SUI Struggles to Recover from Recent Losses Amid Investor Skepticism

SUI holds above $3.00 but faces investor skepticism. A bullish crossover looms, but will it spark recovery or lead to further declines?

SUI has struggled to regain lost ground after a significant 43% decline since the beginning of the year. Despite multiple bounce-back attempts, the altcoin has failed to establish a sustainable recovery.

A lack of investor confidence has further delayed SUI’s price rebound, keeping it under pressure in a volatile market.

SUI Investors’ Skepticism Is A Bane

The Moving Average Convergence Divergence (MACD) indicator is approaching a potential bullish crossover. If confirmed, it would be SUI’s first positive shift in nearly a month. This technical development could signal the start of a recovery rally, drawing attention from investors looking for renewed momentum.

However, the market remains cautious, with traders waiting for confirmation before making significant moves. A successful MACD crossover could encourage buying activity, but hesitation persists due to prevailing bearish sentiment. Without stronger demand, SUI’s recovery attempt may remain short-lived.

SUI MACD. Source:

TradingView

SUI MACD. Source:

TradingView

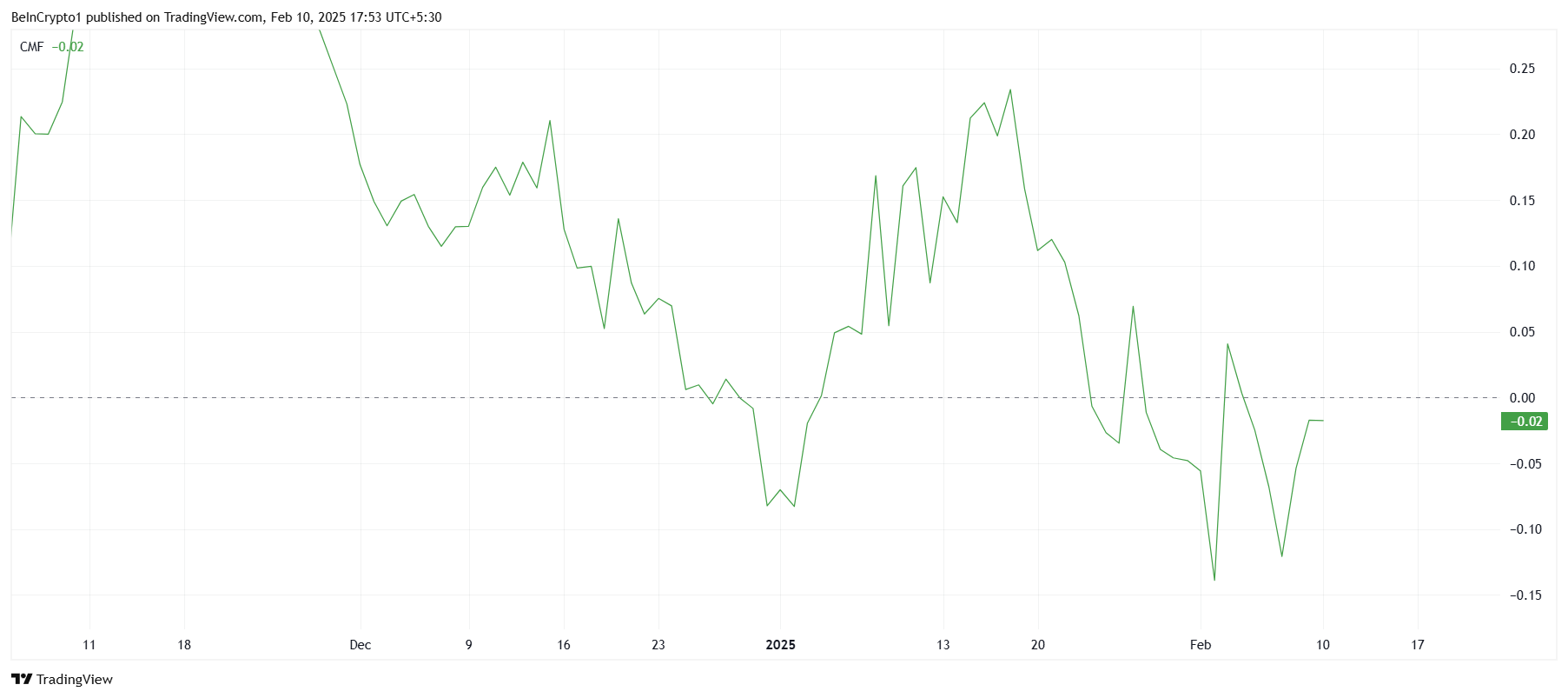

The Chaikin Money Flow (CMF) indicator highlights ongoing capital outflows, reflecting weak investor participation. Since the start of the month, CMF has failed to close above the zero line, showing that selling pressure continues to dominate. This suggests that investors remain skeptical about SUI’s potential for a sustained price increase.

Until inflows start outweighing outflows, SUI may struggle to generate enough demand for a strong breakout. Without a shift in investor sentiment, the altcoin’s recovery could be delayed further. The market needs a surge in accumulation to confirm bullish momentum and counteract existing resistance.

SUI CMF. Source:

TradingView

SUI CMF. Source:

TradingView

SUI Price Prediction: Support Is Intact

SUI’s price has risen by 6% over the last 24 hours, currently trading at $3.25. Despite broader bearish market conditions, the altcoin has maintained its position above $3.00. This resilience has helped prevent a drop below the critical support level of $2.85, keeping hopes for a rebound alive.

Market indicators present mixed signals, but SUI’s ability to hold above the $3.18 support level offers a potential bullish outlook. If the altcoin secures this level, it could move toward $3.69, marking a significant price increase.

SUI Price Analysis. Source:

TradingView

SUI Price Analysis. Source:

TradingView

However, losing the $3.18 support could shift momentum back in favor of the bears. If selling pressure intensifies, SUI may revisit the $2.85 support, with a break below this level invalidating any bullish thesis. Such a scenario could extend investor losses and delay the possibility of a sustained recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report