Helium ($HNT) Eyes Rebound with Key Support and Buy Signal

- Helium shows a buy signal near $3.21, indicating a potential shift in market direction.

- The $3.00–$3.50 range serves as a strong support zone based on past price movements.

- A move above $5.00 may spark a rally, while a drop below $3.10 could trigger losses.

Helium ($HNT) has drawn attention in the crypto community after Ali Charts, an analyst on the X platform, highlighted a technical setup. According to his post, $HNT is testing a support level on its 3-day chart, with the TD Sequential indicator flashing a buy signal. This signal appears precisely at the $3.21 mark, coinciding with the lower boundary of a parallel channel—a scenario that traders interpreted as a potential precursor to a bullish move.

The token’s performance has been anything but steady, dropping from a March 2024 high of $12.00 to its current range of $3.00–$3.50. However, as per Ali Charts’ analysis, this zone represents a historical support level, making it a crucial area for traders and investors to monitor.

Decoding the TD Sequential Buy Signal

The buy signal from the TD Sequential indicator, a favorite among seasoned technical analysts, underscores the possibility of a reversal. This tool is particularly adept at identifying trend exhaustion, and in the past, it has signaled pivots in Helium’s price trajectory. For example, a similar “9” buy signal in May 2024 was followed by a strong rally, pushing $HNT from around $3.00 to highs of $8.00 within weeks.

The current setup gains additional credibility due to its alignment with the lower boundary of a parallel channel, as seen in the chart. This confluence strengthens the bullish thesis, offering traders an attractive risk-to-reward opportunity. Ali Charts’ observations indicate a likely bounce, provided the $3.10 support level holds firm.

Related: Is Ripple (XRP) Ready for Another 1500% Surge Like 2017?

The $3.10–$3.50 Support Zone: A Pivotal Battlefield

The $3.10–$3.50 range, marked on the chart, has proven its significance in Helium’s price history. During past market cycles, this zone has repeatedly acted as a springboard, propelling $HNT toward higher levels. The current test of this range follows a downtrend, marked by declining highs and lows. Traders are now keenly observing whether this historical support will once again act as a launchpad for a potential rebound.

On the upside, key resistance levels include $5.50–$9.50, with a breakout beyond this range opening the door to $8.00 and potentially $12.00. Conversely, failure to hold the $3.10 level could expose $HNT to further downside risk, with the following support zone sitting near $2.50.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

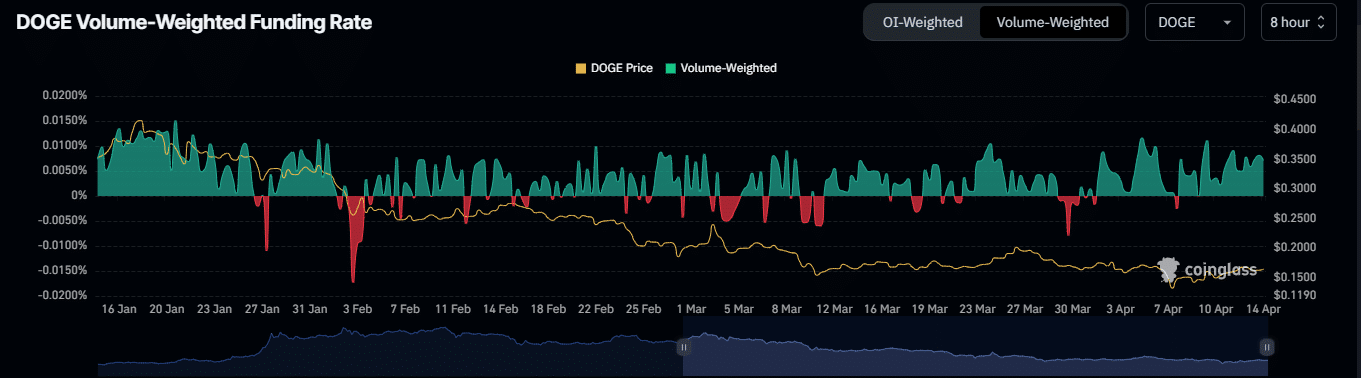

Potential Dogecoin Rally Ahead as Key Support Level and Increased Buying Interest Emerge

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

Market Turmoil: Investors React as OM Coin Crashes 90%

In Brief OM Coin experiences a dramatic 90% drop, alarming the crypto market. IP Coin's price decline raises investor concerns about potential panic sales. Support levels for IP Coin are being closely monitored following recent fluctuations.