Inside $LIBRA’s Rug Pull: Milei, Trump Advisors, and the Stablecoin Heist You Missed

- Foreign investors bribed Milei insiders; $LIBRA memecoin sniped by wallets with advance intel, collapsing post-tweet deletion.

- $LIBRA linked to Melania creators; MeteoraAG insiders extracted $100M+ pre-launch, dwarfing Argentina’s fish export revenue.

The rapid rise and fall of $LIBRA , a memecoin briefly endorsed by Argentine President Javier Milei , has exposed a web of foreign actors, insider advantages, and ethical questions. While the token’s abrupt cancellation after Milei retracted support stunned casual observers, early warnings from within crypto circles hinted at deeper irregularities.

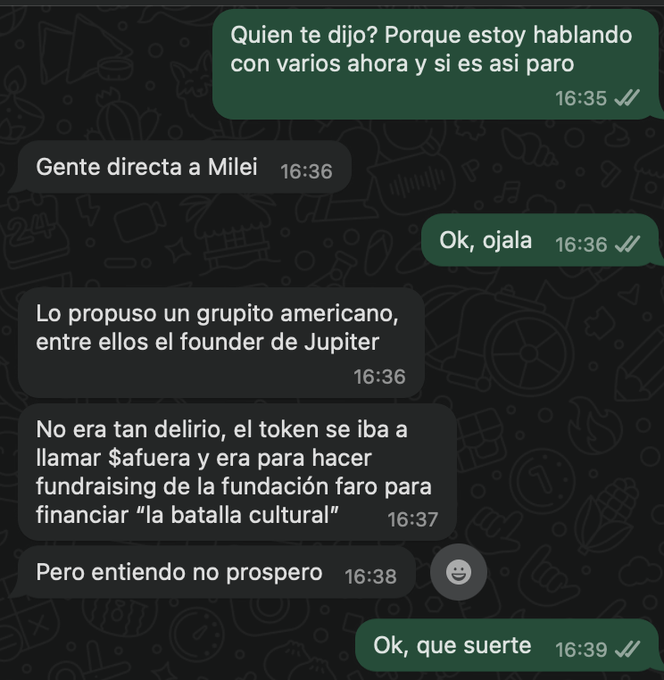

Weeks before $LIBRA’s announcement, rumors circulated about a Milei-linked cryptocurrency. Initial inquiries to Argentine government officials and crypto exchange executives yielded firm denials.

Source: X/DiogenesCasares

Source: X/DiogenesCasares

One executive referenced a separate proposal by U.S. investors for a token named $afuera, which never materialized. Despite these assurances, persistent claims from traders with reliable sources prompted further scrutiny.

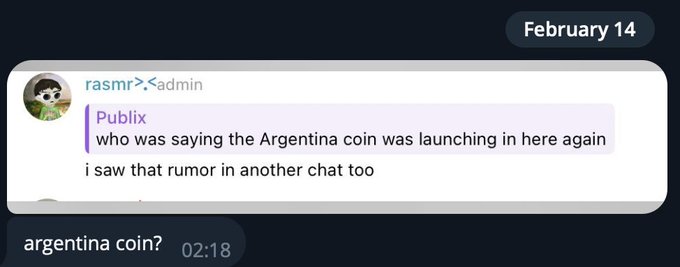

Source: X

Source: X

Concern centered on risks to Argentina’s economic stability

The country recently achieved a decline in inflation, a fragile milestone. Reports later surfaced that a Milei associate allegedly accepted $5 million to promote the token. While no evidence directly implicates the president, the proximity of the individual raised alarms.

Blockchain data further linked early $LIBRA transactions to wallets associated with Melania , a prior memecoin project linked to U.S. political figures. Members of @MeteoraAG , a group tied to Melania, reportedly had advance knowledge of $LIBRA’s launch.

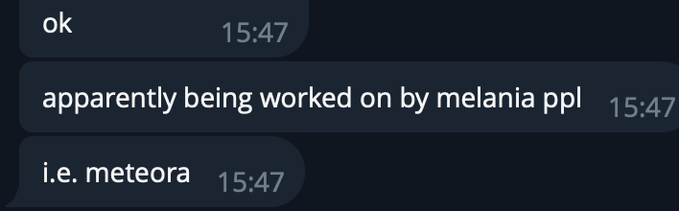

Source: X

Source: X

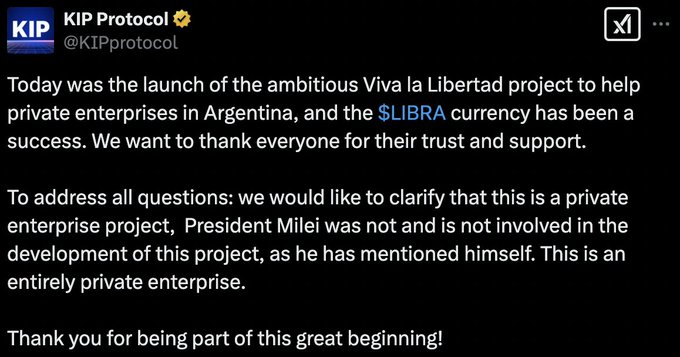

Foreign entities appear central to the scheme. U.S.-based developers and influencers, including @julian_kip of KIP Protocol, promoted $LIBRA as a “grassroots” effort. However, pre-launch access to the token’s contract address enabled selective buying—a practice resembling insider trading.

Source: X

Source: X

The deployer wallet extracted over $100 million in stablecoins, a sum comparable to Argentina’s annual fish exports. An additional $20 million flowed to wallets tied to early participants, including MeteoraAG affiliates.

Milei’s initial tweet endorsing $LIBRA framed it as a private initiative, a distinction reiterated by Bloomberg. His subsequent reversal prevented major exchange listings but did little to mitigate reputational harm.

Critics argue the president must now address alleged corruption within his circle. If the $5 million bribe claim is substantiated, accountability measures—such as removing involved individuals and recovering funds—could demonstrate a break from Argentina’s history of graft.

The incident underscores vulnerabilities when governments engage volatile crypto markets . For Milei, it represents both a misstep and a chance to reaffirm his anti-corruption stance.

Article written following DiogenesCasares’ report in X

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Solana Faces 50% Drop Risk as $125–$137 Range Holds the Key Amid Market Volatility

Panama City Council makes history as the first government institution accepting crypto payments

Share link:In this post: Panama City council voted in favor of becoming the first public institution of government to accept payments in cryptocurrencies. Citizens will now be able to pay taxes, fees, tickets and permits entirely in crypto starting with BTC, ETH, USDC, and USDT. The city partnered with a bank that will receive crypto payments and convert them on the spot to U.S. dollars, allowing for the free flow of crypto in the entire economy.

EnclaveX launch brings fully encrypted, cross-chain futures trading to retail investors