Controversial Enron Launched a Token and Rug-Pulled Investors

ENRON coin was announced yesterday on Solana, and its market cap reached close to $700 million minutes after launch

Key Points

- After reaching its peak, ENRON’s market cap dropped to around $170 million, sparking concerns.

- The coin’s “predatory tokenomics” was against the average investor.

A new memecoin on Solana, ENRON, is under the spotlight following a massive surge in market cap post-launch, followed by a significant crash that affected regular investors.

Yesterday, Enron, a company of renewable energy, announced the launch of their coin, ENRON, on Solana, promising to be the fuel to power their journey. Instead, it turned out to be something else.

ENRON’s Crash

Enron, the company “on a mission to transform energy forever,” as the team notes via X, announced the launch of ENRON coin on Solana on February 4.

In a video , Enron’s Connor Gaydos explained how four years ago, he purchased Enron for $275, owning the trademark, the IP, and the domains, and he registered it as a corporation in Delaware.

He said that he genuinely believed that this was day one of the greatest stories of resurrection of all time, explaining that the company has huge plans and ENRON will be the fuel that powers this journey.

On-chain data revealed that a few minutes after its launch, ENRON reached a market cap of close to $700 million. However, the coin’s market cap is currently sitting around $147 million, according to DEXScreener, following a sharp drop in price that had regular users losing money.

ENRON price in USD todayDEXScreener data shows that top traders made hundreds and tens of thousands of dollars trading the coin, while regular people lost significant amounts.

There was over $100 million in trading volume shortly after the coin’s launch showing high interest which might have been mostly from insiders.

ENRON Tokenomics

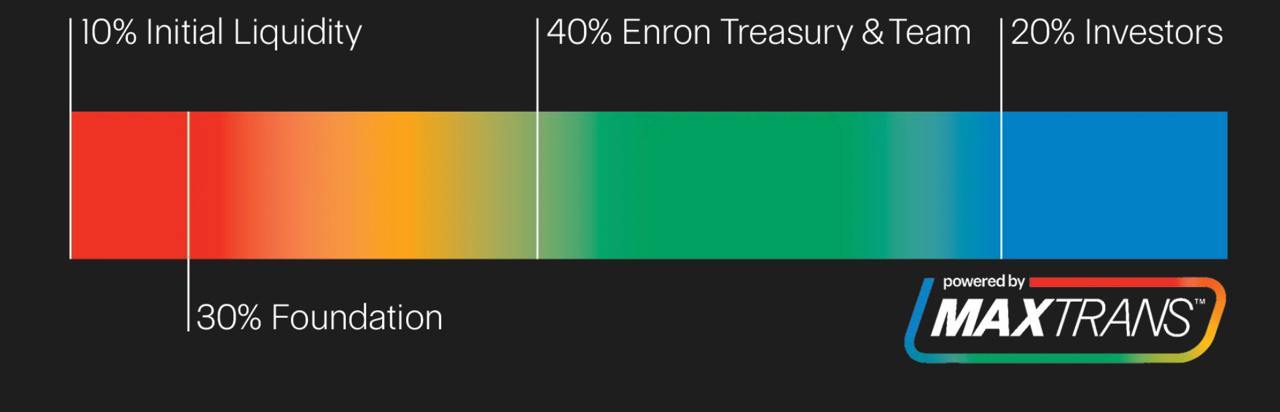

The launch of the coin was described as having predatory tokenomics, suggesting that the structure of the token’s distribution and economics were not in favor of regular investors. Someone pointed out via X that 90% of the coin was for the team, and they were easily able to dump it on people.

Enron official data

Enron official data

According to the official website of the project, the total supply of ENRON will be permanently capped at 1 billion tokens, and there will be no minting beyond the limit – scarcity is set from the start, the team noted.

Enron is said to have been created to disrupt the “trust me” economy, and that’s why the team’s initiative is powered by MAXTRANS – their commitment to Maximum Corporate Transparency.

Enron’s Rug Pull, Explained

As explained above, the coin’s tokenomics seems to have been designed in a way that disproportionately benefits early investors/creators at the expense of later buyers.

The crypto community called the event a rug pull , due to the token’s rapid devaluation post-launch.

ENRON ‘s launch and dump raised concerns especially since Enron is a controversial company, highlighting how people can exploit financial gains in a new and unregulated market.

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas.

The company was founded by Kenneth Lay in 1985 as a merger between Lay’s Houston Natural Gas and InterNorth, both relatively small regional companies at the time of the merger.

In 2001, Enron filed for bankruptcy, becoming one of the largest corporate bankruptcies in US history, until the WorldCom scandal in 2002.

Four years ago it was bought by Gaydos who promised a new journey ahead.

The team at Enron shared a post via X, saying that their plan is real, and the future is bright, highlighting how the resurrected company “gets serious with new electric business.”

Enron via X

Enron via X

However, the team’s latest crypto moves don’t add too much to the user trust sector.

A Potential Parody

More than that, the entire website of the project could be a parody, as noted by an X user who shared data from Enron’s Employee Portal, however, this still has to be confirmed.

The post states that “the information on the website is first amendment protected parody, represents performance art, and is for entertainment purposes only.”

Considering that Gaydos said he had bought the company for only $275 four years ago, this could be true.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zhu Su: Tried to short BERA at $11

Ondo Finance launches Ondo Chain, a Layer1 blockchain for institutional finance

Lido: V3 version is coming soon

Tornado Cash developer Alexey Pertsev was temporarily released, and Vitalik forwarded his support