Pendle 2025: Pathway to the Peak

Pendle saw significant growth in 2024, with Boros emerging as Pendle's disruptive application. Boros aims to leverage blockchain technology to provide functionalities that traditional finance struggles to achieve, expanding Pendle's market reach.

Foreword

Since its inception in mid-2020, the Pendle team has been dedicated to bringing innovation in fixed income to the DeFi market. In the volatile crypto market, our start was not easy, but in the blink of an eye, it has been almost five years.

As a veteran of the crypto industry, we have continuously broken through and grown, overcoming many challenges. I am deeply proud of the team's efforts and accomplishments, and I believe that we will continue to maintain a strong growth trajectory in the future.

Next, I will summarize for you:

· Key Achievements of Pendle in 2024

· Pendle's Three Core Strategies

1. Highlights of the V2 Version

2. Development of the Citadels Project

3. Plans for Boros

· Ultimate Vision

Key Achievements of Pendle in 2024

Building the Fixed Income Market

2024 was a crucial turning point in Pendle's development journey, where we witnessed a significant demand for the fixed income market and successfully scaled the protocol from millions to billions.

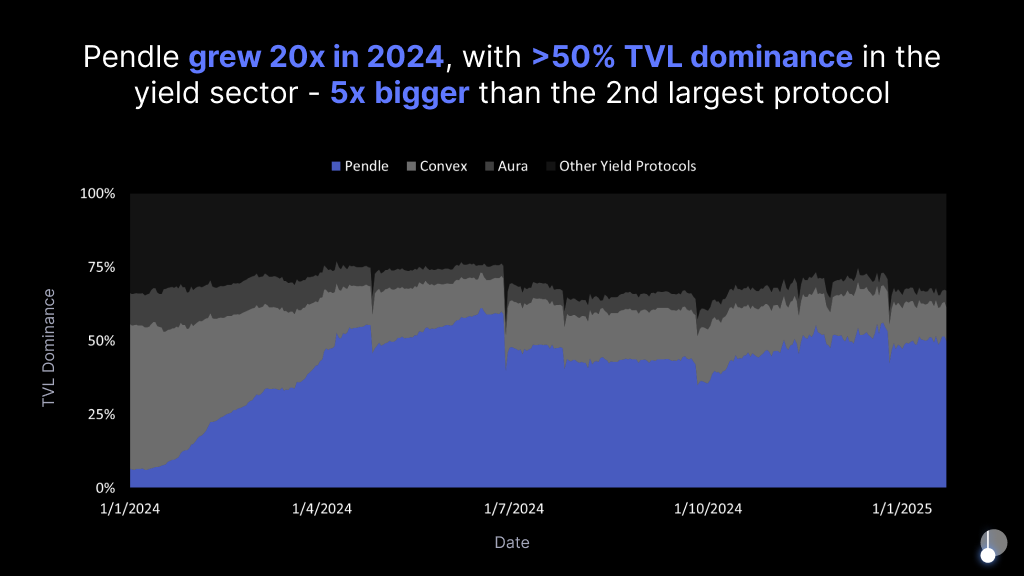

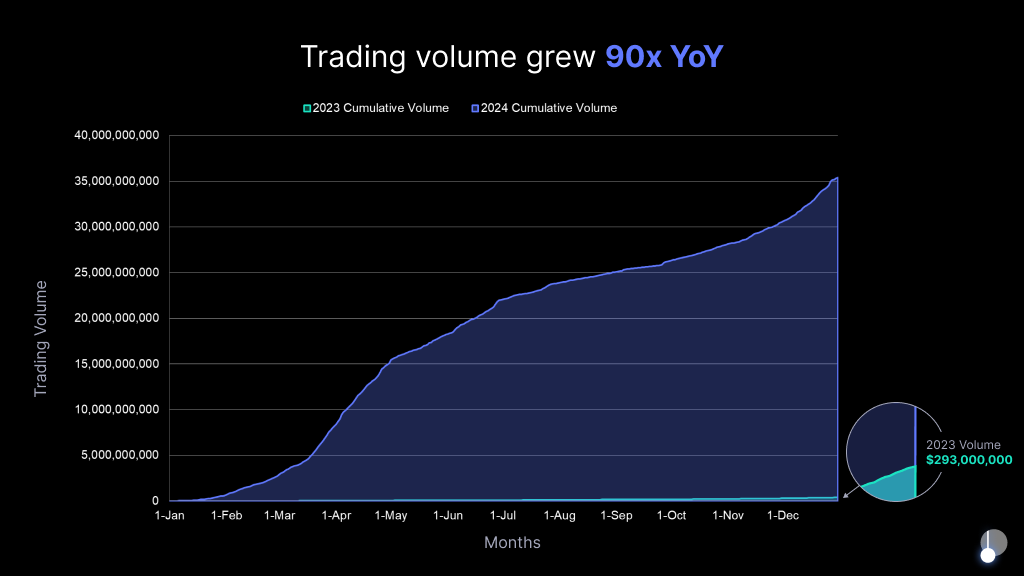

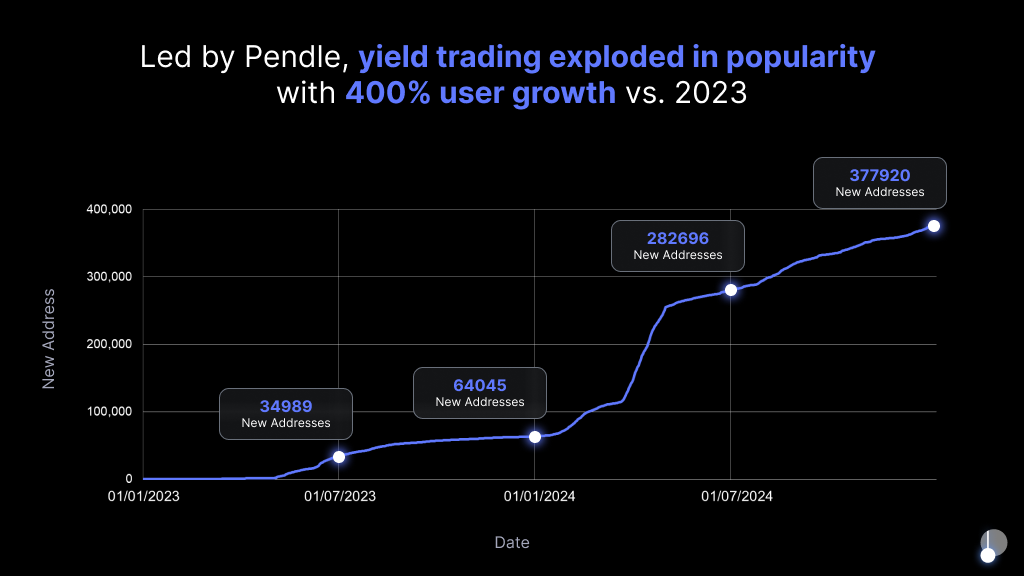

At the beginning of the year, Pendle's TVL was $230 million, and by the end of the year, it had surged to $4.4 billion, achieving a 20x growth. Meanwhile, the daily trading volume skyrocketed from $1.1 million in 2023 to $964 million in 2024, almost a 100x increase. User trust also deepened gradually, with the total PT positions exceeding $100 million.

