David Sacks Confirmed the US is Evaluating Bitcoin Reserve Feasibility

Meanwhile, the SEC announced the initial list of 10 priorities in Crypto Task Force

Key Points

- During yesterday’s press conference, Sacks addressed the golden age in digital assets.

- The US SEC released the top 10 priorities for the Crypto Task Force, as its official webpage went live.

February 4 marked an important day for the crypto industry with optimistic moves taking place in the US.

Yesterday, the leader in crypto and AI, David Sacks, addressed the important matter of establishing a Bitcoin Reserve in the US during his first press conference since taking on his role.

Also, the SEC Commissioner, Hester Peirce, announced the initial list of top 10 priorities that the SEC Crypto Task Force will tackle.

Evaluating the Idea of a Strategic Bitcoin Reserve

During his first press conference , Trump’s crypto czar, Sacks, said that one of the things that the President instructed the team to do was evaluate the idea of a Strategic Bitcoin Reserve in the US.

According to him, this is one of the first things that they are going to look at as part of the internal working group of the administration – the feasibility of establishing an SBR.

He also highlighted that the concept of a sovereign wealth fund is separate. While saying that Bitcoin is an excellent store of value, he said that he’s looking forward to creating the golden age for digital assets.

Sacks called digital assets some of the most important opportunities of our time.

Sacks crypto plan includes the following:

- Proper regulatory clarity

- Stablecoin protection

- Promoting innovation in crypto domestically

- Opening up crypto for banks

More crypto support came from the US SEC Commissioner Hester Peirce who announced that the Crypto Task Force webpage is live, and the entity will drive more crypto clarity.

Crypto Task Force Top 10 Priorities

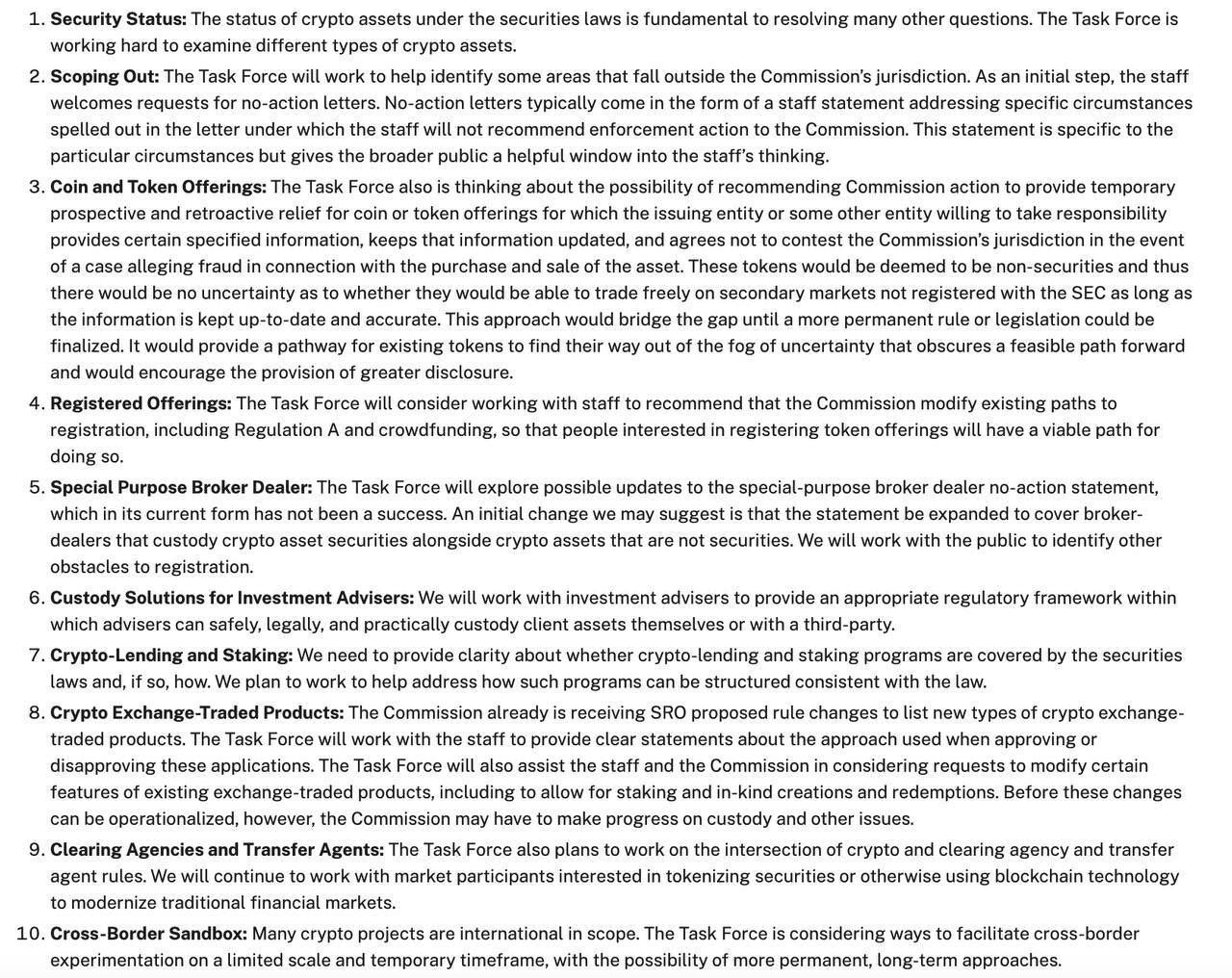

The official notes listed the top 10 priorities for the crypto industry:

- Security Status – The status of crypto assets is fundamental in resolving other issues.

- Scoping Out – Identifying some areas that fall outside the SEC’s jurisdictions, with “no-action letters” (the staff will not recommend enforcement actions) as the first step.

- Coin/Token Offerings – Providing temporary prospective/retroactive relief for coin/token offerings, potentially offering a safe harbor.

- Registered Offerings – Recommending the modification of existing paths to registration.

- Special Purpose Broker-Dealer – Exploring potential updates of the current form that is flawed.

- Custody Solutions for Investment Advisers – Providing an appropriate regulatory framework.

- Crypto Lending/Staking – Providing clarity about securities laws.

- Crypto ETPs – Rule changes to list new types of crypto ETPs.

- Clearing agencies and Transfer Agents – Working on the intersection of crypto and clearing agency/transfer agent rules.

- Cross-Border Sandbox – Considering ways to facilitate cross-border experimentation on a limited scale and temporary timeframe.

SEC official notes

SEC official notes

Meanwhile, Senator Cynthia Lummis shared a post via her X account, showcasing the Subcommittee on Digital Assets logo featuring Chairman Tom Scott, and herself as the Subcommittee Chair.

Lummis is one of the most important supporters of establishing an SBR in the US.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

NFT Crash: Trader Loses $10M Selling THIS Rare NFT Collection

FHEUSDT now launched for futures trading and trading bots

Trump: I passed a "cognitive test" during my physical exam and answered every question correctly

Paul Atkins is the SEC’s confirmed leader