Bitcoin could be part of US sovereign wealth fund plan, says Trump's crypto czar

Quick Take President Trump’s newly appointed “crypto czar” David Sacks outlined the administration’s pro-crypto agenda and confirmed that evaluating a strategic bitcoin reserve is a top priority. This comes as Trump signed an executive order to establish a sovereign wealth fund, with analysts speculating bitcoin could be among its strategic assets.

Speaking at a joint press conference in Washington on Tuesday alongside key congressional committee leaders, David Sacks, President Donald Trump’s newly appointed "crypto czar," outlined the new administration's broad pro-crypto agenda.

Asked about bitcoin’s role in the recently proposed U.S. sovereign wealth fund, Sacks revealed that evaluating a potential bitcoin reserve is a top priority for the administration’s internal working group.

“We’re still waiting for some cabinet secretaries on the working group to be confirmed,” Sacks said. “But once that’s in place, one of our first steps will be assessing the feasibility of a bitcoin reserve.”

The press conference followed President Trump’s signing of an executive order on Monday to establish a sovereign wealth fund—a federally owned investment vehicle designed to increase government revenue through strategic asset investments. Analysts speculate bitcoin could be among the assets considered, adding a new dimension to the debate over the role of digital currencies in public finance.

The executive order primarily aims to monetize U.S. government assets to support national priorities. Trump also hinted at using the fund to acquire strategic holdings, including a potential bid for TikTok, which remains under regulatory scrutiny due to its Chinese ownership.

“When you look at the two key figures behind the sovereign wealth fund, including Treasury Secretary Scott Bessent—both of whom are very pro-crypto—I would be hugely surprised if there wasn’t any bitcoin in it," CoinShares Head of Research James Butterfill told The Block. "From a fund manager’s perspective, including bitcoin makes sense, and it’s highly likely that some bitcoin will be part of the fund."

The CoinShares head of research added that the sovereign wealth fund plan is where the idea of a Bitcoin Strategic Reserve could come to life. "Although strategic reserves are typically separate, in this case, the fund could serve dual purposes," he said.

Butterfill further drew an analogy with Norway’s use of oil revenues: “Consider Norway, which uses its abundant oil revenues to invest for future needs. With the U.S. facing significant debt challenges, there is potential for generating funds—whether by monetizing existing assets or exploring new revenue sources—that might include bitcoin," Butterfill said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

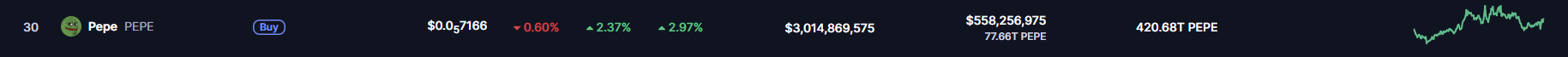

PEPE Price Prediction: Will the Memecoin Hit Its December High Again?

Mantle (MNT) Heading Toward Key Support – Double Bottom Setup Hints at a Possible Reversal

CORE Approaches Key Resistance – Could Breakout Spark a Recovery?