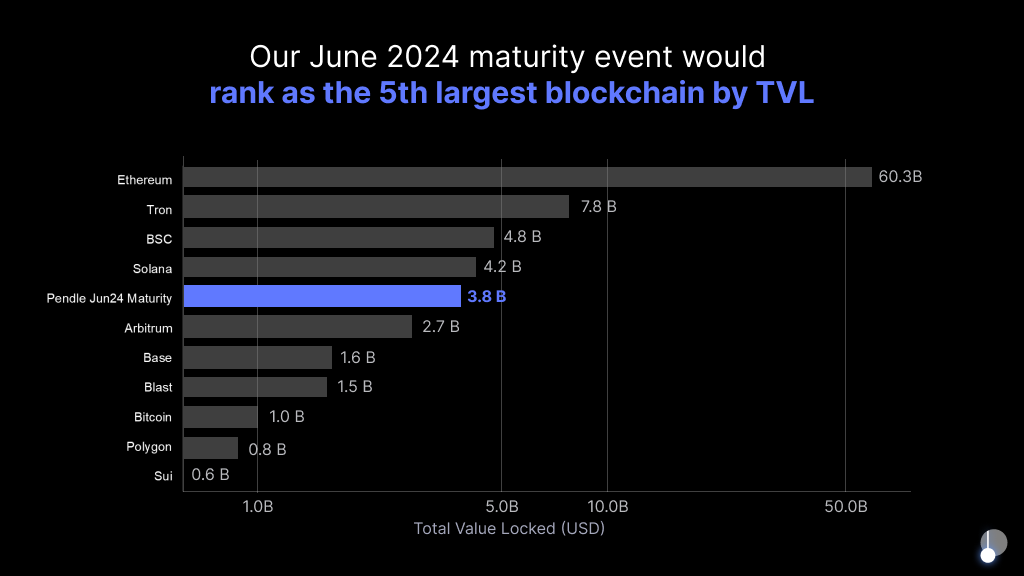

In a significant expiration event in June 2024, Pendle smoothly handled a $3.8 billion-worth position expiring in just a few days, demonstrating the protocol's efficient operational capabilities.

In terms of TVL, Pendle's scale is comparable to a blockchain, ranking even as the world's fifth-largest chain after Ethereum, Solana, Tron, and BNB Chain.

Today, Pendle has become one of the major protocols in the DeFi space, leading not only in TVL but also dominating a significant portion of the DeFi yield market.

In 2024, Pendle not only successfully pioneered the Yield Guild concept but also made it one of the most crucial pillars in the DeFi market.

Pendle Driving the DeFi Ecosystem

In 2024, Pendle expanded to five blockchain networks, with nearly 200 pools live, covering various expiration dates. We continued to grow at an average rate of adding 4 markets per week, reaching a total of 121 active markets by the end of 2024, a 2.5x increase from the previous year.

However, Pendle not only achieved a breakthrough in quantity; these markets also became core liquidity venues for many other projects.

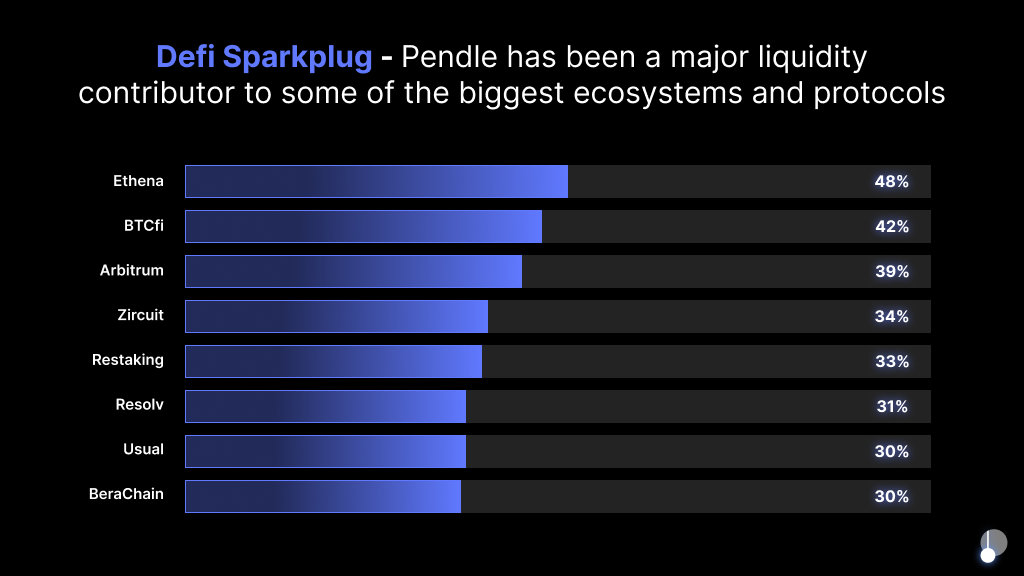

Today, Pendle has become a significant force driving the DeFi narrative and new protocol developments. Protocols like Ethena have 48% of their TVL provided by Pendle; 42% of all BTC rehypothecation is deposited through Pendle; Usual's scale has grown from $3 billion to $12 billion, with around 30% of the growth attributed to Pendle.

