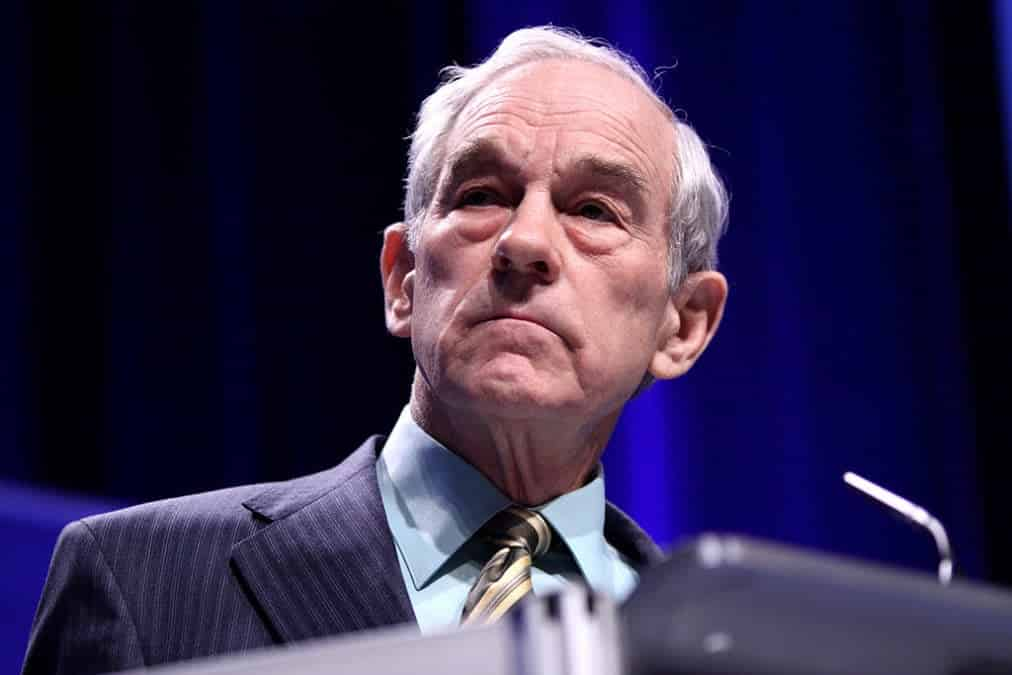

Could a potential Federal Reserve audit by Ron Paul boost bitcoin and shake confidence in the US dollar?

Quick Take Momentum for a Federal Reserve audit is building, driven by growing social media support for Ron Paul to spearhead the effort and a high-profile endorsement from Elon Musk. Proponents argue it could expose flaws in monetary policy, but may also erode confidence in the dollar — potentially accelerating a shift toward alternative assets like bitcoin and gold.

Calls for a Federal Reserve audit have gained fresh momentum, with long-time Fed critic Ron Paul once again at the center of the debate.

The discussion exploded on social media this week after a wave of viral posts on X suggested that Paul should not only spearhead an audit of the central bank but even be considered for the role of Fed Chairman. The idea gained further traction when Elon Musk, head of the newly established Department of Government Efficiency (DOGE), responded with a simple yet powerful endorsement: “Great idea.”

Musk’s backing has intensified speculation over whether the current administration could push for greater transparency at the Fed , an institution that has long operated with a high degree of independence to shield monetary policy from political influence. Historically, efforts to audit the Fed have met strong resistance in Washington, but what would a Federal Reserve audit mean for bitcoin , the U.S. dollar, and the broader financial system?

A Fed audit could result in a 'Minsky Moment' for the dollar

Some experts argue that increased scrutiny of the Fed could weaken confidence in the dollar and accelerate the shift toward alternative assets like bitcoin and gold . "A Ron Paul exposé of the Fed might for the first time force individual Americans to ask uncomfortable questions about just how sound their money is," cryptocurrency derivatives trader Gordon Grant told The Block.

He added that a confrontation between Paul and the U.S. central bank could accelerate a broader shift toward spendable real-world assets — such as using tokenized gold for seamless point-of-sale transactions that instantly convert to fiat or turning to bitcoin as an alternative. This, he suggested, could mark the beginning of a 'Minsky Moment' for the dollar. A Minsky Moment is the point in time that precedes a complete market crash and occurs when investors, realizing the fragility of the system, rapidly lose confidence, triggering a wave of panic selling, liquidity crises, and financial instability.

Grant stated that auditing the Federal Reserve could undermine confidence in the dollar, which, like many faith-based financial constructs, would likely face increased skepticism as a wider audience is confronted with uncomfortable truths. "This would not totally be unlike the pictures of rotting gums and cancerous lung tissue on cigarette cartoons, the more a viewer is forced to stare at the compromises endemic to the usage of a thing on which they have some form of dependence, they either need to convince themselves there is no alternative or the supplier of the thing needs to make it more inevitably unavoidable," he said.

Grant suggested that, internationally, the drawbacks of holding dollars — compared to hard currencies like gold or bitcoin — have become more evident in recent years, particularly in light of events such as the freezing and seizure of Russian assets.

Scrutiny of the Fed could energize bitcoin supporters

The University of Scranton's chair of the Department of Economics, Finance and International Business, Jordan Petsas, told the Block that Elon Musk's backing Ron Paul for auditing or even chairing the Federal Reserve would likely energize bitcoin supporters and libertarians who already advocate for sound money and limited government intervention in the economy. Expanding on this view, Petsas said this could increase bitcoin’s appeal as it could expose issues with monetary policy, fiat currency devaluation, and excessive money printing, ultimately undermining trust in the Fed and strengthening bitcoin’s position as a decentralized store of value.

"Figures like Ron Paul, an outspoken critic of the Fed and supporter of alternative currencies such as gold and, to some extent, bitcoin, could advocate for pro-bitcoin policies, including reducing regulatory pressure," Petsas said. "Finally, if the push to scrutinize the Fed gained legitimacy, it could bolster institutional confidence in bitcoin, leading more investors, including major financial entities, to view it as a viable asset class in the face of uncertainty surrounding the Fed’s policies."

A Fed audit could undermine confidence in the dollar

However, Petsas noted that if Ron Paul was to audit or even possibly chair the Federal Reserve, it could erode confidence in the U.S. dollar. "For example, if an audit revealed questionable practices, such as excessive money printing, it could shake public and investor confidence in the dollar," Petsas said. "A loss of faith in fiat stability could drive demand for alternative stores of value like bitcoin, gold, and even other global currencies."

The broader impact of such an audit would depend on its findings and how markets respond, Petsas added, as it could introduce significant volatility and uncertainty. "If the Fed were seen as politically compromised, international investors and governments could diversify away from the dollar," Petsas explained. “China, Russia, and BRICS nations have already been pushing for alternatives.”

While there are currently no formal legislative efforts to appoint Ron Paul to lead an audit, the online movement advocating for it continues to gain momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Haru Invest CEO Cleared of $650 Million Fraud

Flashbots Warns MEV Bots Undermine Blockchain Scaling Efforts

Bitcoin Gains Market Dominance as Altcoins See Sharp Declines

Solana Launches Network Extensions for Enhanced Blockchain Scalability