Strategy flags profitability risk amid bitcoin volatility, may be exposed to greater tax liabilities than anticipated

Strategy made a profitability warning in its annual report on Tuesday, particularly if there is a significant decrease in the market value of its bitcoin holdings.The firm also warned it may be exposed to greater tax liabilities than anticipated, confirming unrealized fair value gains on its bitcoin could be subject to taxation.

Bitcoin treasury company Strategy (formerly MicroStrategy) did not make any additional bitcoin acquisitions last week, instead issuing a profitability warning amid a potentially greater tax burden in a 10-K filing with the Securities and Exchange Commission on Tuesday.

A 10-K filing is an annual financial report that publicly traded companies must file with the SEC, providing a detailed overview of a company's financial performance, risks and operations.

Reflecting on generating a net loss for the fiscal year ended Dec. 31, 2024, primarily due to $1.79 billion of digital asset impairment losses , Strategy warned it “may not be able to regain profitability in future periods,” particularly if it incurs significant fair value losses related to it bitcoin holdings. A significant decrease in the market value of its bitcoin could adversely affect the firm’s ability to satisfy its financial obligations, it added.

Strategy said its enterprise analytics software business did not generate positive cash flow in 2024, and the company may rely on equity or debt financing to meet its financial obligations. The ability to secure such financing depends heavily on the market value of its bitcoin holdings, and a significant drop in bitcoin’s value could create liquidity risks, potentially forcing the company to sell bitcoin at unfavorable prices. This could materially impact its financial performance and future financing prospects, the firm explained.

Strategy acquired a total of approximately 258,320 BTC in 2024 for $22.07 billion at an average purchase price of $85,447 per bitcoin, inclusive of fees and expenses, and did not sell any bitcoin during the year.

As of Dec. 31, 2024, Strategy held $23.9 billion worth of bitcoin on its balance sheet, consisting of approximately 447,470 BTC, including $4.06 billion in cumulative impairment losses attributable to bitcoin trading price fluctuations, and held $38.1 million in cash and cash equivalents, according to the filing. The firm’s outstanding indebtedness was $7.27 billion, with annual contractual interest expenses of $35.1 million — expected to increase under its bitcoin acquisition strategy.

Previously, digital asset values on a company's books had to be marked down when prices fell but could not be adjusted upward if prices rose unless sold. However, with Strategy adopting the Financial Accounting Standards Board’s new fair-value accounting rules from Jan. 1, 2025, with gains and losses from changes in the fair value of bitcoin recognized in net income each reporting period, a cumulative adjustment of $12.75 billion will be applied to the opening balance of its retained earnings, the company confirmed on Tuesday.

Tax liabilities may be greater than expected

Despite Strategy’s known accounting changes, uncertainty remained over the tax treatment of its bitcoin holdings under the new FASB rules in combination with provisions of the Inflation Reduction Act, unless an exemption could be applied.

“Unrealized fair value gains on our bitcoin holdings could cause us to become subject to the corporate alternative minimum tax under the Inflation Reduction Act of 2022,” Strategy said in the filing.

The U.S. passed the Inflation Reduction Act (IRA) in August 2022, introducing a 15% Corporate Alternative Minimum Tax (CAMT) on firms whose average annual adjusted financial statement income exceeds $1 billion over any consecutive three-year period prior to the initial tax year, unless an exemption applies. Last September, the Treasury Department and the IRS released proposed regulations outlining the application of the CAMT.

Following Strategy’s adoption of the FASB fair value accounting rules, unless the IRA is amended, or the proposed regulations are revised to provide relief, it could become subject to the CAMT in the 2026 tax year and beyond. “If we become subject to the CAMT, it could result in a material tax obligation that we would need to satisfy in cash, which could materially affect our financial results, including our earnings and cash flow, and our financial condition,” the firm said.