Not just individual protocols, blockchain ecosystems like Arbitrum, Zircuit, and Berachain have also gained liquidity through Pendle.

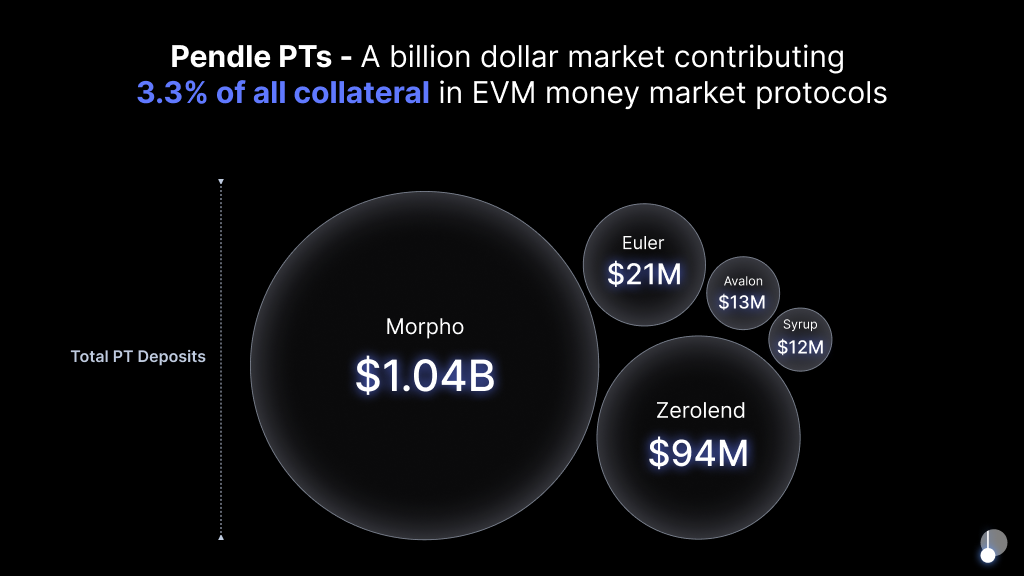

Pendle's PT economy has now grown into a $1.2 billion secondary market, representing 3.3% of all collateral in EVM chain borrowing markets. Around 20% of Morpho deposits are facilitated through Pendle.

Overall, where there is yield, there is Pendle.

While we have made significant strides in 2024 to establish Pendle as a leading Yield Guild platform, this is just the beginning.

Three Core Global Leading Strategies

Improvements in the V2 Version

The DeFi ecosystem generates approximately $17.7 billion in on-chain revenue annually, but currently Pendle only captures less than 5% of this share. While we have already achieved significant milestones, there is still tremendous room for future growth.

As such, the V2 version will introduce the following three major improvements:

1. Openness

We will further open up the protocol's permissionless deployment feature, allowing external users to create and manage their own yield markets through our platform. Through this initiative, Pendle's expansion rate will accelerate, attracting more community participation.

2. Dynamic Fees

To ensure the pool remains optimal during interest rate fluctuations, we will introduce a dynamic fee rebalancing mechanism to optimize the protocol's long-term sustainability.

3. vePENDLE Improvements

We will enhance the functionality of vePENDLE, expand participation channels, allowing more users to engage flexibly in protocol governance, and enhance its role in terms of liquidity.

Currently, the V2 version, after thorough validation, will continue to serve as a key pillar of Pendle in the DeFi yield market. With its strong foundation, we will adopt a more aggressive and ambitious product expansion strategy this year.

This also leads us towards the next strategic direction, which is to build the Citadels project as a vanguard for the next generation of users.

Vision of the Citadels Project

Pendle has already accumulated billions of dollars in trading volume, with the future goal to move towards a multi-trillion-dollar market.

Currently, Pendle mainly serves DeFi users within the EVM ecosystem. However, as the DeFi market continues to grow, we see broader opportunities, and the Citadels project is designed to seize these opportunities.

We aim to provide users with the best experience no matter how they choose to interact with DeFi's yield layer.

Where there's yield, there's Pendle.

