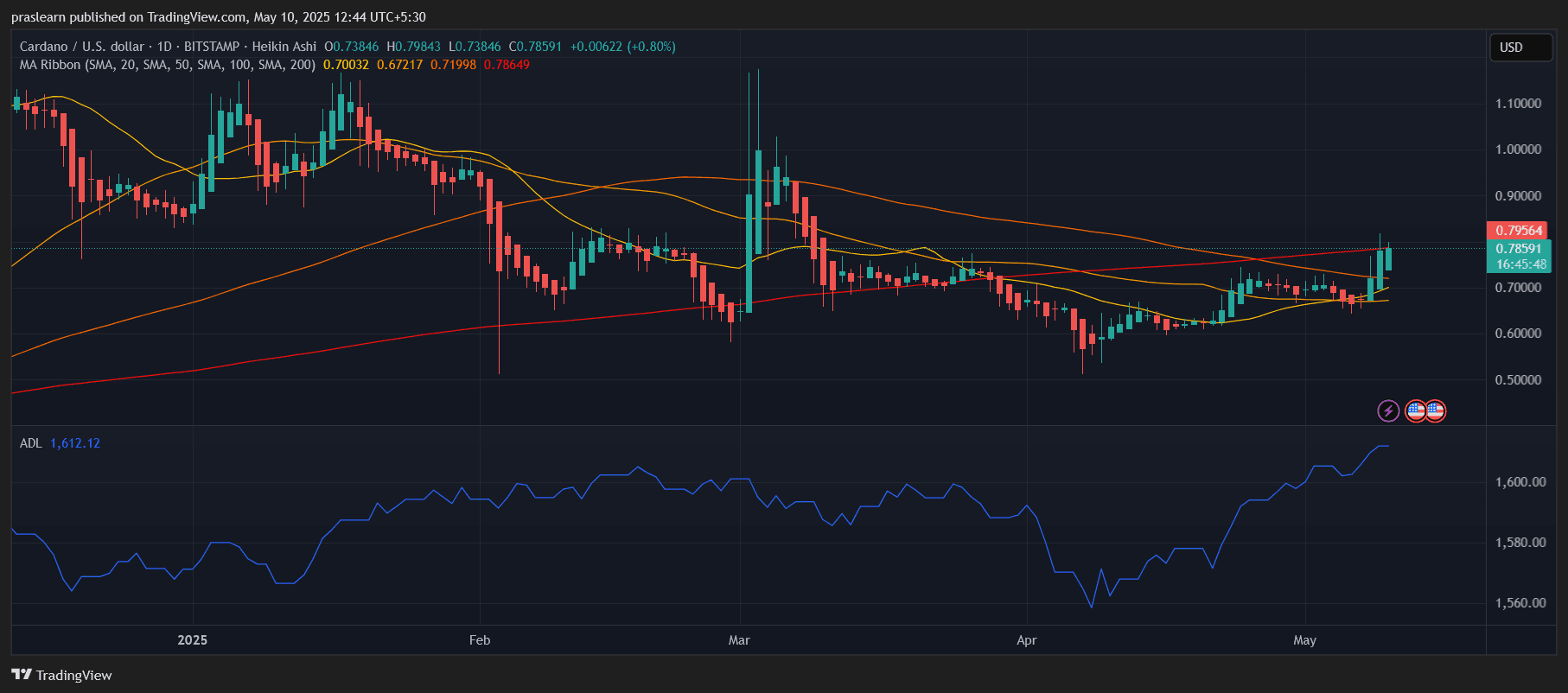

ADA Price Breaks Key Resistance: Is Cardano Set for a Major Rally?

Cardano Poised to Recover 40% Losses From March – Is the ADA Bear Cycle Over?

Cardano’s recent 17% surge signals a potential recovery from March’s 40% loss. The key to further growth lies in breaching the $0.85 resistance and holding support above $0.74.

Pi Network is Inching Towards $1 Thanks to a Major Shift in Holder Behavior

Pi Network’s price has risen 27%, fueled by strong investor sentiment, but it faces a tough resistance at $0.78. A breakout could push the price higher, while failure to hold support at $0.71 risks a decline.

Worldcoin (WLD) Surges Amid Legal Challenges and Speculation on OpenAI Integration