State-level Bitcoin reserve bills could drive $23 billion in buying, VanEck says

Quick Take Several U.S. states have proposed using public funds to invest in cryptocurrencies, with asset manager VanEck estimating that state-level Bitcoin reserve bills could drive $23 billion in buying. President Donald Trump has initiated efforts to develop a federal regulatory framework for digital assets, including stablecoins, and is considering a “strategic national digital assets stockpile.”

As talk of creating a national digital assets stockpile or reserve intensifies, representatives from Texas , Pennsylvania and Ohio , among others, have proposed using public funds to invest in cryptocurrencies or establish state-level bitcoin reserves.

Asset manager VanEck recently analyzed 20 state-level bitcoin reserve bills and estimates that if enacted, they could drive $23 billion in buying — equivalent to about 242,700 BTC. This sum excludes potential pension fund allocations and is likely to grow if legislative efforts advance, according to VanEck’s head of digital assets, Matthew Sigel.

“[T]his $23b number is potentially conservative, given the lack of details (many of these states are "n/a" with size unknown),” Sigel said in a post on X.

Courtesy of VanEck

While nothing is official, several states have proposals to varying degrees. For instance, Florida filed a bill last week proposing the state be allowed to invest in bitcoin and other cryptos. North Carolina representatives proposed a bill to allow the State Treasurer to invest in “qualifying digital assets.”

Notably, Arizona’s Senate Finance Committee voted for a bill to allow public funds to invest in bitcoin. That bill has moved to the Senate Rules Committee and could potentially go on to the House of Representatives for consideration. Three U.S. states — Colorado, Utah and Louisiana — currently accept crypto for state payments. Last November, Detroit said it would become the “largest U.S. city” to accept crypto payments.

Between the fourth quarter of 2022 and the fourth quarter of 2024, governments added about 377,000 BTC to their reserves, largely from criminal seizure, according to VanEck.

On the federal level, last month, U.S. President Donald Trump tasked a group with developing a federal regulatory framework for digital assets, including stablecoins, and evaluating the creation of a “strategic national digital assets stockpile.” White House crypto czar David Sacks recently called bitcoin an “excellent store of value” as the original and strongest cryptocurrency.

VanEck modeled various outcomes based on the BITCOIN Act of 2024, introduced by Sen. Cynthia Lummis, which proposes the U.S. Treasury acquire 1 million BTC over five years.

VanEck’s analysis suggests that if the U.S. follows that proposed trajectory — acquiring 1 million BTC by 2029 — the reserve could represent an estimated 35% of the national debt by 2049, offsetting about $42 trillion of liabilities. However, that would require the price of bitcoin to gain over 43,000% in the next 24 years.

“This optimistic scenario assumes that U.S. debt compounds at 5.0% from a base of $37 trillion from 2025 – 2049, while Bitcoin compounds at 25% annually over the same period from a starting value of $200,000, implying a value of ~$42.3 million per Bitcoin in 2049,” VanEck Research wrote in December .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fartcoin Soars After Breakout: What Investors Need to Know

In Brief Fartcoin experiences a significant breakout with increased trading volume. A newly created wallet purchases over 1 million FARTCOIN, signaling bullish interest. Investors see price movements as opportunities for potential gains.

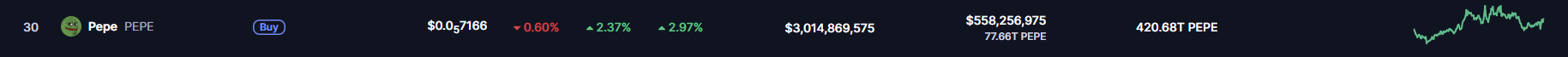

PEPE Price Prediction: Will the Memecoin Hit Its December High Again?

Mantle (MNT) Heading Toward Key Support – Double Bottom Setup Hints at a Possible Reversal