CFTC’s Pham seeks ‘common-sense’ regulation of prediction markets in new roundtable

Quick Take The CFTC will hold a public forum to discuss prediction markets, though it did not name any specific marketplace in its announcement. CFTC Acting Chair Pham said past years of anti-innovation policies have restricted “common-sense” regulations of prediction markets.

The Commodity Futures Trading Commission announced Wednesday that it will hold a public roundtable to examine prediction markets, where its acting chair Caroline D. Pham expressed the need for more clarity in regulating such platforms.

“Unfortunately, the undue delay and anti-innovation policies of the past several years have severely restricted the CFTC’s ability to pivot to common-sense regulation of prediction markets,” said CFTC Acting Chairman Caroline D. Pham.

Pham said prediction markets are an “important new frontier” that can bring truth to the information age by utilizing the power of markets.

“The current Commission interpretations regarding event contracts are a sinkhole of legal uncertainty and an inappropriate constraint on the new administration,” Pham said.

Last year, the commission requested a district court to review a previous ruling in Kalshi’s favor in an attempt to block U.S. election bets on the prediction market. The two have been in a legal dispute since 2023 over the offerings of event contracts linked to congressional matters.

Earlier this week, it was reported that the CFTC was questioning prediction market Kalshi and Singapore-based crypto exchange Crypto.com over whether their derivatives-based Super Bowl sports events contracts were compliant.

“CFTC must break with its past hostility to innovation and take a forward-looking approach to the possibilities of the future,” Pham stated.

The roundtable

The public roundtable is a necessary first step in establishing a comprehensive regulatory framework for prediction markets, Pham said, as the new framework aims to promote the platforms while protecting users from deceptive market practices.

The forum will tackle several key roadblocks in establishing the framework, including past CFTC decisions, court orders and enforcement actions, and interpretations of event contracts on prediction markets in general.

“Participants will include a wide variety of experts and stakeholders representing numerous and diverse interests in these issues,” the statement said.

However, the release did not mention names of prediction markets that would be discussed at the public roundtable.

The roundtable is scheduled to be held at the CFTC headquarters in Washington, D.C., with further details on the event yet to be announced.

According to The Block’s data , decentralized prediction market platform Polymarket had over 462,600 active traders in January. The platform saw a surge in volume in recent months, driven by betting on the U.S. Presidential election and other political events. Its highest record monthly volume was around $2.63 billion in November.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

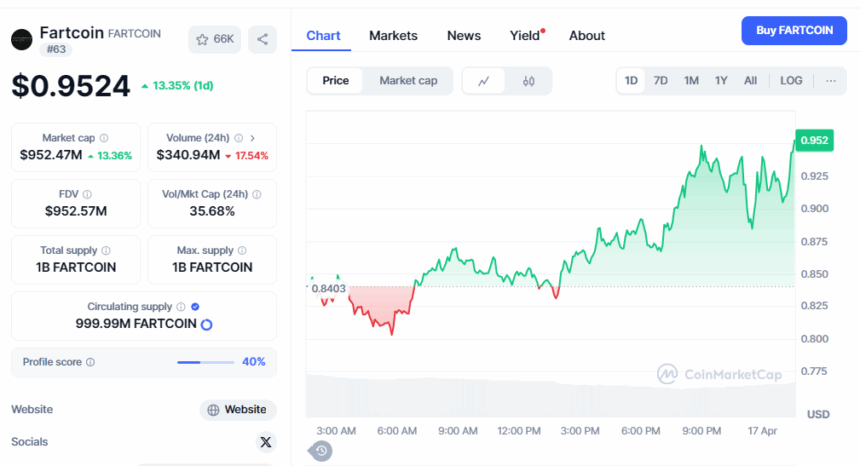

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Bitcoin’s Bull Score Index Hits 58 Days Below 50: What’s Next?