So far, Pendle V2 has become one of the largest protocols in the DeFi market, capturing only about 5% of DeFi yields. The global interest rate derivatives market is valued at up to $558 trillion, 30,000 times the size of our current yield market. If Citadels can capture even a small portion of this market, Pendle can achieve exponential growth. In the future, Pendle will focus on dominating the global yield market and breaking through the current limitations of DeFi.

Here are the directions of three Citadels projects:

1. Extension to Non-EVM Chains

We will be the first to expand Pendle's PT products to non-EVM chains such as Solana, TON, and HYPE, attracting millions of potential users in these ecosystems and bringing new growth opportunities to Pendle.

2. TradFi Expansion

We will design compliant products to open up Pendle's yield market to traditional financial institutions, providing the best encrypted fixed-income opportunities. Our collaboration with Ethena is a great start.

3. Exploration of Islamic Finance

The Islamic finance industry is valued at $3.9 trillion, and we plan to tailor yield products compliant with Sharia law for this market, further expanding the global market coverage.

Outlook for Boros

A Disruption That Truly Makes an Impact

As participants who have experienced multiple market cycles, we understand that no matter how the market changes, building and deploying are always at the core of development. However, with each cycle's progress, our industry is also evolving, and now is the best time to push the technological limits.

At Pendle, we believe that the most transformative applications of blockchain are those that can solve real-world problems and are more efficient than traditional finance, especially in markets that still lack liquidity, transparency, and openness.

We believe Boros is one such application that will leverage blockchain technology to provide functionalities that are hard to achieve in traditional finance.

Targeting the Largest Source of Yield

As the largest yield platform, we have witnessed firsthand the explosive demand for yield trading. Pendle V2's yield market has already shown tremendous potential, thanks to the market's demand for hedging and speculative yield.

Boros will further expand in this area. It will be able to support any type of yield, whether from DeFi, CeFi, or even traditional finance, such as LIBOR or mortgage rates, greatly expanding Pendle's market coverage and redefining the possibilities of the yield market.

Firstly, Boros will focus on the cryptocurrency market's largest yield source—funding rates.

Every day, the cryptocurrency perpetual contracts have $150 billion in open interest, generating or paying funding rates every second. The market has a daily trading volume of $200 billion, which is 10 times that of the spot market. The yield potential in this market far exceeds V2's current spot market.

Currently, there is no reliable way to hedge funding rates at scale. Ethena is an example, where the protocol's yield and sustainability heavily rely on funding rate fluctuations, operating at a scale of billions of dollars. Through Boros, Ethena can lock in a fixed funding rate, ensuring stability in large-scale operations.

Boros allows for rate trading by swapping floating yield streams for fixed yield streams (and vice versa) until maturity.

Another intriguing market is TRUMP's launch on a perpetual contract platform, where traders pay up to approximately 20,000% annualized funding rate to maintain a long position, greatly compressing profit margins. Boros provides a new tool to help TRUMP/USDT perpetual contract traders hedge the floating funding rate, turning it into a fixed payment.

Meanwhile, arbitrage traders can now capture these high-yield opportunities and secure fixed returns.

Boros provides traders with a new standard that allows them to better control and optimize funding rate yields.

What is the Role of $PENDLE?

Where there is yield, there is Pendle.