Strategy also warned it faces significant tax risks across multiple other jurisdictions due to varying statutory rates, potential changes in tax laws and uncertainty around deferred tax assets and liabilities. “In addition, if we sold any of our bitcoin at prices greater than the cost basis of the bitcoin sold, we would incur a tax liability with respect to any gain recognized, and such tax liability could be material,” the firm said.

Strategy’s reserves near 500,000 BTC

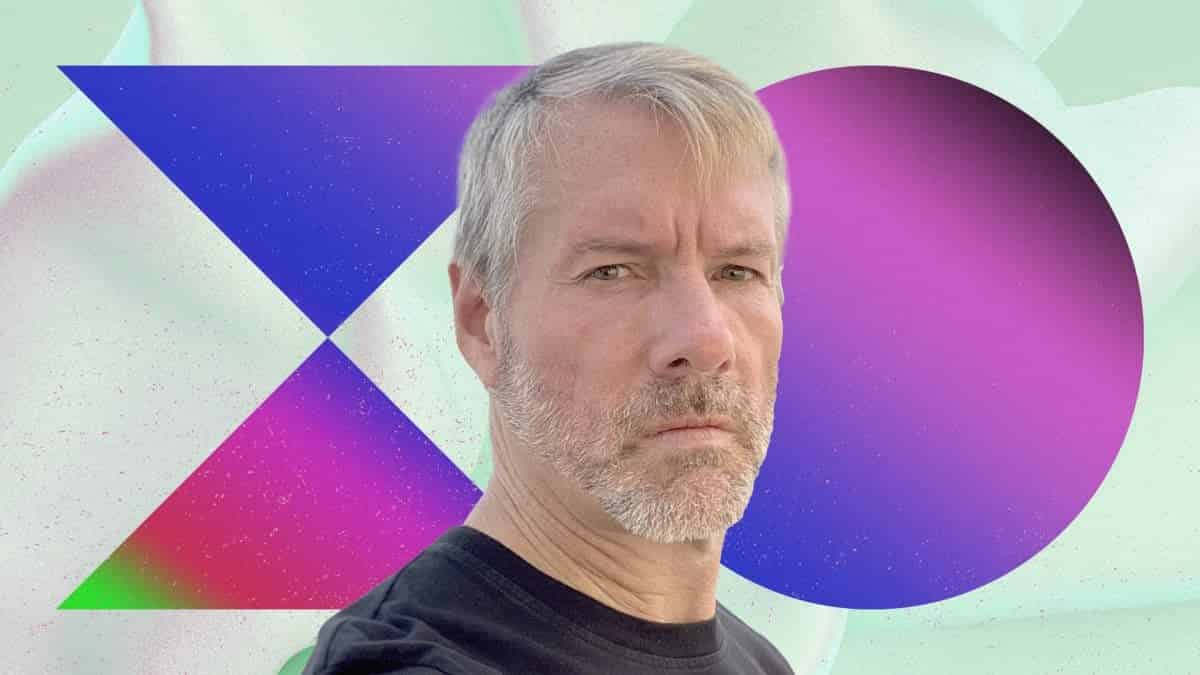

Following Strategy’s latest 7,633 BTC ($742.4 million) acquisition between Feb. 3 and Feb. 9, the company currently holds 478,740 BTC, worth over $46 billion. Strategy’s total holdings were bought at an average price of $65,033 per bitcoin for a total cost of around $31.1 billion, including fees and expenses, according to the company's co-founder and executive chairman, Michael Saylor. To put that in perspective, Strategy holds more than 2.2% of bitcoin’s total 21 million supply.

Strategy’s $86.8 billion market cap trades at a significant premium to its bitcoin net asset value, with some investors airing reservations about the firm's premium to NAV valuation and its equity and debt-funded bitcoin acquisition program for some time.

Strategy shares closed up 3.9% at $337.73 on Friday, gaining more than 350% over the past year, according to TradingView. MSTR is currently down 0.4% in Tuesday trading following the Presidents' Day holiday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report