US prosecutors urged to reassess liability in DeFi protocols

The venture capital firm a16z has urged the U.S. Department of Justice (DOJ) to reconsider its stance on decentralised finance (DeFi) protocols, arguing that these platforms should not be held accountable for actions beyond their control.

In a blog post dated February 4, a16z criticised the DOJ's approach of attributing liability to software developers for activities conducted by third parties on their platforms.

“Holding people responsible for systems and activities over which they exercise no agency or control leads to perverse outcomes,” the firm emphasised.

This concern reflects broader anxieties within the crypto industry about the legal risks faced by developers of decentralised exchanges (DEXs) like Uniswap (CRYPTO:UNI).

A16z argues that, just as car manufacturers are not liable for the actions of negligent drivers, software developers should not be held responsible for how users interact with neutral tools.

The firm also pointed out that the regulatory environment under President Biden has been particularly aggressive toward the crypto sector, citing over 100 enforcement actions by the Securities and Exchange Commission (SEC).

In contrast, the new presidential administration under Donald Trump is expected to take a more favorable approach, focusing on clearer regulatory guidelines that foster innovation.

A16z suggests that a key policy priority for the new administration should be “codifying the proper and legally correct understanding of ‘control’ in law,” especially regarding whether crypto companies qualify as “money transmitting businesses.”

This distinction is crucial, as it determines the regulatory obligations these companies must follow.

The firm maintains that a clearer understanding of control in decentralised systems is necessary to support crypto entrepreneurs and developers in the United States.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tiger21 Founder Michael Sonnenfeldt Says Ultra-Rich are Bullish on BTC

US Debt Crisis and Interest Rates Threaten Bitcoin’s 2025 Rally

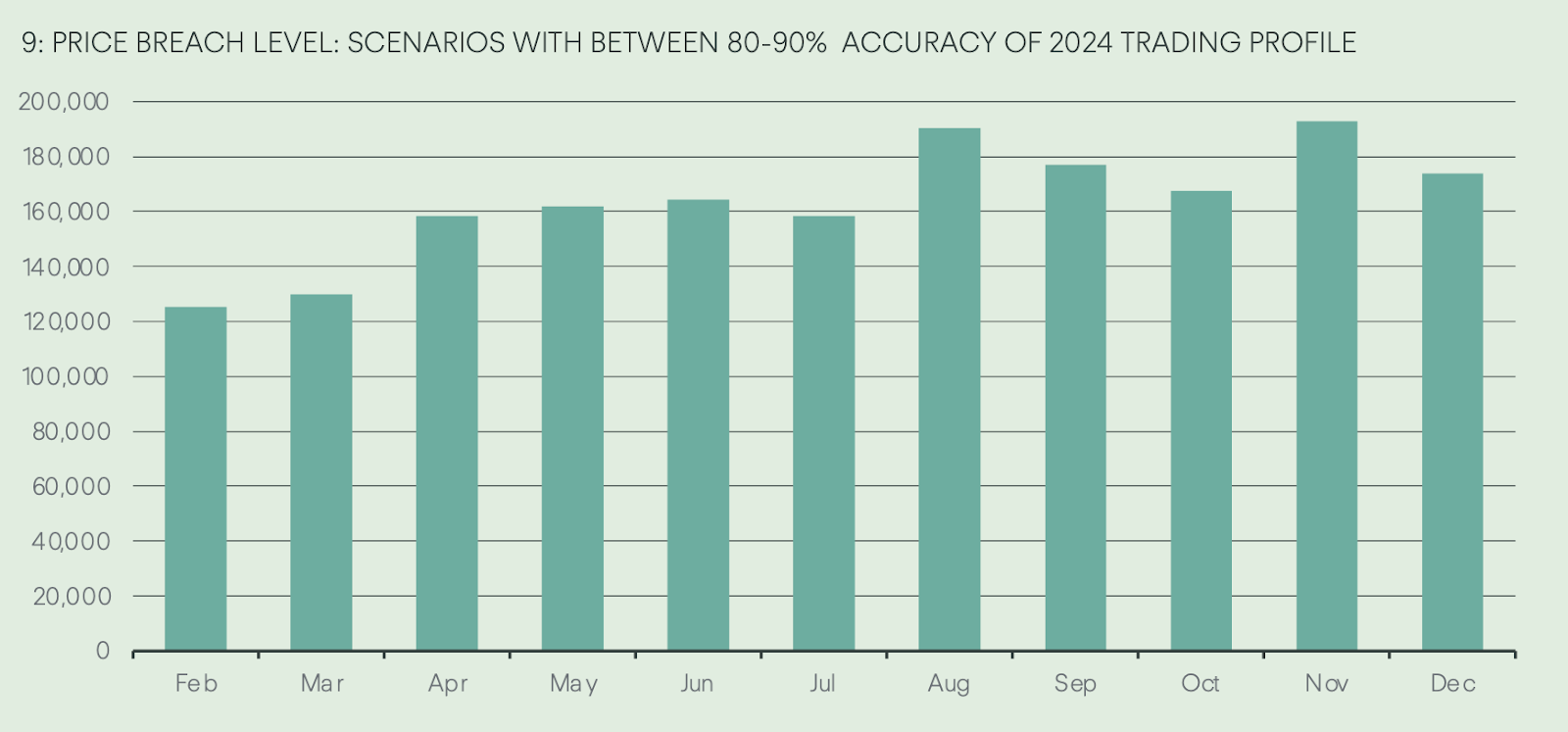

Copper lays out bitcoin price targets, with a twist

The crypto custody firm’s goal was to “identify price points at which traders might consider the market to be overextended”

DOTUSDC now launched for USDC-M futures trading