US Crypto Czar David Sacks calls bitcoin an ‘excellent store of value’: CNBC

Quick Take White House crypto czar David Sacks said bitcoin is an “excellent store of value” as the original and strongest cryptocurrency. Sacks said evaluating a potential bitcoin reserve is a top priority. The crypto czar also told CNBC that he wants more stablecoin innovation to happen in the U.S.

Donald Trump’s AI and crypto czar David Sacks said that bitcoin is an “excellent store of value,” during an interview with CNBC on Tuesday.

“First, you got bitcoin. It was the first digital currency. It’s the original, it’s the strongest one,” said Sacks. “It’s been around for over a dozen years now. No one’s ever hacked it. No one’s ever cracked the security around it.”

During a news conference earlier Tuesday, Sacks outlined the Trump administration’s agenda on cryptocurrencies. The crypto czar revealed that evaluating a potential bitcoin reserve is one of the top priorities for the administration’s internal working group. A national strategic bitcoin reserve is one of many pro-crypto policies that Trump pushed during his election campaign.

Trump has also supported greater clarity in regulating cryptocurrencies, as he signed an executive order to establish a crypto working group to draft new regulations for crypto assets.

“I was on the Hill today meeting with the leaders of our House and Senate committees for banking and for finance, and they are very committed to moving legislation through the House and the Senate this year in order to provide that clear regulatory framework that the digital assets ecosystem needs to sustain innovation in the United States,” Sacks told CNBC, adding that it could be done in the next six months.

Such movements were matched by a major shift happening in the U.S. Securities and Exchange Commission regarding the agency’s approach to cryptocurrencies.

The agency’s newly created crypto task force is now working on distinguishing which cryptocurrencies are securities, which was an issue overshadowed by the SEC’s years-long “regulation by enforcement” approach under former chair Gary Gensler.

Earlier today, the New York Times also reported that the SEC is moving to scale back its special unit for crypto enforcement actions, relocating some of its lawyers to other departments in the agency.

During his interview with CNBC, Sacks also mentioned that the administration wants to bring stablecoin innovation, currently happening mostly offshore, to the U.S. by allowing the issuance of stablecoins domestically.

“I think the power of stablecoins is that it could extend the dollar's dominance internationally, extend it online digitally, and create potentially trillions of dollars of new demand for our U.S. Treasuries,” Sacks said.

Despite bitcoin being the focus of back-to-back announcements from U.S. authorities, the world’s largest cryptocurrency fell 2.8% to $98,052 , struggling to recover much from China’s retaliatory announcement in response to Trump’s tariff proclamation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

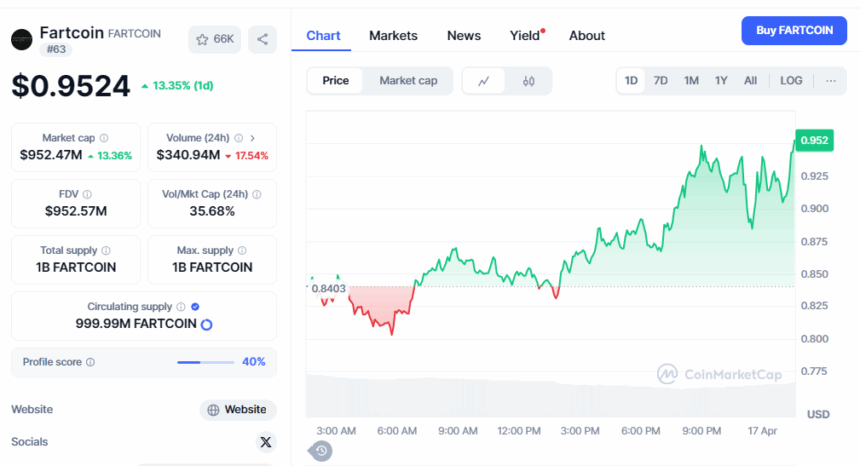

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Bitcoin’s Bull Score Index Hits 58 Days Below 50: What’s Next?