Ethereum Faces Growing Competition as Rivals Gain Ground

Ethereum is facing growing challenges, as competition from rival blockchains continues to intensify.

Despite a surge in the broader crypto market surrounding the U.S. election, Ethereum’s ETH token has struggled to outperform both Bitcoin and other altcoins. The cryptocurrency’s share of the market has dwindled, hitting its lowest point in four years, signaling pressure from competing networks.

JPMorgan analysts point to the increasing prominence of blockchains like Solana and Layer 2 solutions, which provide lower fees and better scalability, as key factors driving this shift.

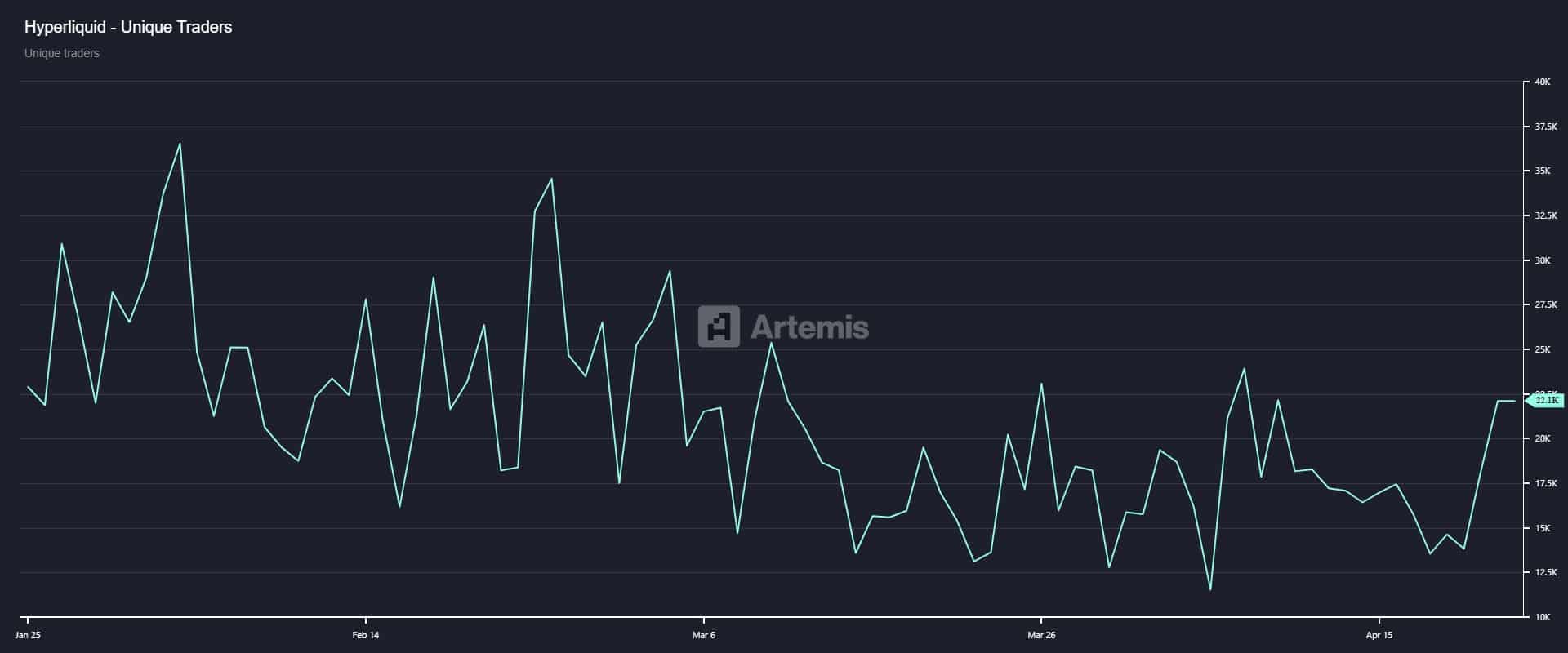

Ethereum’s recent Dencun upgrade, aimed at reducing costs and improving efficiency, has done little to halt the migration of users and applications to more efficient alternatives. Several top decentralized apps, including Uniswap, dYdX, and Hyperliquid, have already switched to dedicated chains designed to better handle their specific needs.

READ MORE:

These Three Altcoins Could Be Gearing Up for a Bullish Reversal, Analyst PredictsOne significant blow to Ethereum’s ecosystem could come from Uniswap’s upcoming move to Unichain. As one of Ethereum’s largest consumers of gas, Uniswap’s departure raises concerns about Ethereum’s revenue model, especially with fewer transactions resulting in lower token burn and potentially higher inflation.

Although Ethereum remains a leader in sectors like stablecoins and decentralized finance (DeFi), its long-term dominance is uncertain. To enhance its institutional appeal, Ethereum’s founders have backed Etherealize, a firm focused on promoting the blockchain’s use in finance, particularly through tokenization. However, analysts warn that the growing competition from other networks could challenge Ethereum’s position in the coming years.

Source

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.