Trump's recent IEEPA tariff orders could boost bitcoin and accelerate global de-dollarization, analysts say

Quick Take On Saturday, U.S. president Trump invoked the IEEPA to impose universal tariffs on Mexico, Canada, and China. The move has raised concerns over U.S. dollar dominance, with analysts suggesting it could drive greater interest in bitcoin as a hedge against economic instability.

The move has sparked debate not only over its economic impact but also its potential consequences for the long-term dominance of the U.S. dollar. Some argue it could accelerate a shift toward hard, non-governmental assets like bitcoin as investors seek alternatives amid rising trade tensions.

"Dollar share of world trade is decreasing and the dollar is losing status as global reserve asset over time, so if you impose more rules like the IEEPA, the moment you do something that could destabilize the nations currency, this makes bitcoin look much more attractive," CoinShares Head of Research James Butterfill told The Block.

The CoinShares head of research highlighted how "bitcoin keeps nefarious governements in check, and bitcoin has the network effects that no other currency has, so there is a high correllation between economic stability and bitcoin growth."

Reuters indicated that the administration relied on IEEPA to bypass the slower procedures associated with other trade statutes and to justify the tariffs as necessary for addressing what it described as a national emergency.

Unconventional use of the IEEPA

"This freezing is not limited to within the country but can also be transnational, with the cooperation of foreign countries, which means that Trump has the power of life and death over all countries in his hands," Muse Labs Chairman Jiang Jinze said. "Arbitrarily activating such laws to provide legitimacy for unconventional means will only strengthen the global decoupling from the U.S. and undermine the long-term credibility of the U.S. dollar."

Cryptocurrency derivatives trader Gordon Grant spoke about how IEEPA actions risk potential debasement of the dollar versus hard assets. "The dollar is still behaving as a risk-off haven, but at some point, in the medium to long term, do folks want to hodl U.S. dollars, given the risks identified in enacting IEEPA?" Grant told The Block. He argued that by interweaving emergency economic measures with trade policy, the administration risks sending mixed signals about the stability of U.S. economic governance. "All of these things could, you might argue, support self-sovereign, portable digital capital like Bitcoin," Grant said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

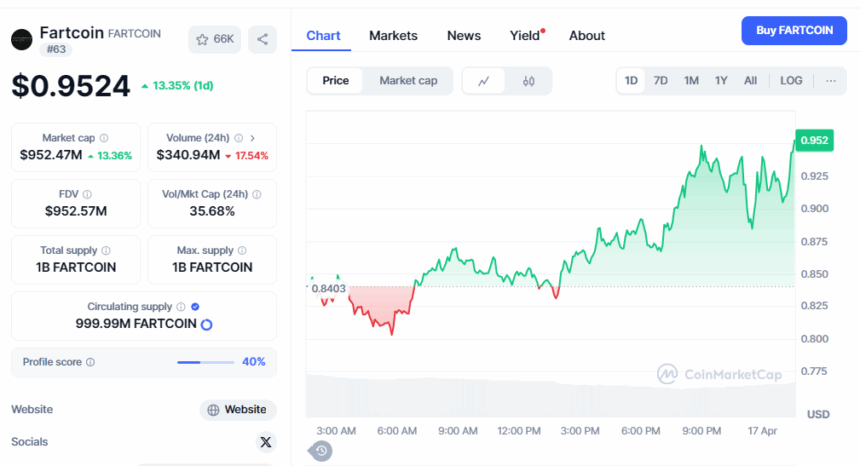

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Bitcoin’s Bull Score Index Hits 58 Days Below 50: What’s Next?