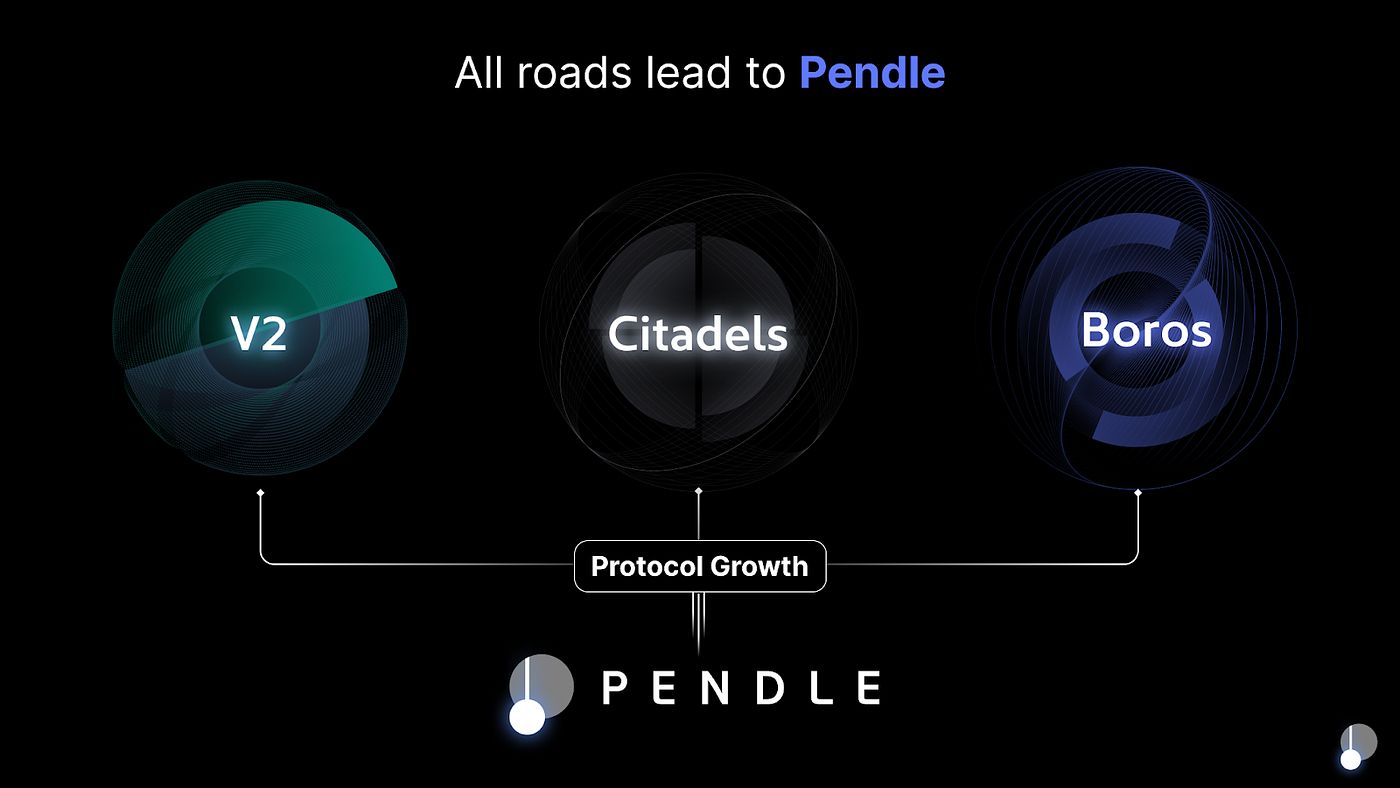

As our ecosystem expands, the value generated by the protocol's three pillars - V2, Citadels, and Boros - will flow into vePENDLE.

Last year, active vePENDLE holders were the biggest beneficiaries of Pendle's growth, with an annualized yield of around 40%, not including the $6.1 million airdrop distributed in December 2024.

Ultimate Vision

Pendle's original vision was clear: to become a leading yield trading protocol. This vision remains our core, but as we build at scale, Pendle's mission has grown.

Pendle aims to be your gateway to accessing yield.

Whether you are a DeFi speculator or a sovereign wealth fund in the Middle East, Pendle will act as the gateway for users to participate in yield trading. We offer protocols, interfaces, and tools covering the entire yield process, whether in DeFi or CeFi.

Our 2025 roadmap includes bold new initiatives, with Citadels and Boros as entirely new verticals. While we strive to achieve these goals, we also recognize that things may not go entirely as planned. When faced with obstacles, we will adjust, reevaluate, and find a way forward, as we have done over the past few years.

The 2025 market will be filled with noise and volatility, with many disruptions and moments of panic. During these times, we will focus on our mission: scaling V2, increasing PT distribution levels, and unlocking Boros' potential. We will not compete on someone else's terms but stay true to our direction and reach our objectives.

By taking a long-term view and surpassing immediate challenges, we are confident that Pendle is on the right track to becoming the "sole yield layer."

The mission is not yet complete — but we will accomplish it.

TN

Pendle CEO and Co-Founder

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — SAHARA/USDT!

SAHARAUSDT now launched for futures trading and trading bots

New spot margin trading pair — H/USDT!

Bitget x BLUM Carnival: Grab a share of 2,635,000 BLUM